Exam 19: Uncertainty, Risk, and Private Information

Exam 1: First Principles233 Questions

Exam 2: Economic Models- Trade-Offs and Trade313 Questions

Exam 3: Supply and Demand290 Questions

Exam 4: Consumer and Producer Surplus224 Questions

Exam 5: Price Controls and Quotas- Meddling With Markets201 Questions

Exam 6: Elasticity98 Questions

Exam 7: Taxes298 Questions

Exam 9: The Rational Consumer44 Questions

Exam 8: International Trade268 Questions

Exam 10: Decision Making by Individuals and Firms116 Questions

Exam 11: Perfect Competition and the Supply Curve355 Questions

Exam 12: Monopoly348 Questions

Exam 13: Oligopoly97 Questions

Exam 14: Monopolistic Competition and Product Differentiation124 Questions

Exam 15: Externalities140 Questions

Exam 16: Public Goods and Common Resources75 Questions

Exam 17: The Economics of the Welfare State91 Questions

Exam 18: Factor Markets and the Distribution of Income314 Questions

Exam 19: Uncertainty, Risk, and Private Information197 Questions

Exam 20: Macroeconomics- the Big Picture168 Questions

Exam 21: Gdp and the Consumer Price Index204 Questions

Exam 22: Unemployment and Inflation351 Questions

Exam 23: Long-Run Economic Growth313 Questions

Exam 24: Savings, Investment Spending398 Questions

Exam 25: Fiscal Policy376 Questions

Exam 26: Money, Banking, and the Federal Reserve System464 Questions

Exam 27: Monetary Policy359 Questions

Exam 28: Inflation, Disinflation, and Deflation240 Questions

Exam 29: Crises and Consequences214 Questions

Exam 30: Macroeconomics- Events and Ideas320 Questions

Exam 31: Open-Economy Macroeconomics466 Questions

Exam 32: Graphs in Economics64 Questions

Exam 33: Toward a Fuller Understanding36 Questions

Exam 34: Consumer Preferences and Consumer Choice62 Questions

Exam 35: Indifference Curve Analysis of Labor Supply41 Questions

Select questions type

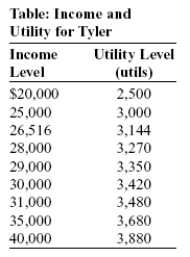

Use the following to answer questions :  -(Table: Income and Utility for Tyler) The table Income and Utility for Tyler shows the utility Tyler receives at various income levels, but she does not know what her income will be next year. There is a 40% chance her income will be $20,000, a 40% chance her income will be $30,000, and a 20% chance her income will be $40,000. What is her expected utility in utils?

-(Table: Income and Utility for Tyler) The table Income and Utility for Tyler shows the utility Tyler receives at various income levels, but she does not know what her income will be next year. There is a 40% chance her income will be $20,000, a 40% chance her income will be $30,000, and a 20% chance her income will be $40,000. What is her expected utility in utils?

(Multiple Choice)

4.7/5  (37)

(37)

Domingo has a total wealth of $500,000 composed of a house worth $100,000 and $400,000 in cash. He keeps the cash in a safe deposit box, so that it is completely safe. However, there is a 10% chance that his house will burn down by the end of the year and be worth nothing and a 90% chance that nothing will happen to it. Without insurance, the expected value of his end-of-year wealth is:

(Multiple Choice)

4.8/5  (33)

(33)

Use the following to answer questions :  -(Table: Income and Utility for Tyler) The table Income and Utility for Tyler shows the utility Tyler receives at various income levels, but she does not know what her income will be next year. There is a 40% chance her income will be $20,000, a 40% chance her income will be $30,000, and a 20% chance her income will be $40,000. What is the maximum amount of insurance Tyler would be willing to pay to guarantee an income of $28,000?

-(Table: Income and Utility for Tyler) The table Income and Utility for Tyler shows the utility Tyler receives at various income levels, but she does not know what her income will be next year. There is a 40% chance her income will be $20,000, a 40% chance her income will be $30,000, and a 20% chance her income will be $40,000. What is the maximum amount of insurance Tyler would be willing to pay to guarantee an income of $28,000?

(Multiple Choice)

4.9/5  (40)

(40)

Which pair of events is likely to be positively correlated?

(Multiple Choice)

4.8/5  (29)

(29)

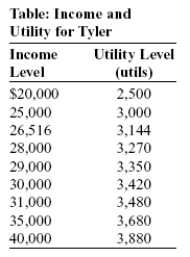

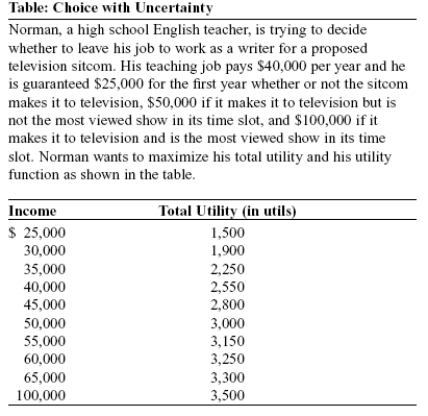

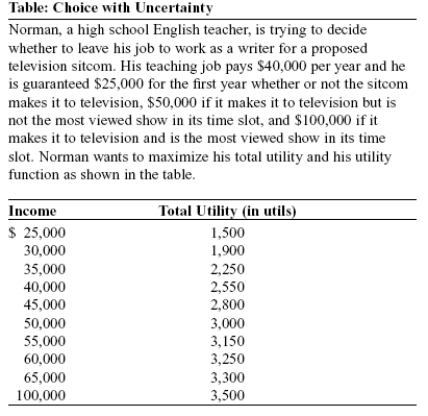

Use the following to answer questions :  -(Table: Choice with Uncertainty) Look at the table Choice with Uncertainty. Suppose the probability that the sitcom does not make it to television is 50%, that it makes it to television but is not the most viewed show in its time slot is 30%, and that it makes it to television and is the most viewed show in its time slot is 20%. Given this information, Norman, as a utility maximizer:

-(Table: Choice with Uncertainty) Look at the table Choice with Uncertainty. Suppose the probability that the sitcom does not make it to television is 50%, that it makes it to television but is not the most viewed show in its time slot is 30%, and that it makes it to television and is the most viewed show in its time slot is 20%. Given this information, Norman, as a utility maximizer:

(Multiple Choice)

4.9/5  (32)

(32)

The easiest risks to reduce by diversification are those associated with positively correlated events.

(True/False)

4.7/5  (34)

(34)

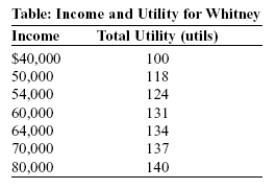

Use the following to answer questions :  -(Table: Income and Utility for Whitney) Look at the table Income and Utility for Whitney. Whitney's income next year is uncertain: there is a 40% probability she will make $40,000 and a 60% probability she will make $80,000. The expected value of Whitney's income is:

-(Table: Income and Utility for Whitney) Look at the table Income and Utility for Whitney. Whitney's income next year is uncertain: there is a 40% probability she will make $40,000 and a 60% probability she will make $80,000. The expected value of Whitney's income is:

(Multiple Choice)

4.9/5  (43)

(43)

Use the following to answer questions

Scenario: Choosing Insurance

The Ramirez family owns three cars and is considering buying insurance to cover the cost of repairs. They face two possible states: in state 1 their cars need no repairs and their income available for purchasing other goods and services is $50,000; in state 2 their cars need $10,000 worth of repairs and their income available for purchasing other goods and services is reduced to $40,000. The probability of repairs is 10%, while the probability of no repairs is 90%.

-(Scenario: Choosing Insurance) Refer to the information in the scenario Choosing Insurance. For $2,000 the Ramirez family can buy insurance that will cover the full cost of repairs. If family members are risk-averse and want to maximize their expected utility:

(Multiple Choice)

4.8/5  (26)

(26)

Insurance companies attempt to minimize moral hazard by imposing:

(Multiple Choice)

4.8/5  (37)

(37)

If an individual is risk-averse, then his or her total utility function must display _____ marginal utility.

(Multiple Choice)

5.0/5  (32)

(32)

Which of the following is TRUE if the insurance market is efficient?

(Multiple Choice)

4.9/5  (44)

(44)

The marginal utility of income for a risk-averse individual will be:

(Multiple Choice)

4.9/5  (37)

(37)

If an insurance company insured 100,000 cars across the state against theft, which of the following would NOT be true?

(Multiple Choice)

4.9/5  (40)

(40)

Use the following to answer questions :  -(Table: Choice with Uncertainty) Look at the table Choice with Uncertainty. Suppose the probability that the sitcom does not make it to television is 50%, that it makes it to television but is not the most viewed show in its time slot is 30%, and that it makes it to television and is the most viewed show in its time slot is 20%. Given this information, Norman's expected income is:

-(Table: Choice with Uncertainty) Look at the table Choice with Uncertainty. Suppose the probability that the sitcom does not make it to television is 50%, that it makes it to television but is not the most viewed show in its time slot is 30%, and that it makes it to television and is the most viewed show in its time slot is 20%. Given this information, Norman's expected income is:

(Multiple Choice)

4.9/5  (42)

(42)

Companies offering life insurance often require a drug test to determine whether the buyer is a smoker. A smoker must pay a higher premium. This is an example of:

(Multiple Choice)

4.7/5  (40)

(40)

A life insurance company will often require an applicant to submit to a brief physical exam to assess that person's basic level of health. This practice is a form of _____ to lessen the problem of _____.

(Multiple Choice)

4.8/5  (48)

(48)

If a stock analyst believes there is a 25% probability that the stock price of Dymonatis will be $30 at the end of the year, a 50% probability that it will be $40, and a 25% probability that it will be $50, then the expected value of the stock at the end of the year is:

(Multiple Choice)

4.9/5  (35)

(35)

Showing 161 - 180 of 197

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)