Exam 17: Activity-Based Costing and Analysis

Exam 1: Introducing Accounting in Business262 Questions

Exam 2: Analyzing and Recording Transactions213 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements230 Questions

Exam 4: Accounting for Merchandising Operations195 Questions

Exam 5: Inventories and Cost of Sales199 Questions

Exam 6: Cash and Internal Controls197 Questions

Exam 7: Accounts and Notes Receivable163 Questions

Exam 8: Long-Term Assets202 Questions

Exam 9: Current Liabilities184 Questions

Exam 10: Long-Term Liabilities185 Questions

Exam 11: Corporate Reporting and Analysis209 Questions

Exam 12: Reporting and Analyzing Cash Flows172 Questions

Exam 13: Analyzing Financial Statements184 Questions

Exam 14: Managerial Accounting Concepts and Principles202 Questions

Exam 15: Job Order Costing and Analysis153 Questions

Exam 16: Process Costing and Analysis185 Questions

Exam 17: Activity-Based Costing and Analysis173 Questions

Exam 18: Cost Behavior and Cost-Volume-Profit Analysis177 Questions

Exam 19: Variable Costing and Performance Reporting175 Questions

Exam 20: Master Budgets and Performance Planning158 Questions

Exam 21: Flexible Budgets and Standard Costing177 Questions

Exam 22: Decentralization and Performance Evaluation128 Questions

Exam 23: Relevant Costing for Managerial Decisions136 Questions

Exam 24: Capital Budgeting and Investment Analysis139 Questions

Exam 25: Investments and International Operations168 Questions

Exam 26: Accounting for Partnerships126 Questions

Exam 27 Appendix : Accounting With Special Journals153 Questions

Select questions type

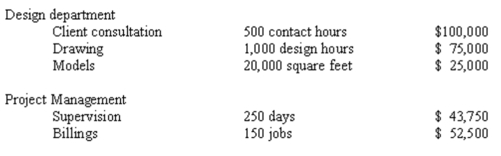

Upside Down, Incorporated designs custom storage spaces to eliminate clutter in both residential and business settings. The following data pertain to a recent reporting period.  Required

(a.) Use ABC to compute overhead rates for each activity.

(b.) Assign costs to a 3,000 square foot job that requires 70 contact hours, 20 design hours, and 14 days to complete.

Required

(a.) Use ABC to compute overhead rates for each activity.

(b.) Assign costs to a 3,000 square foot job that requires 70 contact hours, 20 design hours, and 14 days to complete.

(Essay)

4.8/5  (34)

(34)

Which of the following are advantages of using the plantwide overhead rate method?

(Multiple Choice)

4.9/5  (36)

(36)

A company estimates that overhead costs for the next year will be $3,600,000 for indirect labor, $200,000 for factory utilities and $21,500 for depreciation on factory machinery. The company uses machine hours as its overhead allocation base. If 764,300 machine hours are planned for this next year, what is the company's plantwide overhead rate?

(Essay)

4.8/5  (37)

(37)

Blast Rocket Company manufactures candy-coated popcorn treats which go through two operations, popping and baking, before they are complete. Expected costs and activities for the two departments are shown below. Popping Baking Direct labor hours 238,000 50,000 Machine hours 25,000 141,500 Overhead costs \ 357,000 \ 452,800

(a.) Compute a departmental overhead rate for the popping department based on direct labor hours.

(b.) Compute a departmental overhead rate for the baking department based on machine hours.

(Essay)

4.9/5  (39)

(39)

ABC is significantly less costly to implement and maintain than more traditional overhead costing systems.

(True/False)

4.9/5  (40)

(40)

Lake Prairie Company uses a plantwide overhead rate with machine hours as the allocation base. Next year, 500,000 units are expected to be produced taking .75 machine hours each. How much overhead will be assigned to each unit produced given the following estimated amounts?

Estimated: Department 1 Department 2 Manufacturing overhead costs \ 3,107,500 \ 1,520,000 Direct labor hours 150,000 200,000 Machine hours 200,000 175,000

(Multiple Choice)

5.0/5  (31)

(31)

A method of assigning overhead costs to a product using a single overhead rate is:

(Multiple Choice)

4.8/5  (40)

(40)

Product costs consist of direct labor, direct materials, manufacturing overhead and indirect costs.

(True/False)

4.8/5  (34)

(34)

A cost pool is a collection of costs that are related to the same or similar activity.

(True/False)

5.0/5  (33)

(33)

Because departmental overhead costs are allocated based on measures closely related to production volume, they accurately assign overhead, such as utility costs.

(True/False)

4.9/5  (43)

(43)

The major advantages of using a single plantwide overhead rate are ____________________ and ____________________.

(Essay)

4.9/5  (36)

(36)

Activity-based costing first assigns costs to products and then uses these product costs to assign costs to manufacturing activities.

(True/False)

4.9/5  (35)

(35)

Why is overhead allocation under ABC usually more accurate than either the plantwide overhead allocation method or the departmental overhead allocation method?

(Essay)

4.9/5  (37)

(37)

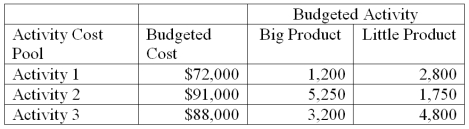

A company has two products: Big and Little. It uses activity-based costing and has prepared the following analysis showing budgeted cost and activity for each of its three activity cost pools.  Annual production and sales level of big product is 62,525 units, and the annual production and sales level of little product is 251,900 units.

(a.) Compute the approximate overhead cost per unit of big product under activity-based costing.

(b.) Compute the approximate overhead cost per unit of little product under activity-based costing.

Annual production and sales level of big product is 62,525 units, and the annual production and sales level of little product is 251,900 units.

(a.) Compute the approximate overhead cost per unit of big product under activity-based costing.

(b.) Compute the approximate overhead cost per unit of little product under activity-based costing.

(Essay)

4.9/5  (33)

(33)

Activity-based costing eliminates the need for overhead allocation rates.

(True/False)

4.8/5  (34)

(34)

The more activities tracked by activity-based costing, the more accurately overhead costs are assigned.

(True/False)

4.9/5  (39)

(39)

When using the plantwide overhead rate method, total budgeted overhead costs are combined into one overhead cost pool.

(True/False)

4.8/5  (36)

(36)

The final step of activity-based costing assigns overhead costs to pools rather than to products.

(True/False)

4.8/5  (33)

(33)

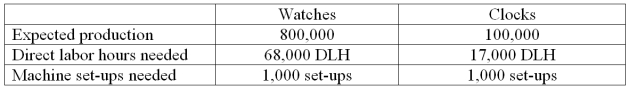

Time Bender Company makes watches and clocks. The following estimated data are available for the company's next fiscal year.

Total Direct labor costs $1,700,000

Total Set-up costs$190,000

Determine the set-up cost per unit for the watches and the clocks if set-up costs are assigned using a plantwide overhead rate based on direct labor hours (Round to two decimal places)

Determine the set-up cost per unit for the watches and the clocks if set-up costs are assigned using a plantwide overhead rate based on direct labor hours (Round to two decimal places)

(Essay)

4.7/5  (43)

(43)

Showing 21 - 40 of 173

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)