Exam 11: Property, plant, and Equipment and Intangible Assets: Utilization and Impairment

Exam 1: Environment and Theoretical Structure of Financial Accounting144 Questions

Exam 2: Review of the Accounting Process124 Questions

Exam 3: The Balance Sheet and Financial Disclosures111 Questions

Exam 4: The Income Statement, comprehensive Income, and the Statement of Cash Flows103 Questions

Exam 5: Income Measurement347 Questions

Exam 6: Time Value of Money Concepts109 Questions

Exam 7: Cash and Receivables160 Questions

Exam 8: Inventories: Measurement129 Questions

Exam 9: Inventories: Additional Issues124 Questions

Exam 10: Property, plant, and Equipment and Intangible Assets: Acquisition and Disposition120 Questions

Exam 11: Property, plant, and Equipment and Intangible Assets: Utilization and Impairment133 Questions

Exam 12: Investments179 Questions

Exam 13: Current Liabilities and Contingencies116 Questions

Exam 14: Bonds and Long-Term Notes147 Questions

Exam 15: Leases143 Questions

Exam 16: Accounting for Income Taxes155 Questions

Exam 17: Pensions and Other Postretirement Benefits196 Questions

Exam 20: Accounting Changes125 Questions

Exam 21: The Statement of Cash Flows155 Questions

Select questions type

Biological assets are valued at fair value less estimated costs to sell under International Financial Reporting Standards (IFRS).

(True/False)

4.7/5  (36)

(36)

Component depreciation,required under International Financial Reporting Standards (IFRS),is allowed but rarely used by U.S.companies.

(True/False)

4.7/5  (42)

(42)

The three factors in cost allocation of a depreciable asset are service life,allocation base,and allocation method.

(True/False)

4.8/5  (39)

(39)

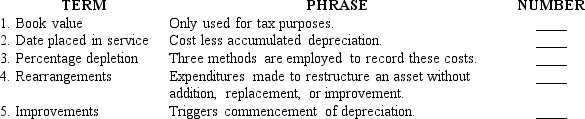

Listed below are five terms followed by a list of phrases that describe or characterize five of the terms.Match each phrase with the number for the correct term.

(Essay)

4.8/5  (42)

(42)

Canliss Mining uses the retirement method to determine depreciation on its office equipment.During 2014,its first year of operations,office equipment was purchased at a cost of $14,000.Useful life of the equipment averages four years and no salvage value is anticipated.In 2016,equipment costing $5,000 was sold for $600 and replaced with new equipment costing $6,000.Canliss would record 2016 depreciation of:

(Multiple Choice)

4.8/5  (38)

(38)

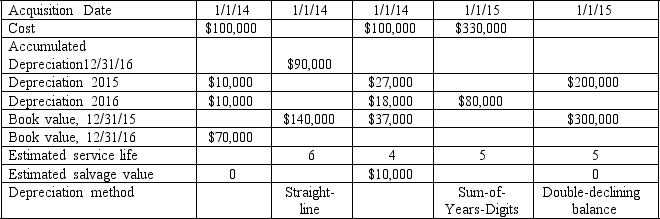

The table below contains data on depreciation for equipment.

Required: Fill in the missing data in the table.

(Essay)

4.9/5  (25)

(25)

Using the double-declining balance method,depreciation for 2017 would be:

(Multiple Choice)

4.8/5  (34)

(34)

Required:

Compute depreciation for 2016 and 2017 and the book value of the drill press at December 31,2016 and 2017,assuming the units-of-production method is used.

(Essay)

4.9/5  (33)

(33)

Accounting for a change in the estimated service life of equipment:

(Multiple Choice)

4.8/5  (37)

(37)

Fryer Inc.owns equipment for which it paid $90 million.At the end of 2016,it had accumulated depreciation on the equipment of $27 million.Due to adverse economic conditions,Fryer's management determined that it should assess whether an impairment loss should be recognized for the equipment.The estimated undiscounted future cash flows to be provided by the equipment total $60 million,and the equipment's fair value at that point is $40 million.Under these circumstances,Fryer:

(Multiple Choice)

4.7/5  (40)

(40)

Using the straight-line method,the book value at December 31,2016,would be:

(Multiple Choice)

4.9/5  (36)

(36)

Under group and composite depreciation methods,gains and losses on the disposal of individual assets need not be computed.

(True/False)

4.9/5  (30)

(30)

Using the double-declining balance method,depreciation for 2016 and the book value at December 31,2016,would be:

(Multiple Choice)

4.9/5  (42)

(42)

Required:

Compute depreciation for 2016 and 2017 and the book value of the spooler at December 31,2016 and 2017,assuming the straight-line method is used.

(Essay)

4.9/5  (40)

(40)

In the first year of an asset's life,which of the following methods has the smallest depreciation?

(Multiple Choice)

4.7/5  (34)

(34)

Using the sum-of-the-years'-digits method,depreciation for 2016 and book value at December 31,2016,would be:

(Multiple Choice)

4.9/5  (31)

(31)

Using the sum-of-the years'-digits method,depreciation for 2017 and book value at December 31,2017,would be

(Multiple Choice)

5.0/5  (41)

(41)

Briefly discuss why straight-line is the most common depreciation method used in practice.

(Essay)

4.9/5  (45)

(45)

Showing 21 - 40 of 133

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)