Exam 21: Incremental Analysis

Exam 1: Accounting: Information for Decision Making135 Questions

Exam 2: Basic Financial Statements158 Questions

Exam 3: The Accounting Cycle: Capturing Economic Events161 Questions

Exam 4: The Accounting Cycle: Accruals and Deferrals160 Questions

Exam 5: The Accounting Cycle: Reporting Financial Results136 Questions

Exam 6: Merchandising Activities144 Questions

Exam 7: Financial Assets233 Questions

Exam 8: Inventories and the Cost of Goods Sold169 Questions

Exam 9: Plant and Intangible Assets154 Questions

Exam 10: Liabilities221 Questions

Exam 11: Stockholders Equity: Paid-In Capital166 Questions

Exam 12: Income and Changes in Retained Earnings153 Questions

Exam 13: Statement of Cash Flows181 Questions

Exam 14: Financial Statement Analysis165 Questions

Exam 15: Global Business and Accounting95 Questions

Exam 16: Management Accounting: a Business Partner124 Questions

Exam 17: Job Order Cost Systems and Overhead Allocations116 Questions

Exam 18: Process Costing103 Questions

Exam 19: Costing and the Value Chain89 Questions

Exam 20: Cost-Volume-Profit Analysis147 Questions

Exam 21: Incremental Analysis119 Questions

Exam 22: Responsibility Accounting and Transfer Pricing108 Questions

Exam 23: Operational Budgeting115 Questions

Exam 24: Standard Cost Systems130 Questions

Exam 25: Rewarding Business Performance71 Questions

Exam 26: Capital Budgeting125 Questions

Exam 28: Forms of Business Organization52 Questions

Exam 27: The Time Value of Money: Future Amounts and Present Values Answer Key49 Questions

Select questions type

Assuming that the MR Corporation has an inventory of 200 defective motors costing $450,000 to produce and $150,000 to repair, if the company receives an offer to purchase these motors for $100,000, the company's decision should be to sell the motors at the offered price.

The $450,000 production costs are sunk costs and therefore irrelevant to the decision. The relevant costs are the repair costs of $150,000 compared to the offer to purchase for $100,000. Since the offer is less than the repair costs, the decision should be not to sell the motors at the offered price.

Free

(True/False)

5.0/5  (38)

(38)

Correct Answer:

False

Nonfinancial considerations are relevant in decision making.

Free

(True/False)

4.9/5  (29)

(29)

Correct Answer:

True

In deciding whether or not to accept a special order, what is the opportunity cost of using machinery for which the firm has sufficient excess capacity to accept the order?

(Multiple Choice)

4.9/5  (37)

(37)

Assume that Perry's fixed costs remain unchanged if the seats are purchased from an outside supplier. In order to operate more profitably by buying the seats rather than manufacturing them, Perry must negotiate a price per unit from the outside supplier that is less than:

(Multiple Choice)

4.8/5  (43)

(43)

Special order decision

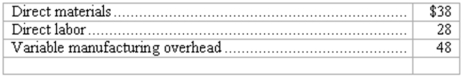

Prudent Products Corporation manufactures and sells 1,000 motorcycle engines each month. A primary component in each motor is an oil pump used to keep the motor lubricated. Prudent Products has the monthly capacity to produce 1,500 oil pumps. The variable unit costs associated with manufacturing each pump are shown below:

Fixed manufacturing overhead per month (for up to 1,500 units of production) averages $46,000. Volk's Autos, Inc., has offered to purchase 250 oil pumps from Prudent Products per month to be used in its own motorcycles.

(a) Prudent Product's average unit cost of manufacturing each oil pump if it rejects Volk's Autos' order is $___________ per unit.

(b) The incremental unit cost of producing each additional oil pump is $___________ per unit.

(c) If this special order is accepted, the price per unit that Prudent Products could charge Volk's Autos in order to earn a $20,000 monthly pretax profit on the sale is $___________ per unit.

Fixed manufacturing overhead per month (for up to 1,500 units of production) averages $46,000. Volk's Autos, Inc., has offered to purchase 250 oil pumps from Prudent Products per month to be used in its own motorcycles.

(a) Prudent Product's average unit cost of manufacturing each oil pump if it rejects Volk's Autos' order is $___________ per unit.

(b) The incremental unit cost of producing each additional oil pump is $___________ per unit.

(c) If this special order is accepted, the price per unit that Prudent Products could charge Volk's Autos in order to earn a $20,000 monthly pretax profit on the sale is $___________ per unit.

(Short Answer)

4.8/5  (39)

(39)

If Joan Reid's order is rejected, what will be John Boyd 's average unit cost of manufacturing each motor?

(Multiple Choice)

4.9/5  (39)

(39)

What will be the average per-unit manufacturing cost of the VCR, including repair costs, assuming that K Corp. does the repairs? $_____________ per unit

(Short Answer)

4.8/5  (31)

(31)

Incremental analysis rarely requires the decision maker to exercise judgment.

(True/False)

4.9/5  (41)

(41)

Which of the following types of cost are always relevant to a decision?

(Multiple Choice)

4.8/5  (33)

(33)

Which of the following questions would not be relevant to a make or buy decision?

(Multiple Choice)

4.8/5  (35)

(35)

Links, Inc. produces golf gloves. The gloves sell for $16 each. Variable costs are $8.50 and fixed costs are $1.50 each. An Australian company has offered to pay $12 each for 2,000 gloves. The manufacturing capacity will not be affected by this special order and it will not affect regular sales. Fixed assets will not change but variable selling costs will increase by $1.75 a glove due to delivery costs.

(a) What is the relevant cost per unit on this special order?

(b) How will company profits be affected?

(c) Should the company accept this special order?

(Essay)

4.7/5  (35)

(35)

Joint production decisions

Grassy Fertilizer manufactures two lines of garden grade fertilizer as part of a joint production process: GF10 and GF20. Joint costs up to the split-off point total $85,000 per batch. These joint costs are allocated to GF10 and GF20 in proportion to their relative sales values at the split-off point of $40,000 and $60,000, respectively.

Both lines of garden grade fertilizer can be further processed into commercial grade fertilizer. The following table summarizes the costs and revenue associated with additional processing of GF10 and GF20:

Additional Final selling price per Processing batch of commercial Costs grade fertilizer GF10 \ 18,000 \ 67,000 GF20 38,000 97,000

(a) The $85,000 in joint costs should be allocated to each product as follows:

GF10 $____________, GF20 $_____________ (b) Which product (GF10 or GF20) would result in a net decrease in operating income if processed into a commercial grade fertilizer? ______________ (c) Which product (GF10 or GF20) would result in a net increase in operating income if processed into a commercial grade fertilizer? ______________

(Essay)

4.9/5  (35)

(35)

Should K Corp.(1) sell the units for scrap or (2) repair the units? Underline the most profitable action, and indicate the amount of the net financial benefit of this action to the company. $____________

(Short Answer)

4.8/5  (35)

(35)

Mell Co. manufactured 100 personal computers at a cost of $30,000. It can sell them as is for $65,000, or install hard disks in them and sell them for $105,000. The $30,000 original manufacturing cost is:

(Multiple Choice)

4.9/5  (29)

(29)

Consultant Frank Alvarez recently commented that the most common error made by his clients is ignoring opportunity costs associated with business decisions. The costs Alvarez was referring to are:

(Multiple Choice)

4.7/5  (33)

(33)

Assume that Allen Distributors offers to purchase the additional 5,000 saws at a price of $47 per unit. If Burns accepts this price, Burns' monthly gross profit on sales of power saws will:

(Multiple Choice)

4.9/5  (26)

(26)

In making a decision, management will look thoroughly at both relevant and irrelevant data.

(True/False)

4.8/5  (43)

(43)

Products for which sales of one contribute to the sales of another are called:

(Multiple Choice)

4.8/5  (40)

(40)

Showing 1 - 20 of 119

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)