Exam 9: Fixed Assets and Intangible Assets

Exam 1: Introduction to Accounting and Business185 Questions

Exam 2: Analyzing Transactions212 Questions

Exam 3: The Adjusting Process169 Questions

Exam 4: Completing the Accounting Cycle193 Questions

Exam 5: Accounting for Merchandising Businesses219 Questions

Exam 6: Inventories163 Questions

Exam 7: Sarbanes-Oxley, internal Control, and Cash175 Questions

Exam 8: Receivables145 Questions

Exam 9: Fixed Assets and Intangible Assets174 Questions

Exam 10: Current Liabilities and Payroll171 Questions

Exam 11: Corporations: Organization, stock Transactions, and Dividends169 Questions

Exam 12: Long-Term Liabilities: Bonds and Notes183 Questions

Exam 13: Investments and Fair Value Accounting127 Questions

Exam 14: Statement of Cash Flows160 Questions

Exam 15: Financial Statement Analysis183 Questions

Select questions type

On July 1st,Hartford Construction purchases a bulldozer for $228,000.The equipment has a 9 year life with a residual value of $16,000.Hartford uses units-of-production method depreciation and the bulldozer is expected to yield 26,500 operating hours.

(a)Calculate the depreciation expense per hour of operation.

(b)The bulldozer is operated 1,250 hours in the first year,2,755 hours in the second year,and 1,225 hours in the third year of operations.Journalize the depreciation expense for each year.

(Essay)

4.8/5  (25)

(25)

Minerals removed from the earth are classified as intangible assets.

(True/False)

4.8/5  (37)

(37)

The acquisition costs of property,plant,and equipment should include all normal,reasonable and necessary costs to get the asset in place and ready for use.

(True/False)

4.8/5  (38)

(38)

On April 15,Compton Co.paid $2,800 to upgrade a delivery truck and $125 for an oil change.Journalize the entries for the upgrade to delivery truck and oil change expenditures.

(Essay)

4.9/5  (45)

(45)

On June 1,2014,Aaron Company purchased equipment at a cost of $120,000 that has a depreciable cost of $90,000 and an estimated useful life of 3 years and 30,000 hours.

Using straight line depreciation,prepare the journal entry to record depreciation expense for (a)the first year, (b)the second year and (c)the last year.

$90,000/3 years = $30,000 per full year

$30,000/12 months = $2,500 per month

1st year - $2,500 x 7 months = $17,500

Last year - $2,500 x 5 months = $12,500

(Essay)

4.7/5  (34)

(34)

It is not necessary for a company to use the same depreciation method for financial statements and for determining income taxes.

(True/False)

4.9/5  (36)

(36)

Revising depreciation estimates does affect the amounts of depreciation expense recorded in past periods.

(True/False)

4.8/5  (38)

(38)

An operating lease is accounted for as if the lessee has purchased the asset.

(True/False)

4.8/5  (40)

(40)

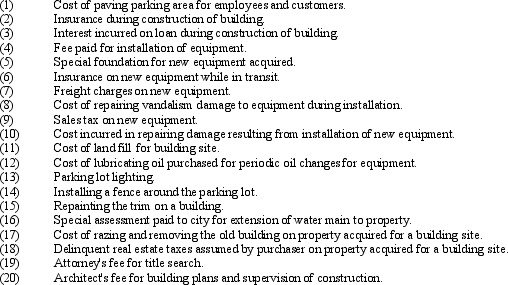

Identify each of the following expenditures as chargeable to (a)Land, (b)Land Improvements, (c)Buildings, (d)Machinery and Equipment,or (e)other account.

(Essay)

4.9/5  (41)

(41)

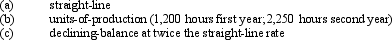

Equipment purchased at the beginning of the fiscal year for $360,000 is expected to have a useful life of 5 years,or 14,000 operating hours,and a residual value of $10,000.Compute the depreciation for the first and second years of use by each of the following methods:

(Round the answer to the nearest dollar. )

(Round the answer to the nearest dollar. )

(Essay)

4.7/5  (43)

(43)

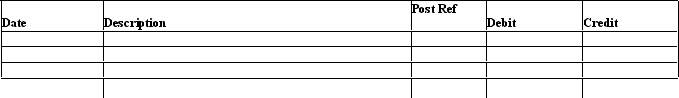

Macon Co.acquired drilling rights for $7,500,000.The oil deposit is estimated at 37,500,000 gallons.During the current year,3,000,000 gallons were drilled.Journalize the adjusting entry at December 31,2011 to recognize the depletion expense.

Journal

(Essay)

4.7/5  (38)

(38)

Falcon Company acquired an adjacent lot to construct a new warehouse,paying $40,000 and giving a short-term note for $410,000.Legal fees paid were $13,275,delinquent taxes assessed were $14,500,and fees paid to remove an old building from the land were $15,800.Materials salvaged from the demolition of the building were sold for $6,800.A contractor was paid $890,000 to construct a new warehouse.Determine the cost of the land to be reported on the balance sheet and show your work.

(Essay)

4.9/5  (42)

(42)

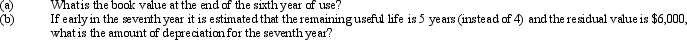

Equipment costing $80,000 with a useful life of 10 years and a residual value of $8,000 has been depreciated for 6 years by the straight-line method.Assume a fiscal year ending December 31.

(Essay)

4.9/5  (33)

(33)

Fixed assets are ordinarily presented in the balance sheet

(Multiple Choice)

4.9/5  (35)

(35)

If a fixed asset with a book value of $10,000 is traded for a similar fixed asset,and a trade-in allowance of $15,000 is granted by the seller,if the transaction is deemed to have commercial substance,the buyer would report a gain on disposal of fixed assets of $5,000.

(True/False)

4.9/5  (37)

(37)

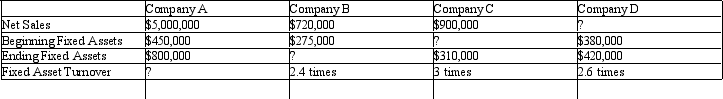

Fill in the missing numbers using the formula for Fixed Asset Turnover:

(Essay)

5.0/5  (40)

(40)

All property,plant,and equipment assets are depreciated over time.

(True/False)

4.7/5  (38)

(38)

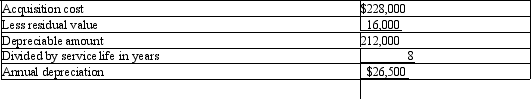

On July 1st,Harding Construction purchases a bulldozer for $228,000.The equipment has a 8 year life with a residual value of $16,000.Harding uses straight-line depreciation.

(a)Calculate the depreciation expense and provide the journal entry for the first year ending December 31st.

(b)Calculate the third year's depreciation expense and provide the journal entry for the third year ending December 31st.

(c)Calculate the last year's depreciation expense and provide the journal entry for the last year.

Annual depreciation is:

(Essay)

4.9/5  (34)

(34)

Factors contributing to a decline in the usefulness of a fixed asset may be divided into the following two categories

(Multiple Choice)

5.0/5  (33)

(33)

Showing 121 - 140 of 174

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)