Exam 11: Property, plant, and Equipment and Intangible Assets: Utilization and Impairment

Exam 1: Environment and Theoretical Structure of Financial Accounting144 Questions

Exam 2: Review of the Accounting Process124 Questions

Exam 3: The Balance Sheet and Financial Disclosures111 Questions

Exam 4: The Income Statement, comprehensive Income, and the Statement of Cash Flows103 Questions

Exam 5: Income Measurement347 Questions

Exam 6: Time Value of Money Concepts109 Questions

Exam 7: Cash and Receivables160 Questions

Exam 8: Inventories: Measurement129 Questions

Exam 9: Inventories: Additional Issues124 Questions

Exam 10: Property, plant, and Equipment and Intangible Assets: Acquisition and Disposition120 Questions

Exam 11: Property, plant, and Equipment and Intangible Assets: Utilization and Impairment133 Questions

Exam 12: Investments179 Questions

Exam 13: Current Liabilities and Contingencies116 Questions

Exam 14: Bonds and Long-Term Notes147 Questions

Exam 15: Leases143 Questions

Exam 16: Accounting for Income Taxes155 Questions

Exam 17: Pensions and Other Postretirement Benefits196 Questions

Exam 20: Accounting Changes125 Questions

Exam 21: The Statement of Cash Flows155 Questions

Select questions type

Required:

Determine the amount,if any,of the impairment loss that El Dorado must recognize on these assets.

(Essay)

4.8/5  (31)

(31)

Total depreciation is the same over the life of an asset regardless of the method of depreciation used.

(True/False)

4.7/5  (47)

(47)

Using the straight-line method,depreciation for 2017 and the equipment's book value at December 31,2017,would be:

(Multiple Choice)

4.8/5  (39)

(39)

The factors that need to be determined to compute depreciation are an asset's:

(Multiple Choice)

4.9/5  (40)

(40)

Canliss Mining uses the replacement method to determine depreciation on its office equipment.During 2014,its first year of operations,office equipment was purchased at a cost of $14,000.Useful life of the equipment averages four years and no salvage value is anticipated.In 2016,equipment costing $5,000 was sold for $600 and replaced with new equipment costing $6,000.Canliss would record 2016 depreciation of:

(Multiple Choice)

4.9/5  (39)

(39)

A change from the straight-line method to the sum-of-years'-digits method of depreciation is handled as:

(Multiple Choice)

4.9/5  (44)

(44)

Briefly explain the disclosures that are required relative to depreciable assets.

(Essay)

4.7/5  (38)

(38)

Using the straight-line method,depreciation for 2017 and book value at December 31,2017,would be:

(Multiple Choice)

4.8/5  (40)

(40)

Briefly explain the following statement.Depreciation is a process of cost allocation,not valuation.

(Essay)

4.8/5  (30)

(30)

A change in the estimated useful life and residual value of machinery in the current year is handled as:

(Multiple Choice)

4.8/5  (38)

(38)

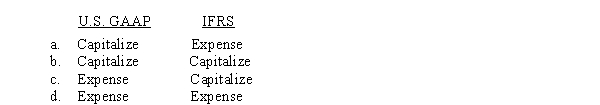

The normal treatment of litigation costs to successfully defend an intangible right under U.S.GAAP and International Financial Reporting Standards (IFRS),respectively,is:

(Short Answer)

4.9/5  (36)

(36)

According to International Financial Reporting Standards (IFRS),the revaluation of equipment when fair value exceeds book value,results in:

(Multiple Choice)

4.9/5  (42)

(42)

Required:

Compute depreciation for 2016 and 2017 and the book value of the spooler at December 31,2016 and 2017,assuming the sum-of-the-years'-digits method is used.

(Essay)

4.7/5  (33)

(33)

Using the straight-line method,depreciation for 2016 would be:

(Multiple Choice)

4.9/5  (43)

(43)

Advocates of accelerated depreciation methods argue that their use tends to level out the total cost of ownership of an asset over its benefit period if one considers both depreciation and repair and maintenance costs.

(True/False)

4.8/5  (42)

(42)

On September 30,2016,Sternberg Company sold office equipment for $12,000.The equipment was purchased on March 31,2013,for $24,000.The asset was being depreciated over a five-year life using the straight-line method,with depreciation based on months in service.No residual value was anticipated.

Required:

Prepare the journal entries to record 2016 depreciation and the sale of the equipment.

(Essay)

5.0/5  (37)

(37)

Ellen's Antiques reported the following in its December 31,2016,balance sheet:

Equipment $4,000,000

Accumulated depreciation-equipment $3,150,000

In a disclosure note,Ellen's indicates that it uses straight-line depreciation over eight years and estimates salvage value at 10% of cost.

Required: Compute the average age of Ellen's equipment at 12/31/2015.

(Essay)

4.9/5  (32)

(32)

By the replacement depreciation method,depreciation is recorded when assets are replaced.

(True/False)

4.8/5  (32)

(32)

Showing 81 - 100 of 133

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)