Exam 4: Variable Costing and Segment Reporting: Tools for Management

Exam 1: Managerial Accounting and Cost Concepts186 Questions

Exam 2: Cost-Volume-Profit Relationships187 Questions

Exam 3: Job-Order Costing100 Questions

Exam 4: Variable Costing and Segment Reporting: Tools for Management224 Questions

Exam 5: Activity-Based-Costing: a Tool to Aid Decision Making145 Questions

Exam 6: Differential Analysis: the Key to Decision Making174 Questions

Exam 7: Capital Budgeting Decisions167 Questions

Exam 8: Profit Planning172 Questions

Exam 9: Flexible Budgets and Performance Analysis306 Questions

Exam 10: Standard Costs and Variances187 Questions

Exam 11: Performance Measurement in Decentralized Organizations115 Questions

Exam 12: Pricing Products and Services82 Questions

Exam 13: Profitability Analysis76 Questions

Exam 14: Least Squares Regression Computations21 Questions

Exam 15: Activity-Based Absorption Costing12 Questions

Exam 16: the Predetermined Overhead Rate and Capacity28 Questions

Exam 17: Super-Variable Costing49 Questions

Exam 18: Abc Action Analysis16 Questions

Exam 19: the Concept of Present Value13 Questions

Exam 20: Income Taxes and the Net Present Value Method147 Questions

Exam 21: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System111 Questions

Exam 22: Transfer Pricing25 Questions

Exam 23: Service Department Charges51 Questions

Select questions type

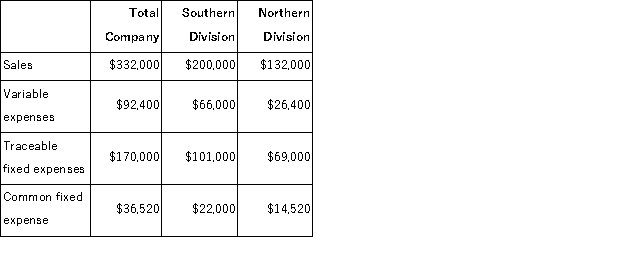

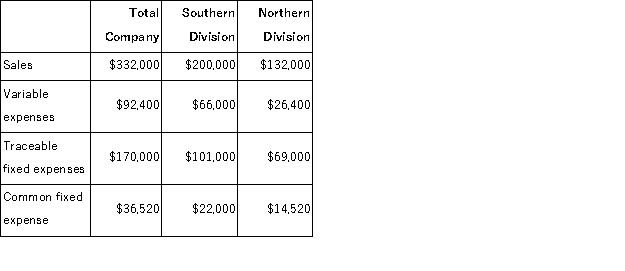

Pevy Corporation has two divisions: Southern Division and Northern Division.The following data are for the most recent operating period:  The common fixed expenses have been allocated to the divisions on the basis of sales. What is the company's overall net operating income if it operates at the break-even points for its two divisions?

The common fixed expenses have been allocated to the divisions on the basis of sales. What is the company's overall net operating income if it operates at the break-even points for its two divisions?

(Multiple Choice)

5.0/5  (37)

(37)

Under variable costing, product cost does not contain any fixed manufacturing overhead cost.

(True/False)

4.8/5  (37)

(37)

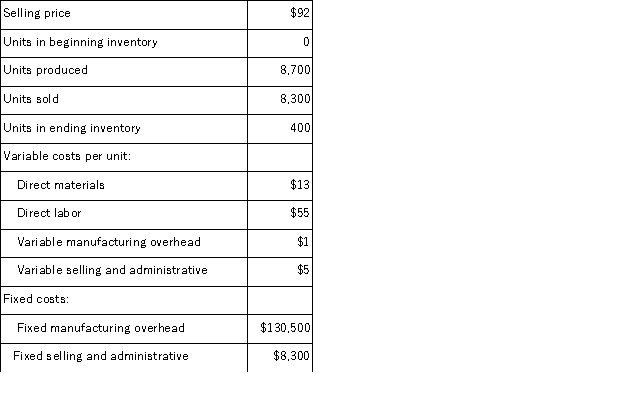

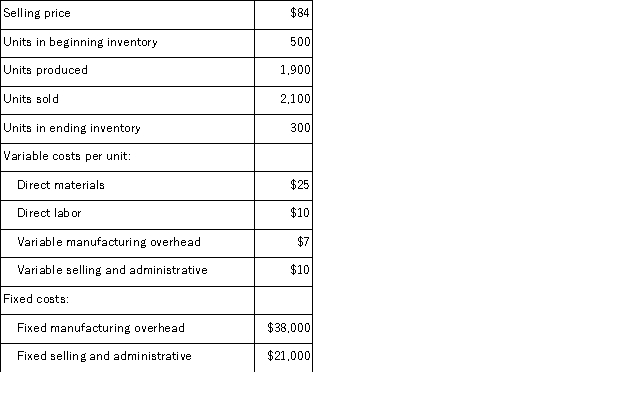

Farron Corporation, which has only one product, has provided the following data concerning its most recent month of operations:  What is the net operating income for the month under absorption costing?

What is the net operating income for the month under absorption costing?

(Multiple Choice)

4.8/5  (37)

(37)

A common fixed cost is a fixed cost that is incurred because of the existence of a particular business segment and that would be eliminated if the segment were eliminated.

(True/False)

4.9/5  (39)

(39)

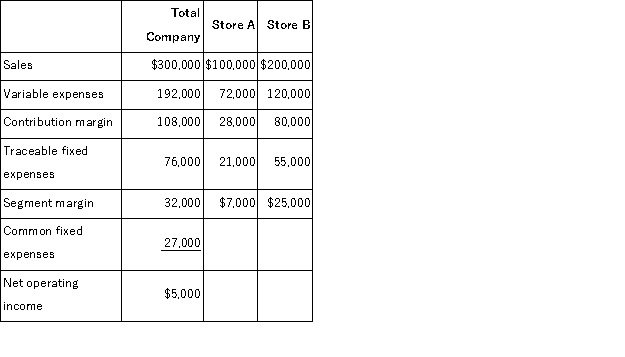

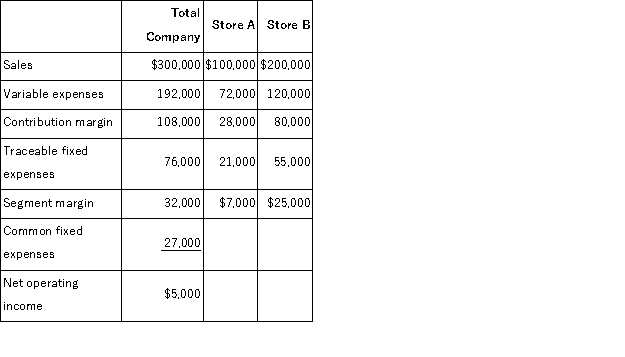

O'Neill, Incorporated's segmented income statement for the most recent month is given below.  For each of the following questions, refer back to the above original data. The marketing department believes that a promotional campaign at Store A costing $6, 000 will increase sales by $15, 000.If its plan is adopted, overall company net operating income should:

For each of the following questions, refer back to the above original data. The marketing department believes that a promotional campaign at Store A costing $6, 000 will increase sales by $15, 000.If its plan is adopted, overall company net operating income should:

(Multiple Choice)

4.8/5  (36)

(36)

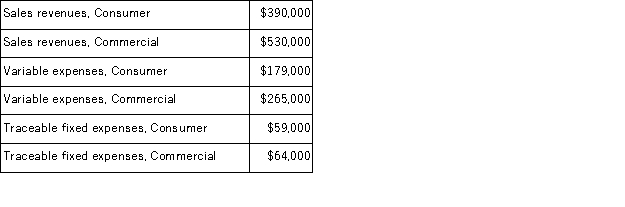

Clemmens Corporation has two major business segments: Consumer and Commercial.Data for the segments and for the company for August appear below:  In addition, common fixed expenses totaled $265, 000 and were allocated as follows: $135, 000 to the Consumer business segment and $130, 000 to the Commercial business segment. A properly constructed segmented income statement in a contribution format would show that the net operating income of the company as a whole is:

In addition, common fixed expenses totaled $265, 000 and were allocated as follows: $135, 000 to the Consumer business segment and $130, 000 to the Commercial business segment. A properly constructed segmented income statement in a contribution format would show that the net operating income of the company as a whole is:

(Multiple Choice)

5.0/5  (34)

(34)

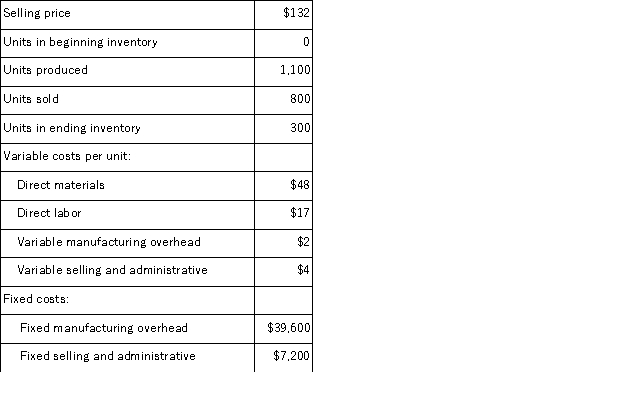

Nelson Corporation, which has only one product, has provided the following data concerning its most recent month of operations:  The company produces the same number of units every month, although the sales in units vary from month to month.The company's variable costs per unit and total fixed costs have been constant from month to month.

Required:

a.Prepare a contribution format income statement for the month using variable costing.

b.Prepare an income statement for the month using absorption costing.

The company produces the same number of units every month, although the sales in units vary from month to month.The company's variable costs per unit and total fixed costs have been constant from month to month.

Required:

a.Prepare a contribution format income statement for the month using variable costing.

b.Prepare an income statement for the month using absorption costing.

(Essay)

4.8/5  (36)

(36)

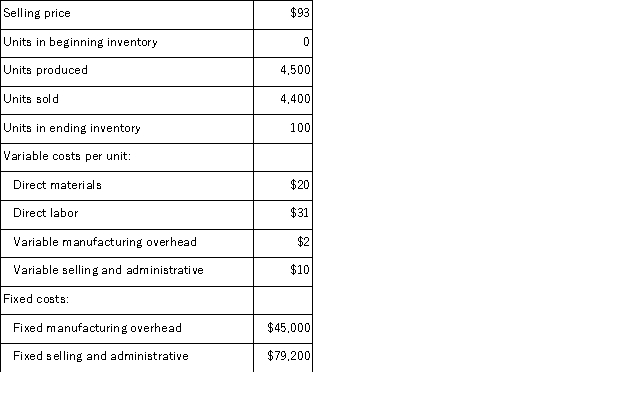

A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations:  What is the total period cost for the month under absorption costing?

What is the total period cost for the month under absorption costing?

(Multiple Choice)

4.8/5  (29)

(29)

When using segmented income statements, the dollar sales for a segment to break even equals the common fixed expenses of the segment divided by the segment CM ratio.

(True/False)

4.8/5  (29)

(29)

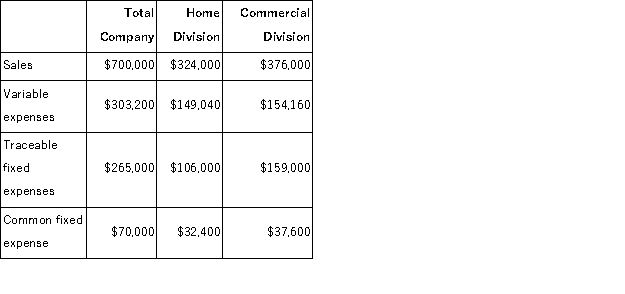

Monce Corporation has two divisions: Home Division and Commercial Division.The following report is for the most recent operating period:  The common fixed expenses have been allocated to the divisions on the basis of sales.

Required:

a.What is the Home Division's break-even in sales dollars?

b.What is the Commercial Division's break-even in sales dollars?

c.What is the company's overall break-even in sales dollars?

The common fixed expenses have been allocated to the divisions on the basis of sales.

Required:

a.What is the Home Division's break-even in sales dollars?

b.What is the Commercial Division's break-even in sales dollars?

c.What is the company's overall break-even in sales dollars?

(Essay)

4.9/5  (37)

(37)

A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations:  What is the total period cost for the month under variable costing?

What is the total period cost for the month under variable costing?

(Multiple Choice)

4.7/5  (34)

(34)

George Corporation has no beginning inventory and manufactures a single product.If the number of units produced exceeds the number of units sold, then net operating income under the absorption method for the year will:

(Multiple Choice)

4.9/5  (36)

(36)

Under absorption costing, fixed manufacturing overhead is treated as a product cost.

(True/False)

4.9/5  (45)

(45)

Because absorption costing emphasizes costs by behavior, it works well with cost-volume-profit analysis.

(True/False)

4.8/5  (45)

(45)

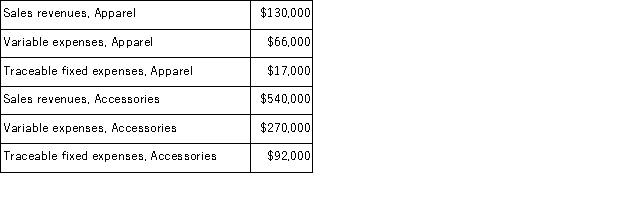

Pratt Corporation has two major business segments-Apparel and Accessories.Data concerning those segments for October appear below:  Common fixed expenses totaled $153, 000 and were allocated as follows: $73, 000 to the Apparel business segment and $80, 000 to the Accessories business segment.

Required:

Prepare a segmented income statement in the contribution format for the company.Omit percentages;show only dollar amounts.

Common fixed expenses totaled $153, 000 and were allocated as follows: $73, 000 to the Apparel business segment and $80, 000 to the Accessories business segment.

Required:

Prepare a segmented income statement in the contribution format for the company.Omit percentages;show only dollar amounts.

(Essay)

4.7/5  (42)

(42)

O'Neill, Incorporated's segmented income statement for the most recent month is given below.  For each of the following questions, refer back to the above original data. If sales in Store B increase by $30, 000 as a result of a $5, 000 increase in traceable fixed expenses:

For each of the following questions, refer back to the above original data. If sales in Store B increase by $30, 000 as a result of a $5, 000 increase in traceable fixed expenses:

(Multiple Choice)

4.8/5  (33)

(33)

Net operating income is affected by the number of units produced when absorption costing is used.

(True/False)

4.8/5  (42)

(42)

Pevy Corporation has two divisions: Southern Division and Northern Division.The following data are for the most recent operating period:  The common fixed expenses have been allocated to the divisions on the basis of sales. The company's overall break-even sales is closest to:

The common fixed expenses have been allocated to the divisions on the basis of sales. The company's overall break-even sales is closest to:

(Multiple Choice)

4.8/5  (36)

(36)

Swifton Corporation produces a single product.Last year, the company had net operating income of $40, 000 using variable costing.Beginning and ending inventories were 22, 000 and 27, 000 units, respectively.If the fixed manufacturing overhead cost was $3 per unit both last year and this year, what was the income using absorption costing?

(Multiple Choice)

4.7/5  (37)

(37)

Showing 181 - 200 of 224

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)