Exam 3: The Adjusting Process

Exam 1: Introduction to Accounting and Business191 Questions

Exam 2: Analyzing Transactions226 Questions

Exam 3: The Adjusting Process180 Questions

Exam 4: Completing the Accounting Cycle195 Questions

Exam 5: Accounting Systems160 Questions

Exam 6: Accounting for Merchandising Businesses218 Questions

Exam 7: Inventories169 Questions

Exam 8: Sarbanes-Oxley, Internal Control, and Cash177 Questions

Exam 9: Receivables151 Questions

Exam 10: Fixed Assets and Intangible Assets172 Questions

Exam 11: Current Liabilities and Payroll171 Questions

Exam 12: Accounting for Partnerships and Limited Liability Companies192 Questions

Exam 13: Corporations: Organization, Stock Transactions, and Dividends171 Questions

Exam 14: Long-Term Liabilities: Bonds and Notes188 Questions

Exam 15: Investments and Fair Value Accounting133 Questions

Exam 16: Statement of Cash Flows165 Questions

Exam 17: Financial Statement Analysis186 Questions

Select questions type

Adjusting journal entries are dated on the last day of the period.

(True/False)

4.9/5  (42)

(42)

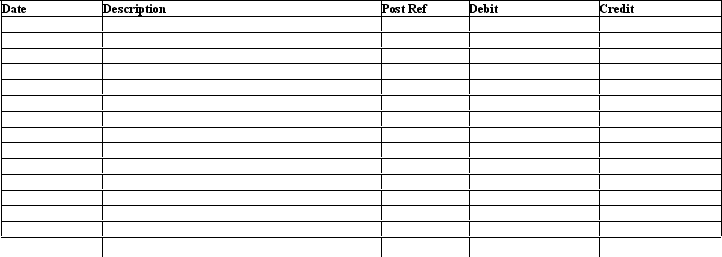

Prepare the December 31 adjusting entries for the following transactions. Omit explanations.

1. Fees accrued but unbilled total $6,300.

2. The supplies account balance on December 31 is $4,750. Supplies on hand are $960.

3. Wages accrued but not paid are $2,700.

4. Depreciation of office equipment is $1,650.

5. Rent expired during year, $10,800.

(Essay)

4.8/5  (38)

(38)

The matching concept supports matching expenses with the related revenues.

(True/False)

4.9/5  (38)

(38)

The type of account and normal balance of Unearned Rent is

(Multiple Choice)

4.8/5  (31)

(31)

Generally accepted accounting principles requires that companies use the ____ of accounting.

(Multiple Choice)

4.9/5  (35)

(35)

For the year ending December 31, Orion, Inc. mistakenly omitted adjusting entries for $1,500 of supplies that were used, (2) unearned revenue of $4,200 that was earned, and (3) insurance of $5,000 that expired. For the year ending December 31, what is the effect of these errors on revenues, expenses, and net income?

(Multiple Choice)

4.9/5  (39)

(39)

A company depreciates its equipment $500 a year. The adjusting entry for December 31 is debit Depreciation Expense, $500 and credit Equipment, $500.

(True/False)

4.8/5  (34)

(34)

At the end of April, the first month of the year, the usual adjusting entry transferring rent earned to a revenue account from the unearned rent account was omitted. Indicate which items will be incorrectly stated, because of the error, on (a) the income statement for April and (b) the balance sheet as of April 30. Also indicate whether the items in error will be overstated or understated.

(Essay)

4.8/5  (45)

(45)

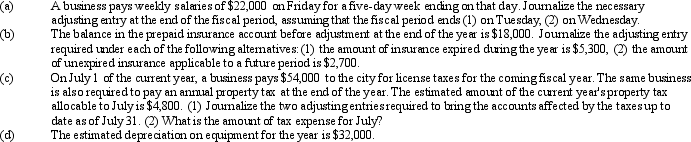

For each of the following, journalize the necessary adjusting entry:

(Essay)

4.7/5  (39)

(39)

Which of the following is not true regarding depreciation?

(Multiple Choice)

5.0/5  (40)

(40)

If the effect of the credit portion of an adjusting entry is to increase the balance of a liability account, which of the following describes the effect of the debit portion of the entry?

(Multiple Choice)

4.7/5  (37)

(37)

On March 1, a business paid $3,600 for a twelve month liability insurance policy. On April 1 the same business entered into a two-year rental contract for equipment at a total cost of $18,000. Determine the following amounts:

(a) insurance expense for the month of March

(b) prepaid insurance as of March 31

(c) equipment rent expense for the month of April

(d) prepaid equipment rental as of April 30

(Essay)

4.9/5  (37)

(37)

A company pays $36,000 for twelve month's rent on October 1. The adjusting entry on December 31 is debit Rent Expense, $9,000 and credit Prepaid Rent, $9,000.

(True/False)

4.9/5  (41)

(41)

Unearned rent, representing rent for the next six months' occupancy, would be reported on the landlord's balance sheet as a(n)

(Multiple Choice)

4.8/5  (43)

(43)

At January 31, the end of the first month of the year, the usual adjusting entry transferring expired insurance to an expense account is omitted. Which items will be incorrectly stated, because of the error, on (a) the income statement for January and (b) the balance sheet as of January 31? Also indicate whether the items in error will be overstated or understated.

(Essay)

4.9/5  (38)

(38)

If there is a balance in the prepaid rent account after adjusting entries are made, it represents a(n)

(Multiple Choice)

4.8/5  (37)

(37)

The balance in the supplies account, before adjustment at the end of the year is $6,250. The proper adjusting entry if the amount of supplies on hand at the end of the year is $1,500 would be

(Multiple Choice)

4.9/5  (44)

(44)

Showing 101 - 120 of 180

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)