Exam 3: The Adjusting Process

Exam 1: Introduction to Accounting and Business194 Questions

Exam 2: Analyzing Transactions222 Questions

Exam 3: The Adjusting Process179 Questions

Exam 4: Completing the Accounting Cycle196 Questions

Exam 5: Accounting for Merchandising Businesses221 Questions

Exam 6: Inventories167 Questions

Exam 7: Sarbanes-Oxley, Internal Control, and Cash174 Questions

Exam 8: Receivables147 Questions

Exam 9: Fixed Assets and Intangible Assets175 Questions

Exam 10: Current Liabilities and Payroll172 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Dividends168 Questions

Exam 12: Long-Term Liabilities: Bonds and Notes181 Questions

Exam 13: Investments and Fair Value Accounting137 Questions

Exam 14: Statement of Cash Flows162 Questions

Exam 15: Financial Statement Analysis184 Questions

Select questions type

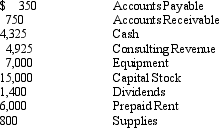

Jacki Lopez started JVL Consulting on January 1, 2011. The following are the account balances at the end of the first month of business, before adjusting entries were recorded:

Adjustment data:

Supplies on hand at the end of the month: $300

Unbilled consulting revenue: $850

Rent expense for the month: $2,000

Depreciation on equipment: $150

(a) Prepare the required adjusting entries, adding accounts as needed.

(b) Prepare an Adjusted Trial Balance for JVL Consulting as of January 31, 2011.

Adjustment data:

Supplies on hand at the end of the month: $300

Unbilled consulting revenue: $850

Rent expense for the month: $2,000

Depreciation on equipment: $150

(a) Prepare the required adjusting entries, adding accounts as needed.

(b) Prepare an Adjusted Trial Balance for JVL Consulting as of January 31, 2011.

(Essay)

4.9/5  (38)

(38)

The entry to adjust for the cost of supplies used during the accounting period is

(Multiple Choice)

5.0/5  (38)

(38)

A contra asset account for Land will normally appear in the balance sheet.

(True/False)

4.9/5  (35)

(35)

If the effect of the credit portion of an adjusting entry is to increase the balance of a liability account, which of the following describes the effect of the debit portion of the entry?

(Multiple Choice)

4.7/5  (29)

(29)

Explain the difference between accrual-basis accounting and cash-basis accounting.

(Essay)

4.8/5  (34)

(34)

On November 1st, clients of Great Designs Company prepaid $2,800 for services to be provided in the future at a rate of $70 per hour.

(a) Journalize the receipt of this cash.

(b) As of November 30th, Great Designs shows that 16 hours of services have been provided on this agreement. Prepare the necessary journal entry to record this.

(c) Determine the total unearned fees in hours and dollars at November 30th.

(Essay)

4.8/5  (30)

(30)

All of the following statements regarding vertical analysis are true except

(Multiple Choice)

4.8/5  (37)

(37)

Which of the accounts below would most likely appear on an adjusted trial balance but probably would not appear on the unadjusted trial balance?

(Multiple Choice)

4.9/5  (37)

(37)

Austin, Inc. made a Prepaid Rent payment of $2,800 on January 1st. The company's monthly rent is $700. The amount of Prepaid Rent that would appear on the January 31 balance sheet after adjustment is:

(Multiple Choice)

4.8/5  (40)

(40)

The matching concept requires expenses be recorded in the same period that the related revenue is recorded.

(True/False)

4.9/5  (34)

(34)

The adjusting entry to adjust supplies was omitted at the end of the year. This would effect the income statement by having

(Multiple Choice)

4.9/5  (30)

(30)

A one-year insurance policy was purchased on October 1, 2011 for $4,200. The adjusting entry on December 31, 2011 would be

(Essay)

4.9/5  (34)

(34)

Depreciation on equipment for the year is $900.

(a) Record the journal entry if the company adjusts its account once a year.

(b) Record the journal entry if the company adjusts its account on a monthly basis.

(Essay)

4.8/5  (42)

(42)

The Supplies account had a beginning balance of $1,750. Supplies purchased during the period totaled $3,500. At the end of the period before adjustment, $350 of supplies were on hand. Prepare the adjusting entry for supplies.

(Essay)

4.8/5  (34)

(34)

Even though GAAP requires the accrual basis of accounting, some businesses prefer using the cash basis of accounting.

(True/False)

4.9/5  (43)

(43)

Depreciation Expense is reported on the balance sheet as an addition to the related asset.

(True/False)

4.8/5  (40)

(40)

Showing 41 - 60 of 179

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)