Exam 3: The Adjusting Process

Exam 1: Introduction to Accounting and Business191 Questions

Exam 2: Analyzing Transactions226 Questions

Exam 3: The Adjusting Process180 Questions

Exam 4: Completing the Accounting Cycle195 Questions

Exam 5: Accounting Systems160 Questions

Exam 6: Accounting for Merchandising Businesses218 Questions

Exam 7: Inventories169 Questions

Exam 8: Sarbanes-Oxley, Internal Control, and Cash177 Questions

Exam 9: Receivables151 Questions

Exam 10: Fixed Assets and Intangible Assets172 Questions

Exam 11: Current Liabilities and Payroll171 Questions

Exam 12: Accounting for Partnerships and Limited Liability Companies192 Questions

Exam 13: Corporations: Organization, Stock Transactions, and Dividends171 Questions

Exam 14: Long-Term Liabilities: Bonds and Notes188 Questions

Exam 15: Investments and Fair Value Accounting133 Questions

Exam 16: Statement of Cash Flows165 Questions

Exam 17: Financial Statement Analysis186 Questions

Select questions type

One of the accounting concepts upon which deferrals and accruals are based is

(Multiple Choice)

4.7/5  (31)

(31)

On December 31, the balance in the Office Supplies account is $1,385. A count shows $435 worth of supplies on hand. Prepare the adjusting entry for supplies.

(Essay)

4.8/5  (39)

(39)

Depreciation Expense and Accumulated Depreciation are classified, respectively, as

(Multiple Choice)

4.9/5  (37)

(37)

A company purchases a one-year insurance policy on June 1 for $2,760. The adjusting entry on December 31 is

(Multiple Choice)

4.9/5  (42)

(42)

Ski Master Company pays weekly salaries of $18,000 on Friday for a five-day week ending on that day. Journalize the necessary adjusting entry at the end of the accounting period, assuming that the period ends on Wednesday.

(Essay)

4.8/5  (36)

(36)

The general term used to indicate delaying the recognition of an expense already paid or of a revenue already received is

(Multiple Choice)

4.9/5  (46)

(46)

The adjusting entry to adjust supplies was omitted at the end of the year. This would effect the income statement by having

(Multiple Choice)

4.8/5  (39)

(39)

The unexpired insurance at the end of the fiscal period represents

(Multiple Choice)

4.9/5  (34)

(34)

Which of the accounts below would most likely appear on an adjusted trial balance but probably would not appear on the trial balance?

(Multiple Choice)

4.8/5  (42)

(42)

Depreciation on equipment for the year is $6,300.

(a) Record the journal entry if the company adjusts its account once a year.

(b) Record the journal entry if the company adjusts its account on a monthly basis.

(Essay)

4.8/5  (32)

(32)

A company pays $6,500 for two season tickets on September 1. If $2,500 is earned by December 31, the adjusting entry made at that time is debit Cash, $2,500 and credit Ticket Revenue, $2,500.

(True/False)

4.8/5  (39)

(39)

At year-end, the balance in the prepaid insurance account, prior to any adjustments, is $6,000. The amount of the journal entry required to record insurance expense will be $4,000 if the amount of unexpired insurance applicable to future periods is $2,000.

(True/False)

4.9/5  (41)

(41)

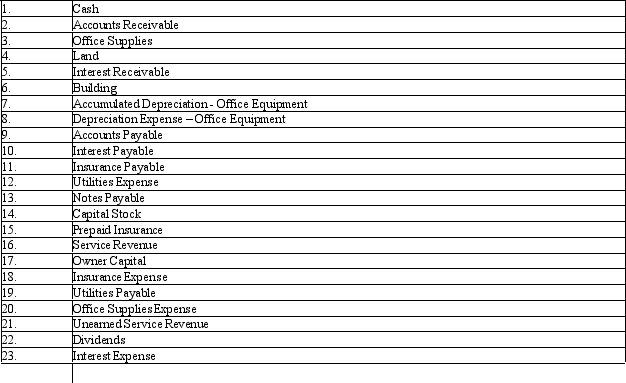

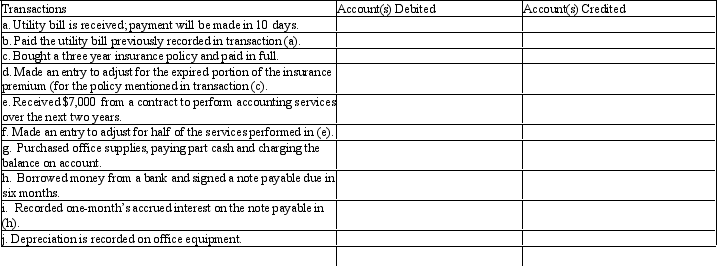

Listed below are accounts to use for transactions (a) through (j), each identified by a number. Following this list are the transactions. You are to indicate for each transaction the accounts that should be debited and credited by placing the account number(s) in the appropriate box.

(Essay)

4.9/5  (41)

(41)

When preparing an income statement vertical analysis, each revenue and expense is expressed as a percent of net income.

(True/False)

4.9/5  (36)

(36)

Revenues and expenses should be recorded in the same period to which they relate.

(True/False)

4.9/5  (41)

(41)

Showing 81 - 100 of 180

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)