Exam 19: Uncertainty, Risk, and Private Information

Exam 1: First Principles233 Questions

Exam 2: Economic Models- Trade-Offs and Trade313 Questions

Exam 3: Supply and Demand290 Questions

Exam 4: Consumer and Producer Surplus224 Questions

Exam 5: Price Controls and Quotas- Meddling With Markets201 Questions

Exam 6: Elasticity98 Questions

Exam 7: Taxes298 Questions

Exam 9: The Rational Consumer44 Questions

Exam 8: International Trade268 Questions

Exam 10: Decision Making by Individuals and Firms116 Questions

Exam 11: Perfect Competition and the Supply Curve355 Questions

Exam 12: Monopoly348 Questions

Exam 13: Oligopoly97 Questions

Exam 14: Monopolistic Competition and Product Differentiation124 Questions

Exam 15: Externalities140 Questions

Exam 16: Public Goods and Common Resources75 Questions

Exam 17: The Economics of the Welfare State91 Questions

Exam 18: Factor Markets and the Distribution of Income314 Questions

Exam 19: Uncertainty, Risk, and Private Information197 Questions

Exam 20: Macroeconomics- the Big Picture168 Questions

Exam 21: Gdp and the Consumer Price Index204 Questions

Exam 22: Unemployment and Inflation351 Questions

Exam 23: Long-Run Economic Growth313 Questions

Exam 24: Savings, Investment Spending398 Questions

Exam 25: Fiscal Policy376 Questions

Exam 26: Money, Banking, and the Federal Reserve System464 Questions

Exam 27: Monetary Policy359 Questions

Exam 28: Inflation, Disinflation, and Deflation240 Questions

Exam 29: Crises and Consequences214 Questions

Exam 30: Macroeconomics- Events and Ideas320 Questions

Exam 31: Open-Economy Macroeconomics466 Questions

Exam 32: Graphs in Economics64 Questions

Exam 33: Toward a Fuller Understanding36 Questions

Exam 34: Consumer Preferences and Consumer Choice62 Questions

Exam 35: Indifference Curve Analysis of Labor Supply41 Questions

Select questions type

Why might the supply curve of insurance policies shift to the right?

(Multiple Choice)

5.0/5  (37)

(37)

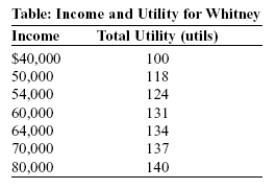

Use the following to answer questions :  -(Table: Income and Utility for Whitney) Look at the table Income and Utility for Whitney. Whitney's income next year is uncertain: there is a 40% probability she will make $40,000 and a 60% probability she will make $80,000. What certain income leaves Whitney as well off as her uncertain income?

-(Table: Income and Utility for Whitney) Look at the table Income and Utility for Whitney. Whitney's income next year is uncertain: there is a 40% probability she will make $40,000 and a 60% probability she will make $80,000. What certain income leaves Whitney as well off as her uncertain income?

(Multiple Choice)

4.9/5  (33)

(33)

At the end of the 1980s, Lloyd's of London was in severe financial trouble because of:

(Multiple Choice)

4.7/5  (39)

(39)

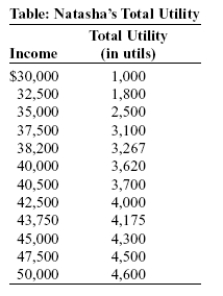

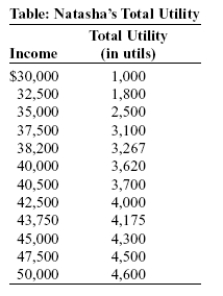

Use the following to answer questions  -(Table: Natasha's Total Utility) Look at the table Natasha's Total Utility. Natasha earns $50,000 per year but faces losing $20,000 of it if she is late with her work. If there is a 25% probability that Natasha will be late with her work and her income will equal $30,000, what certain income leaves Natasha just as well off as her uncertain income?

-(Table: Natasha's Total Utility) Look at the table Natasha's Total Utility. Natasha earns $50,000 per year but faces losing $20,000 of it if she is late with her work. If there is a 25% probability that Natasha will be late with her work and her income will equal $30,000, what certain income leaves Natasha just as well off as her uncertain income?

(Multiple Choice)

4.9/5  (48)

(48)

Use the following to answer questions

Scenario: Health Costs

Alan is hoping for a healthy year, meaning that he would have zero health costs. Given his habits, there is a 40% chance that Alan will develop a health issue resulting in $50,000 in health costs. Assume these are the only two conditions that could exist for Alan in the coming year.

-(Scenario: Health Costs) Look at the scenario Health Costs. Suppose that Alan decides to change his habits dramatically and as a result decreases the probability of his developing a health problem such that he now has a 20% chance of becoming ill. What is the expected value of Alan's health costs now?

(Multiple Choice)

4.8/5  (29)

(29)

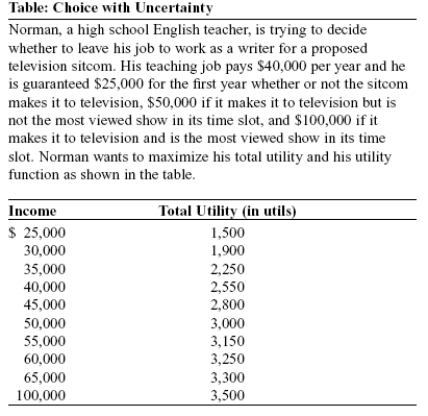

Use the following to answer questions :  -(Table: Choice with Uncertainty) Look at the table Choice with Uncertainty. Suppose the probability that the sitcom does not make it to television is 50%, that it makes it to television but is not the most viewed show in its time slot is 30%, and that it makes it to television and is the most viewed show in its time slot is 20%. Given this information, Norman's expected total utility is _____ utils.

-(Table: Choice with Uncertainty) Look at the table Choice with Uncertainty. Suppose the probability that the sitcom does not make it to television is 50%, that it makes it to television but is not the most viewed show in its time slot is 30%, and that it makes it to television and is the most viewed show in its time slot is 20%. Given this information, Norman's expected total utility is _____ utils.

(Multiple Choice)

4.8/5  (39)

(39)

Risk-averse individuals are willing to make deals that reduce their income to reduce their risk.

(True/False)

4.9/5  (38)

(38)

On any particular day, the probability that it will rain is 25% and that you will be sick is 10%. The probability that both happen on the same day is:

(Multiple Choice)

4.9/5  (36)

(36)

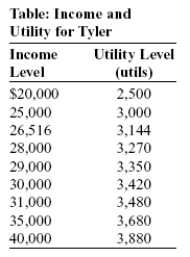

Use the following to answer questions :  -(Table: Income and Utility for Tyler) The table Income and Utility for Tyler shows the utility Tyler receives at various income levels, but she does not know what her income will be next year. There is a 40% chance her income will be $20,000, a 40% chance her income will be $30,000, and a 20% chance her income will be $40,000. We know that Tyler is risk-averse because:

-(Table: Income and Utility for Tyler) The table Income and Utility for Tyler shows the utility Tyler receives at various income levels, but she does not know what her income will be next year. There is a 40% chance her income will be $20,000, a 40% chance her income will be $30,000, and a 20% chance her income will be $40,000. We know that Tyler is risk-averse because:

(Multiple Choice)

4.9/5  (35)

(35)

Assume that flood insurance premiums are determined in the competitive market. Suppose that devastating floods along the Mississippi River have increased the degree of risk aversion among the insurance investors in this market. The _____ insurance shifts _____, leading to a(n) _____ in equilibrium premiums and a(n) _____ in the quantity of insurance bought and sold.

(Multiple Choice)

4.8/5  (37)

(37)

You go into a grocery store to buy a soft drink. You find that different brands or varieties have different prices: for a one-liter bottle, Coke costs $1, Pepsi costs $0.95, and ginger ale costs $1.05. The price of a one-liter bottle of a soft drink at your grocery store is therefore a random variable.

(True/False)

4.7/5  (35)

(35)

Use the following to answer questions  -(Table: Natasha's Total Utility) Look at the table Natasha's Total Utility. Natasha's marginal utility _____ as her income increases. The marginal utility of income between $30,000 and $32,500 is _____ utils per dollar, while it is _____ utils per dollar between $47,500 and $50,000.

-(Table: Natasha's Total Utility) Look at the table Natasha's Total Utility. Natasha's marginal utility _____ as her income increases. The marginal utility of income between $30,000 and $32,500 is _____ utils per dollar, while it is _____ utils per dollar between $47,500 and $50,000.

(Multiple Choice)

4.9/5  (34)

(34)

Common strategies to deal with the problem of adverse selection include screening (using observable information to make inferences about private information), signaling (engaging in actions that reveal one's private information), and establishing a good reputation.

(True/False)

4.9/5  (31)

(31)

A fair insurance policy is one in which the premium equals the expected value of the claim.

(True/False)

4.9/5  (31)

(31)

Economic growth that is not industry-specific is most likely to:

(Multiple Choice)

4.8/5  (33)

(33)

Buying a warranty on a new television is an example of paying to avoid risk.

(True/False)

4.8/5  (41)

(41)

The Baker family is faced with two possible states. In state 1, they remain healthy and incur no medical expenses. In state 2, their medical expenses will be $8,000. There is a 30% chance that state 1 will occur and a 70% chance that state 2 will occur. An insurance company offers to pay all of their medical expenses for a premium of $6,000. From the Bakers' point of view, this is a fair insurance policy.

(True/False)

4.9/5  (31)

(31)

Showing 81 - 100 of 197

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)