Exam 8: Inventories and the Cost of Goods Sold

Exam 1: Accounting: Information for Decision Making135 Questions

Exam 2: Basic Financial Statements158 Questions

Exam 3: The Accounting Cycle: Capturing Economic Events161 Questions

Exam 4: The Accounting Cycle: Accruals and Deferrals160 Questions

Exam 5: The Accounting Cycle: Reporting Financial Results136 Questions

Exam 6: Merchandising Activities144 Questions

Exam 7: Financial Assets233 Questions

Exam 8: Inventories and the Cost of Goods Sold169 Questions

Exam 9: Plant and Intangible Assets154 Questions

Exam 10: Liabilities221 Questions

Exam 11: Stockholders Equity: Paid-In Capital166 Questions

Exam 12: Income and Changes in Retained Earnings153 Questions

Exam 13: Statement of Cash Flows181 Questions

Exam 14: Financial Statement Analysis165 Questions

Exam 15: Global Business and Accounting95 Questions

Exam 16: Management Accounting: a Business Partner124 Questions

Exam 17: Job Order Cost Systems and Overhead Allocations116 Questions

Exam 18: Process Costing103 Questions

Exam 19: Costing and the Value Chain89 Questions

Exam 20: Cost-Volume-Profit Analysis147 Questions

Exam 21: Incremental Analysis119 Questions

Exam 22: Responsibility Accounting and Transfer Pricing108 Questions

Exam 23: Operational Budgeting115 Questions

Exam 24: Standard Cost Systems130 Questions

Exam 25: Rewarding Business Performance71 Questions

Exam 26: Capital Budgeting125 Questions

Exam 28: Forms of Business Organization52 Questions

Exam 27: The Time Value of Money: Future Amounts and Present Values Answer Key49 Questions

Select questions type

When prices are increasing, which inventory method will produce the highest cost of goods sold?

Free

(Multiple Choice)

4.8/5  (43)

(43)

Correct Answer:

B

Any business that sells numerous units of identical products may determine its cost of goods sold using a flow assumption, rather than the specific identification method.

Free

(True/False)

4.7/5  (35)

(35)

Correct Answer:

True

Assuming that Ace Systems uses the average cost flow assumption, the cost of goods sold to be recorded at January 28 is:

Free

(Multiple Choice)

4.8/5  (40)

(40)

Correct Answer:

A

During periods of inflation which method would yield the largest ending inventory and cost of goods sold?

(Multiple Choice)

4.7/5  (37)

(37)

In a period of rising prices, a company is most likely to use the specific identification method of pricing inventory if:

(Multiple Choice)

4.9/5  (43)

(43)

Comparison of LIFO and FIFO

Company X and Company Y sell the same product. The cost of this product has been rising steadily throughout the year. Both companies reported the same net income for the year, although Company X used the first-in, first-out method of pricing inventory, while Company Y used the last-in, first-out method.

(a) Which company's valuation of ending inventory in the balance sheet is more likely to approximate replacement cost?

Company ______________________________

(b) Which company reports a cost of goods sold figure in the current year income statement that is more likely to reflect the replacement cost of the units sold?

Company ______________________________

(c) Which company is minimizing income taxes it must pay?

Company ______________________________

(d) Which company would have reported the higher net income if both companies had used the same method of pricing inventory?

Company ______________________________

(Essay)

4.8/5  (37)

(37)

Under the FIFO flow assumption, the cost of these items to be included in inventory in the company's year-end balance sheet is:

(Multiple Choice)

4.8/5  (45)

(45)

The CPA firm auditing Capri Corporation found that net income had been overstated. Which of the following could be the cause?

(Multiple Choice)

4.7/5  (37)

(37)

Inventory flow assumptions

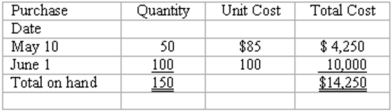

The perpetual inventory records of Handy Hardware show 150 units of a particular product on hand, acquired at the following dates and costs:

On June 3, Handy sold 120 units of this product.

Instructions: Prepare a journal entry to record the cost of goods sold relating to the sale on June 3, assuming that Handy uses:

(a) A LIFO flow assumption.

(b) A FIFO flow assumption.

(c) The average cost (or moving average) flow assumption.

On June 3, Handy sold 120 units of this product.

Instructions: Prepare a journal entry to record the cost of goods sold relating to the sale on June 3, assuming that Handy uses:

(a) A LIFO flow assumption.

(b) A FIFO flow assumption.

(c) The average cost (or moving average) flow assumption.

(Essay)

4.8/5  (40)

(40)

Garden World uses the retail method to estimate its monthly cost of goods sold and month-end inventory. At May 31, the accounting records indicate the cost of goods available for sale during the month (beginning inventory plus purchases) totaled $540,000. These goods had been priced for resale at $900,000. Sales in May totaled $480,000. The estimated inventory at May 31 is:

(Multiple Choice)

4.9/5  (34)

(34)

A write down of inventory due to obsolescence reduces the amount in the Inventory account and may increase the amount in the Cost of Goods Sold account.

(True/False)

4.7/5  (46)

(46)

In a perpetual inventory system, two entries are normally made to record each sales transaction. The purpose of these entries is best described as follows:

(Multiple Choice)

4.7/5  (33)

(33)

In a perpetual inventory system, an inventory flow assumption is used primarily for determining which costs to use in:

(Multiple Choice)

4.9/5  (43)

(43)

During January, Sundown Corporation had sales of $300,000 and a cost of goods available for sale of $600,000. The company consistently earns a gross profit rate of 45%. Using the gross profit method, the estimated inventory at January 31 amounts to:

(Multiple Choice)

4.8/5  (38)

(38)

An advantage to the LIFO method of accounting for inventory is that it values the cost of goods sold at current replacement costs.

(True/False)

4.9/5  (40)

(40)

Kent Company has used the same inventory method for many years. This is an example of which principle?

(Multiple Choice)

4.9/5  (29)

(29)

As a result of taking an annual physical inventory, it usually is necessary in a perpetual inventory system to make an entry:

(Multiple Choice)

4.9/5  (35)

(35)

Which of the four inventory cost flow assumptions transfers the most recent purchase cost to the cost of goods sold and the remaining items in inventory are valued at the oldest acquisition costs?

(Multiple Choice)

4.8/5  (40)

(40)

Showing 1 - 20 of 169

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)