Exam 3: The Adjusting Process

Exam 1: Introduction to Accounting and Business194 Questions

Exam 2: Analyzing Transactions222 Questions

Exam 3: The Adjusting Process179 Questions

Exam 4: Completing the Accounting Cycle196 Questions

Exam 5: Accounting for Merchandising Businesses221 Questions

Exam 6: Inventories167 Questions

Exam 7: Sarbanes-Oxley, Internal Control, and Cash174 Questions

Exam 8: Receivables147 Questions

Exam 9: Fixed Assets and Intangible Assets175 Questions

Exam 10: Current Liabilities and Payroll172 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Dividends168 Questions

Exam 12: Long-Term Liabilities: Bonds and Notes181 Questions

Exam 13: Investments and Fair Value Accounting137 Questions

Exam 14: Statement of Cash Flows162 Questions

Exam 15: Financial Statement Analysis184 Questions

Select questions type

One of the accounting concepts upon which deferrals and accruals are based is

(Multiple Choice)

5.0/5  (35)

(35)

When preparing an income statement vertical analysis, each revenue and expense is expressed as a percent of net income.

(True/False)

4.9/5  (39)

(39)

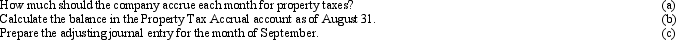

On January 1, the Newman Company estimated its property tax to be $5,100 for the year.

(Essay)

4.9/5  (47)

(47)

On January 1st, Great Designs Company had a debit balance of $1,450 in the Office Supplies account. During the month, Great Designs purchased $115 and $160 of office supplies and journalized them to the Office Supplies asset account upon purchasing. On January 31st, an inspection of the office supplies cabinet shows that only $350 of Office Supplies remains in the locker. Prepare the January 31st adjusting entry for Office Supplies.

(Essay)

4.8/5  (36)

(36)

The supplies account has a balance of $1,200 at the beginning of the year and was debited during the year for $2,300, representing the total of supplies purchased during the year. If $650 of supplies are on hand at the end of the year, the supplies expense to be reported on the income statement for the year is

(Multiple Choice)

4.7/5  (35)

(35)

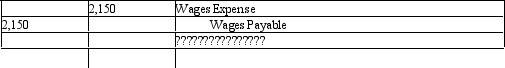

The following adjusting journal entry found in the journal is missing an explanation. Select the best explanation for the entry.

(Multiple Choice)

4.9/5  (40)

(40)

Data for an adjusting entry described as "accrued wages, $2,020" would result in

(Multiple Choice)

4.7/5  (42)

(42)

If the debit portion of an adjusting entry is to an asset account, then the credit portion must be to a liability account.

(True/False)

4.9/5  (30)

(30)

The company determines that the interest expense on a note payable for period ending December 31st is $775. This amount is payable on January 1st. Prepare the journal entries required on December 31st and January 1st.

(Essay)

4.9/5  (42)

(42)

A company pays $6,500 for two season tickets on September 1. If $2,500 is earned by December 31, the adjusting entry made at that time is debit Cash, $2,500 and credit Ticket Revenue, $2,500.

(True/False)

4.8/5  (33)

(33)

The system of accounting where revenues are recorded when they are earned and expenses are recorded when they are incurred is called the cash basis of accounting.

(True/False)

4.8/5  (44)

(44)

Supplies are recorded as assets when purchased. Therefore, the credit to supplies in the adjusting entry is for the amount of supplies

(Multiple Choice)

4.9/5  (39)

(39)

Generally accepted accounting principles require the accrual basis of accounting.

(True/False)

4.9/5  (25)

(25)

The systematic allocation of land's cost to expense is called depreciation.

(True/False)

4.9/5  (41)

(41)

The prepaid insurance account had a beginning balance of $6,600 and was debited for $2,300 of premiums paid during the year. Journalize the adjusting entry required at the end of the year assuming the amount of unexpired insurance related to future periods is $4,100.

(Essay)

4.9/5  (41)

(41)

A company realizes that the last two day's revenue for the month was billed but not recorded. The adjusting entry on December 31 is debit Accounts Receivable and credit Fees Earned.

(True/False)

4.8/5  (36)

(36)

Which of the following is an example of a prepaid expense?

(Multiple Choice)

4.9/5  (37)

(37)

On December 31, the balance in the Office Supplies account is $1,385. A count shows $435 worth of supplies on hand. Prepare the adjusting entry for supplies.

(Essay)

4.7/5  (33)

(33)

On January 1, DogMart Company purchased a two-year liability insurance policy for $22,800 cash. The purchase was recorded to Prepaid Insurance. Prepare the January 31 adjusting entry.

(Essay)

4.7/5  (40)

(40)

Showing 161 - 179 of 179

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)