Exam 3: Adjusting Accounts and Preparing Financial Statements

Exam 1: Introducing Accounting in Business262 Questions

Exam 2: Analyzing and Recording Transactions213 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements230 Questions

Exam 4: Accounting for Merchandising Operations195 Questions

Exam 5: Inventories and Cost of Sales199 Questions

Exam 6: Cash and Internal Controls197 Questions

Exam 7: Accounts and Notes Receivable163 Questions

Exam 8: Long-Term Assets202 Questions

Exam 9: Current Liabilities184 Questions

Exam 10: Long-Term Liabilities185 Questions

Exam 11: Corporate Reporting and Analysis209 Questions

Exam 12: Reporting and Analyzing Cash Flows172 Questions

Exam 13: Analyzing Financial Statements184 Questions

Exam 14: Managerial Accounting Concepts and Principles202 Questions

Exam 15: Job Order Costing and Analysis153 Questions

Exam 16: Process Costing and Analysis185 Questions

Exam 17: Activity-Based Costing and Analysis173 Questions

Exam 18: Cost Behavior and Cost-Volume-Profit Analysis177 Questions

Exam 19: Variable Costing and Performance Reporting175 Questions

Exam 20: Master Budgets and Performance Planning158 Questions

Exam 21: Flexible Budgets and Standard Costing177 Questions

Exam 22: Decentralization and Performance Evaluation128 Questions

Exam 23: Relevant Costing for Managerial Decisions136 Questions

Exam 24: Capital Budgeting and Investment Analysis139 Questions

Exam 25: Investments and International Operations168 Questions

Exam 26: Accounting for Partnerships126 Questions

Exam 27 Appendix : Accounting With Special Journals153 Questions

Select questions type

Prepare general journal entries on December 31 to record the following unrelated year-end adjustments.

a. Estimated depreciation on office equipment for the year, $4,000

b. The Prepaid Insurance account has a $3,680 debit balance before adjustment. An examination of insurance policies shows $950 of insurance expired

c. The Prepaid Insurance account has a $2,400 debit balance before adjustment. An examination of insurance policies shows $600 of unexpired insurance

d. The company has three office employees who each earn $100 per day for a five-day workweek that ends on Friday. The employees were paid on Friday, December 26 and have worked full days on Monday, Tuesday and Wednesday, December 29, 30 and 31

e. On November 1, the company received 6 months' rent in advance from a tenant whose rent is $700 per month. The $4,200 was credited to the Unearned Rent account

f. The company collects rent monthly from its tenants. One tenant whose rent is $750 per month has not paid his rent for December

(Short Answer)

5.0/5  (44)

(44)

A trial balance prepared after adjustments have been recorded is called a(n):

(Multiple Choice)

4.8/5  (42)

(42)

A company purchased a new truck at a cost of $42,000 on July 1, 2011. The truck is estimated to have a useful life of 6 years and a salvage value of $3,000. How much depreciation expense will be recorded for the truck for the year ended December 31, 2011?

(Multiple Choice)

4.8/5  (40)

(40)

Plant assets and intangible assets are usually long-term assets that are used to produce or sell products and services.

(True/False)

4.9/5  (40)

(40)

On April 1, 2011, a company paid the $1,350 premium on a three-year insurance policy with benefits beginning on that date. What will be the insurance expense on the annual income statement for the year ended December 31, 2011?

(Multiple Choice)

4.9/5  (49)

(49)

The Income Summary account is closed to the retained earnings account.

(True/False)

4.7/5  (34)

(34)

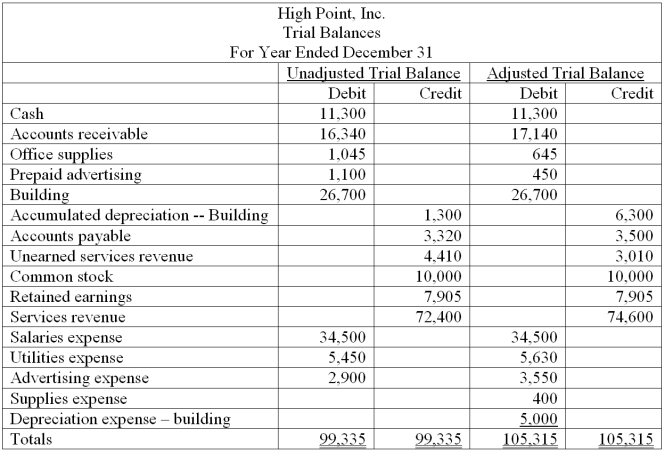

The following unadjusted and adjusted trial balances were taken from the current year's accounting system for High Point, Inc.

In general journal form, present the six adjusting entries that explain the changes in the account balances from the unadjusted to the adjusted trial balance.

In general journal form, present the six adjusting entries that explain the changes in the account balances from the unadjusted to the adjusted trial balance.

(Short Answer)

4.8/5  (38)

(38)

The special account used only in the closing process to temporarily hold the amounts of revenues and expenses before the net difference is added to (or subtracted from) the retained earnings account is the:

(Multiple Choice)

4.8/5  (41)

(41)

When preparing a work sheet an adjusted trial balance amount is mistakenly sorted to the wrong work sheet column. The Balance Sheet columns will balance on completing the work sheet but with the wrong net income, if the amount sorted in error is:

(Multiple Choice)

4.9/5  (36)

(36)

Financial statements are typically prepared in the following order:

(Multiple Choice)

4.8/5  (40)

(40)

Prepaid expenses, depreciation, accrued expenses, unearned revenues and accrued revenues are all examples of:

(Multiple Choice)

5.0/5  (37)

(37)

Current assets and current liabilities are expected to be used up or come due within one year or the company's operating cycle whichever is longer.

(True/False)

4.9/5  (43)

(43)

A trial balance prepared after the closing entries have been journalized and posted is the:

(Multiple Choice)

4.9/5  (33)

(33)

An account linked with another account that has an opposite normal balance and that is subtracted from the balance of the related account is a(n):

(Multiple Choice)

4.8/5  (41)

(41)

The Unadjusted Trial Balance columns of a work sheet total $84,000. The Adjustments columns contain entries for the following: Office supplies used during the period, $1,200.

Expiration of prepaid rent, $700.

Accrued salaries expense, $500.

Depreciation expense, $800.

Accrued service fees receivable, $400.

The Adjusted Trial Balance columns total is:

(Multiple Choice)

4.8/5  (40)

(40)

A current ratio of 2:1 suggests that a company has ____________ current assets to cover current liabilities.

(Short Answer)

5.0/5  (36)

(36)

A company had no office supplies available at the beginning of the year. During the year, the company purchased $250 worth of office supplies. On December 31, $75 worth of office supplies remained. How much should the company report as office supplies expense for the year?

(Multiple Choice)

4.9/5  (35)

(35)

Discuss the importance of periodic reporting and the time period principle.

(Essay)

4.8/5  (40)

(40)

A trial balance prepared before any adjustments have been recorded is:

(Multiple Choice)

4.8/5  (41)

(41)

The approach to preparing financial statements based on recognizing revenues when they are earned and matching expenses to those revenues is:

(Multiple Choice)

4.8/5  (34)

(34)

Showing 181 - 200 of 230

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)