Exam 19: Uncertainty, Risk, and Private Information

Exam 1: First Principles233 Questions

Exam 2: Economic Models- Trade-Offs and Trade313 Questions

Exam 3: Supply and Demand290 Questions

Exam 4: Consumer and Producer Surplus224 Questions

Exam 5: Price Controls and Quotas- Meddling With Markets201 Questions

Exam 6: Elasticity98 Questions

Exam 7: Taxes298 Questions

Exam 9: The Rational Consumer44 Questions

Exam 8: International Trade268 Questions

Exam 10: Decision Making by Individuals and Firms116 Questions

Exam 11: Perfect Competition and the Supply Curve355 Questions

Exam 12: Monopoly348 Questions

Exam 13: Oligopoly97 Questions

Exam 14: Monopolistic Competition and Product Differentiation124 Questions

Exam 15: Externalities140 Questions

Exam 16: Public Goods and Common Resources75 Questions

Exam 17: The Economics of the Welfare State91 Questions

Exam 18: Factor Markets and the Distribution of Income314 Questions

Exam 19: Uncertainty, Risk, and Private Information197 Questions

Exam 20: Macroeconomics- the Big Picture168 Questions

Exam 21: Gdp and the Consumer Price Index204 Questions

Exam 22: Unemployment and Inflation351 Questions

Exam 23: Long-Run Economic Growth313 Questions

Exam 24: Savings, Investment Spending398 Questions

Exam 25: Fiscal Policy376 Questions

Exam 26: Money, Banking, and the Federal Reserve System464 Questions

Exam 27: Monetary Policy359 Questions

Exam 28: Inflation, Disinflation, and Deflation240 Questions

Exam 29: Crises and Consequences214 Questions

Exam 30: Macroeconomics- Events and Ideas320 Questions

Exam 31: Open-Economy Macroeconomics466 Questions

Exam 32: Graphs in Economics64 Questions

Exam 33: Toward a Fuller Understanding36 Questions

Exam 34: Consumer Preferences and Consumer Choice62 Questions

Exam 35: Indifference Curve Analysis of Labor Supply41 Questions

Select questions type

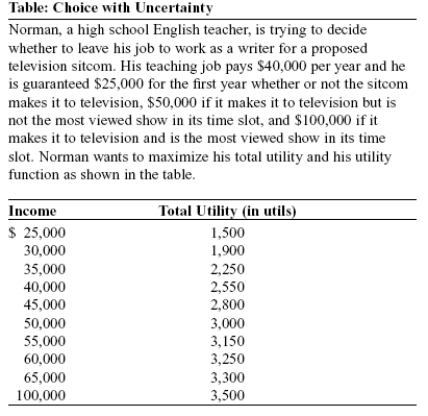

Use the following to answer questions :  -(Table: Choice with Uncertainty) Look at the table Choice with Uncertainty. Suppose that the probability that the sitcom does not make it to television is 60%, the probability that it makes it to television but is not the most viewed show in its time slot is 30%, and that the probability that it makes it to television and is the most viewed show in its time slot is 10%. Norman's expected total utility is _____ utils.

-(Table: Choice with Uncertainty) Look at the table Choice with Uncertainty. Suppose that the probability that the sitcom does not make it to television is 60%, the probability that it makes it to television but is not the most viewed show in its time slot is 30%, and that the probability that it makes it to television and is the most viewed show in its time slot is 10%. Norman's expected total utility is _____ utils.

Free

(Multiple Choice)

5.0/5  (33)

(33)

Correct Answer:

B

Suppose a person rolls a typical six-sided die. What is the probability that the die will come up with a 1 and then a 2?

Free

(Multiple Choice)

4.8/5  (32)

(32)

Correct Answer:

B

Risk-averse individuals are willing to pay a premium that is _____ their expected claims.

(Multiple Choice)

4.8/5  (39)

(39)

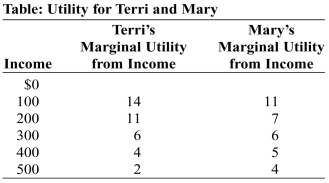

Use the following to answer questions :  -(Table: Utility for Terri and Mary) Look at the table Utility for Terri and Mary. Each has an income of $300. _____ is more risk-averse because _____ has a _____ drop in total utility if income were to fall by $100.

-(Table: Utility for Terri and Mary) Look at the table Utility for Terri and Mary. Each has an income of $300. _____ is more risk-averse because _____ has a _____ drop in total utility if income were to fall by $100.

(Multiple Choice)

4.9/5  (35)

(35)

_____ is (are) a strategy(ies) for dealing with adverse selection in the labor market.

(Multiple Choice)

4.8/5  (39)

(39)

Sellers of used cars may have private information to which buyers are not privy. This leads to all of the following EXCEPT:

(Multiple Choice)

4.7/5  (38)

(38)

Newman has decided to take a road trip in a rental car. He has the minimum amount of personal car insurance to rent the car, but he decides to pay a little extra to the rental car company to completely insure himself against any damage to the rental car. How is there a potential moral hazard due to Newman's purchase of the additional insurance?

(Essay)

4.8/5  (40)

(40)

Used-car dealers will often advertise how long they have been in business as a means of _____ their long-term _____.

(Multiple Choice)

4.7/5  (33)

(33)

Risk-averse individuals will always buy insurance, regardless of the premiums charged.

(True/False)

4.9/5  (35)

(35)

Suppose the probability of a major theft at a hotel is 1%, while the probability of an earthquake hitting the hotel is 2.3%. The probability that both would occur on the same day is therefore:

(Multiple Choice)

4.8/5  (36)

(36)

Use the following to answer questions

Scenario: Diversification

Morris is considering investing $10,000 in a sunglass company or a rain poncho company. If it is a rainy year and he invests only in the sunglass company, he will lose $5,000. However, if it is a rainy year and he invests only in the rain poncho company, he will earn $10,000. If it is a sunny year and he invests only in the sunglass company, he will earn $10,000; if he invests only in the rain poncho company, he will lose $5,000 in a sunny year. There is a 50% chance of a sunny year and a 50% chance of a rainy year.

-(Scenario: Diversification) Look at the scenario Diversification. If Morris invests half of his money in the sunglass company and half in the rain poncho company, he will earn _____ in a sunny year and _____ in a rainy year.

(Multiple Choice)

4.9/5  (46)

(46)

Use the following to answer questions

Scenario: Health Costs

Alan is hoping for a healthy year, meaning that he would have zero health costs. Given his habits, there is a 40% chance that Alan will develop a health issue resulting in $50,000 in health costs. Assume these are the only two conditions that could exist for Alan in the coming year.

-(Scenario: Health Costs) Look at the scenario Health Costs. When Alan's probability of developing a health problem decreases, holding everything else constant, Alan's expected value of health care costs:

(Multiple Choice)

4.9/5  (35)

(35)

Two individuals make up the auto insurance market. Bonnie drives well, and the probability of her having an accident is 10% this year. Lisa also drives carefully, and her probability of having an accident is 5%. What is the probability that Bonnie and Lisa will both have accidents this year?

(Multiple Choice)

4.8/5  (36)

(36)

The opportunity to engage in pooling shifts the _____ curve of insurance to the right; insurance companies will take on _____ risk and charge a _____ premium than without pooling.

(Multiple Choice)

4.7/5  (37)

(37)

As the premium for an insurance policy falls, there is an increase in the _____ insurance.

(Multiple Choice)

4.8/5  (31)

(31)

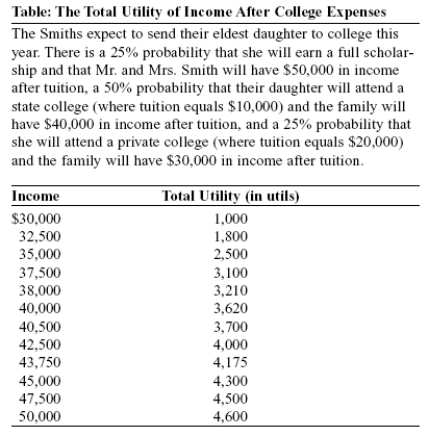

Use the following to answer questions :  -(Table: Total Utility of Income After College Expenses) Look at the table Total Utility of Income After College Expenses. The Smith family's expected income after tuition is:

-(Table: Total Utility of Income After College Expenses) Look at the table Total Utility of Income After College Expenses. The Smith family's expected income after tuition is:

(Multiple Choice)

4.9/5  (34)

(34)

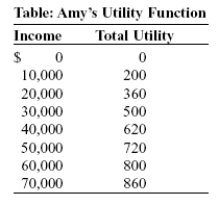

Use the following to answer questions :  -(Table: Amy's Utility Function) Look at the table Amy's Utility Function. Amy is an entrepreneur with current income equal to $40,000. Amy is considering development of a new product. The probability that her new product earns Amy $10,000 in additional income is 0.5, and the probability that Amy incurs a reduction of $10,000 from her current income is also 0.5. Suppose Amy can buy a fair insurance policy that will compensate her for any losses. Amy's premium will be _____, her guaranteed income will be _____, and her expected utility will be _____ utils.

-(Table: Amy's Utility Function) Look at the table Amy's Utility Function. Amy is an entrepreneur with current income equal to $40,000. Amy is considering development of a new product. The probability that her new product earns Amy $10,000 in additional income is 0.5, and the probability that Amy incurs a reduction of $10,000 from her current income is also 0.5. Suppose Amy can buy a fair insurance policy that will compensate her for any losses. Amy's premium will be _____, her guaranteed income will be _____, and her expected utility will be _____ utils.

(Multiple Choice)

4.9/5  (32)

(32)

Showing 1 - 20 of 197

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)