Exam 10: The basics of capital budgeting: evaluating cash flows

Exam 1: An overview of financial management and the financial environment46 Questions

Exam 2: Financial statements, cash flow, and taxes77 Questions

Exam 3: Analysis of financial statements104 Questions

Exam 4: Time value of money168 Questions

Exam 5: Bonds, bond valuation, and interest rates100 Questions

Exam 6: Risk and return146 Questions

Exam 7: Valuation of stocks and corporations80 Questions

Exam 8: Financial options and applications in corporate finance28 Questions

Exam 9: The cost of capital92 Questions

Exam 10: The basics of capital budgeting: evaluating cash flows108 Questions

Exam 11: Cash flow estimation and risk analysis78 Questions

Exam 12: Corporate valuation and financial planning41 Questions

Exam 13: Agency conflicts and corporate governance6 Questions

Exam 15: Capital structure decisions72 Questions

Exam 16: Supply chains and working capital management138 Questions

Exam 17: Multinational financial management49 Questions

Select questions type

In theory, capital budgeting decisions should depend solely on forecasted cash flows and the opportunity cost of capital.The decision criterion should not be affected by managers' tastes, choice of accounting method, or the profitability of other independent projects.

(True/False)

4.9/5  (35)

(35)

Assume a project has normal cash flows.All else equal, which of the following statements is CORRECT?

(Multiple Choice)

4.9/5  (43)

(43)

Normal Projects S and L have the same NPV when the discount rate is zero.However, Project S's cash flows come in faster than those of L.Therefore, we know that at any discount rate greater than zero, L will have the higher NPV.

(True/False)

4.9/5  (39)

(39)

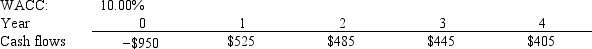

Pet World is considering a project that has the following cash flow data.What is the project's IRR? Note that a project's IRR can be less than the WACC (and even negative), in which case it will be rejected.

(Multiple Choice)

4.9/5  (44)

(44)

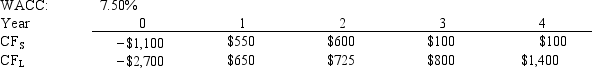

Current Design Co.is considering two mutually exclusive, equally risky, and not repeatable projects, S and L.Their cash flows are shown below.The CEO believes the IRR is the best selection criterion, while the CFO advocates the NPV.If the decision is made by choosing the project with the higher IRR rather than the one with the higher NPV, how much, if any, value will be forgone, i.e., what's the chosen NPV versus the maximum possible NPV? Note that (1)"true value" is measured by NPV, and (2)under some conditions the choice of IRR vs.NPV will have no effect on the value gained or lost.

(Multiple Choice)

4.7/5  (43)

(43)

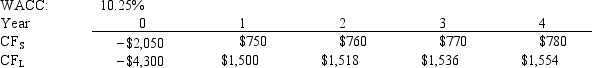

Projects S and L, whose cash flows are shown below, are mutually exclusive, equally risky, and not repeatable.Hooper Inc.is considering which of these two projects to undertake.If the decision is made by choosing the project with the higher IRR, how much value will be forgone? Note that under certain conditions choosing projects on the basis of the IRR will not cause any value to be lost because the project with the higher IRR will also have the higher NPV, so no value will be lost if the IRR method is used.

(Multiple Choice)

5.0/5  (37)

(37)

Clifford Company is choosing between two projects.The larger project has an initial cost of $100, 000, annual cash flows of $30, 000 for 5 years, and an IRR of 15.24%.The smaller project has an initial cost of $50, 000, annual cash flows of $16, 000 for 5 years, and an IRR of 16.63%.The projects are equally risky.Which of the following statements is CORRECT?

(Multiple Choice)

4.8/5  (35)

(35)

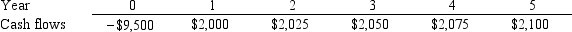

Shannon Co.is considering a project that has the following cash flow and WACC data.What is the project's discounted payback?

(Multiple Choice)

4.8/5  (30)

(30)

Showing 101 - 108 of 108

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)