Exam 12: Standard Costs and Variances

Exam 1: Managerial Accounting and Cost Concepts166 Questions

Exam 2: Cost-Volume-Profit Relationships241 Questions

Exam 3: Job-Order Costing119 Questions

Exam 4: Variable Costing and Segment Reporting: Tools for Management200 Questions

Exam 5: Activity-Based-Costing: a Tool to Aid Decision Making139 Questions

Exam 6: Differential Analysis: The Key to Decision Making152 Questions

Exam 7: Capital Budgeting Decisions145 Questions

Exam 9: Capital Budgeting Decisions36 Questions

Exam 10: Profit Planning106 Questions

Exam 11: Flexible Budgets and Performance Analysis294 Questions

Exam 12: Standard Costs and Variances179 Questions

Exam 13: Performance Measurement in Decentralized Organizations93 Questions

Exam 14: Managerial Accounting and Cost Concepts22 Questions

Exam 15: Job-Order Costing27 Questions

Exam 16: Activity-Based-Costing: a Tool to Aid Decision Making15 Questions

Exam 17: A Capital Budgeting Decisions12 Questions

Exam 18: Standard Costs and Variances105 Questions

Exam 19: Performance Measurement in Decentralized Organizations21 Questions

Exam 20: Performance Measurement in Decentralized Organizations41 Questions

Exam 21: Profitability Analysis71 Questions

Exam 22: Pricing Products and Services67 Questions

Select questions type

Vitko Corporation makes automotive engines. For the most recent month, budgeted production was 6,000 engines. The standard power cost is $8.80 per machine-hour. The company's standards indicate that each engine requires 6.1 machine-hours. Actual production was 6,400 engines. Actual machine-hours were 38,730 machine-hours. Actual power cost totaled $350,628.

Required:

Determine the rate and efficiency variances for the variable overhead item power cost and indicate whether those variances are unfavorable or favorable. Show your work!

(Essay)

4.9/5  (48)

(48)

A labor efficiency variance resulting from the use of poor quality materials should be charged to:

(Multiple Choice)

4.9/5  (44)

(44)

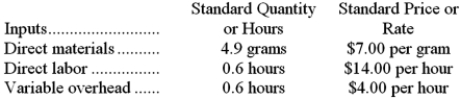

Silmon Corporation makes a product with the following standard costs:  In June the company produced 4,200 units using 21,830 grams of the direct material and 2,580 direct labor-hours. During the month the company purchased 24,100 grams of the direct material at a price of $6.80 per gram. The actual direct labor rate was $14.60 per hour and the actual variable overhead rate was $3.90 per hour. The materials price variance is computed when materials are purchased. Variable overhead is applied on the basis of direct labor-hours.

Required:

a. Compute the materials quantity variance.

b. Compute the materials price variance.

c. Compute the labor efficiency variance.

d. Compute the direct labor rate variance.

e. Compute the variable overhead efficiency variance.

f. Compute the variable overhead rate variance.

In June the company produced 4,200 units using 21,830 grams of the direct material and 2,580 direct labor-hours. During the month the company purchased 24,100 grams of the direct material at a price of $6.80 per gram. The actual direct labor rate was $14.60 per hour and the actual variable overhead rate was $3.90 per hour. The materials price variance is computed when materials are purchased. Variable overhead is applied on the basis of direct labor-hours.

Required:

a. Compute the materials quantity variance.

b. Compute the materials price variance.

c. Compute the labor efficiency variance.

d. Compute the direct labor rate variance.

e. Compute the variable overhead efficiency variance.

f. Compute the variable overhead rate variance.

(Essay)

4.9/5  (32)

(32)

A materials price variance is favorable if the actual price exceeds the standard price.

(True/False)

4.9/5  (39)

(39)

Tavorn Corporation applies manufacturing overhead to products on the basis of standard machine-hours. The company's standard variable manufacturing overhead rate is $1.80 per machine-hour. The actual variable manufacturing overhead cost for the month was $13,080. The original budget for the month was based on 7,100 machine-hours. The company actually worked 7,210 machine-hours during the month. The standard hours allowed for the actual output of the month totaled 7,070 machine-hours. What was the variable overhead efficiency variance for the month?

(Multiple Choice)

4.7/5  (39)

(39)

When more hours of labor time are necessary to complete a job than the standard allows, the labor rate variance is unfavorable.

(True/False)

4.9/5  (37)

(37)

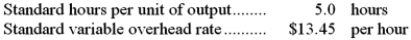

The following standards for variable manufacturing overhead have been established for a company that makes only one product:  The following data pertain to operations for the last month:

The following data pertain to operations for the last month:  What is the variable overhead rate variance for the month?

What is the variable overhead rate variance for the month?

(Multiple Choice)

4.9/5  (41)

(41)

Standard costs should generally be based on the actual costs of prior periods.

(True/False)

4.9/5  (42)

(42)

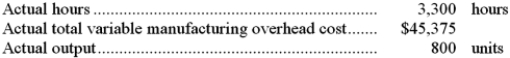

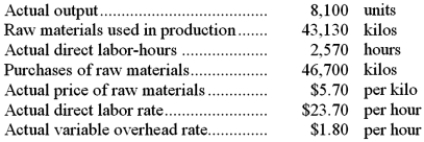

Blomdahl Corporation makes a product with the following standard costs:  The company reported the following results concerning this product in October.

The company reported the following results concerning this product in October.  The materials price variance is recognized when materials are purchased. Variable overhead is applied on the basis of direct labor-hours.

Required:

a. Compute the materials quantity variance.

b. Compute the materials price variance.

c. Compute the labor efficiency variance.

d. Compute the direct labor rate variance.

e. Compute the variable overhead efficiency variance.

f. Compute the variable overhead rate variance.

The materials price variance is recognized when materials are purchased. Variable overhead is applied on the basis of direct labor-hours.

Required:

a. Compute the materials quantity variance.

b. Compute the materials price variance.

c. Compute the labor efficiency variance.

d. Compute the direct labor rate variance.

e. Compute the variable overhead efficiency variance.

f. Compute the variable overhead rate variance.

(Essay)

4.8/5  (37)

(37)

Showing 61 - 80 of 179

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)