Exam 9: Fixed Assets and Intangible Assets

Exam 1: Introduction to Accounting and Business185 Questions

Exam 2: Analyzing Transactions212 Questions

Exam 3: The Adjusting Process169 Questions

Exam 4: Completing the Accounting Cycle193 Questions

Exam 5: Accounting for Merchandising Businesses219 Questions

Exam 6: Inventories163 Questions

Exam 7: Sarbanes-Oxley, internal Control, and Cash175 Questions

Exam 8: Receivables145 Questions

Exam 9: Fixed Assets and Intangible Assets174 Questions

Exam 10: Current Liabilities and Payroll171 Questions

Exam 11: Corporations: Organization, stock Transactions, and Dividends169 Questions

Exam 12: Long-Term Liabilities: Bonds and Notes183 Questions

Exam 13: Investments and Fair Value Accounting127 Questions

Exam 14: Statement of Cash Flows160 Questions

Exam 15: Financial Statement Analysis183 Questions

Select questions type

The method of determining depreciation that yields successive reductions in the periodic depreciation charge over the estimated life of the asset is

(Multiple Choice)

4.8/5  (41)

(41)

Once the useful life of a depreciable asset has been estimated and the amount to be depreciated each year has been determined,the amounts can not be changed.

(True/False)

4.8/5  (36)

(36)

The units of production depreciation method provides a good match of expenses against revenue.

(True/False)

4.7/5  (40)

(40)

A machine with a cost of $120,000 has an estimated residual value of $15,000 and an estimated life of 5 years or 15,000 hours.It is to be depreciated by the units-of-production method.What is the amount of depreciation for the second full year,during which the machine was used 5,000 hours?

(Multiple Choice)

4.8/5  (35)

(35)

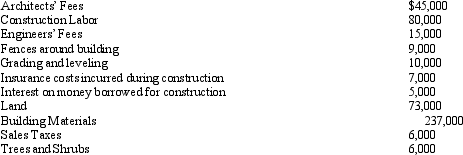

Eagle Country Club has acquired a lot to construct a clubhouse.Eagle had the following costs related to the construction:

Determine the cost of the Club House to be reported on the balance sheet.

Determine the cost of the Club House to be reported on the balance sheet.

(Essay)

4.7/5  (38)

(38)

As a company records depreciation expense for a period of time a corresponding cash inflow from investing activities is reported on the statement of cash flows.

(True/False)

4.7/5  (36)

(36)

Expenditures that add to the utility of fixed assets for more than one accounting period are

(Multiple Choice)

4.8/5  (33)

(33)

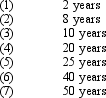

Convert each of the following estimates of useful life to a straight-line depreciation rate,stated as a percentage.

(Essay)

5.0/5  (36)

(36)

Computer equipment was acquired at the beginning of the year at a cost of $63,000 that has an estimated residual value of $3,000 and an estimated useful life of 5 years.Determine the (a)depreciable cost (b)double-declining-balance rate,and (c)double-declining-balance depreciation for the first year.

(Essay)

4.9/5  (37)

(37)

A capitalized asset will appear on the balance sheet as a long term asset.

(True/False)

5.0/5  (40)

(40)

When determining whether to record an asset as a fixed asset,what two criteria must be met?

(Multiple Choice)

4.8/5  (36)

(36)

When a company establishes an outstanding reputation and has a competitive advantage because of it,the company should record goodwill on its financial statements.

(True/False)

4.7/5  (29)

(29)

A fixed asset with a cost of $41,000 and accumulated depreciation of $36,000 is traded for a similar asset priced at $50,000.Assuming a trade-in allowance of $4,000,the cost basis of the new asset is

(Multiple Choice)

4.9/5  (40)

(40)

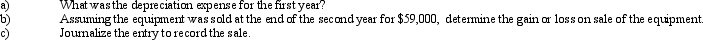

Equipment was acquired at the beginning of the year at a cost of $75,000.The equipment was depreciated using the straight-line method based upon an estimated useful life of 6 years and an estimated residual value of $7,500.

(Essay)

4.8/5  (42)

(42)

On June 1,2014,Aaron Company purchased equipment at a cost of $120,000 that has a depreciable cost of $90,000 and an estimated useful life of 3 years and 30,000 hours.

Using straight line depreciation,calculate depreciation expense for the second year.

(Multiple Choice)

5.0/5  (36)

(36)

Williams Company acquired machinery on July 1,2009,at a cost of $130,000.The estimated useful life of the machinery was 10 years and the estimated residual value was $10,000.Williams uses the double-declining-balance method of depreciation.On October 1,2012,Williams sold the equipment for $75,000.

1)Record the journal entry for the depreciation on this machinery for 2012.

2)Record the journal entry for the sale of the machinery.

(Essay)

4.8/5  (43)

(43)

Costs associated with normal research and development activities should be treated as intangible assets.

(True/False)

4.8/5  (34)

(34)

Golden Sales has bought $135,000 in fixed assets on January 1st associated with sales equipment.The residual value of these assets is estimated at $10,000 after they service their 4 year service life.Golden Sales managers want to evaluate the options of depreciation.

(a)Compute the annual straight-line depreciation and provide the sample depreciation journal entry to be posted at the end of each of the years.

(b)Write the journal entries for each year of the service life for these assets using the double- declining balance method.

(Essay)

4.8/5  (34)

(34)

The process of transferring the cost of metal ores and other minerals removed from the earth to an expense account is called

(Multiple Choice)

4.9/5  (32)

(32)

When a company exchanges machinery and receives a trade-in allowance greater than the book value,this transaction would be recorded with the following entry (assuming the exchange was considered to have commercial substance):

(Multiple Choice)

4.9/5  (32)

(32)

Showing 81 - 100 of 174

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)