Exam 19: Share-Based Compensation and Earnings Per Share

Exam 1: Environment and Theoretical Structure of Financial Accounting135 Questions

Exam 2: Review of the Accounting Process126 Questions

Exam 3: The Balance Sheet and Financial Disclosures102 Questions

Exam 4: The Income Statement, Comprehensive Income, and the Statement of Cash Flows103 Questions

Exam 5: Income Measurement and Profitability Analysis210 Questions

Exam 6: Time Value of Money Concepts114 Questions

Exam 7: Cash and Receivables164 Questions

Exam 8: Inventories: Measurement126 Questions

Exam 9: Property, Plant, and Equipment and Intangible Assets: Acquisition and Disposition120 Questions

Exam 10: Property, Plant, and Equipment and Intangible Assets: Acquisition and Disposition128 Questions

Exam 11: Property, Plant, and Equipment and Intangible Assets: Utilization and Impairment146 Questions

Exam 12: Investments186 Questions

Exam 13: Current Liabilities and Contingencies153 Questions

Exam 14: Bonds and Long-Term Notes167 Questions

Exam 15: Leases160 Questions

Exam 16: Accounting for Income Taxes145 Questions

Exam 17: Pensions and Other Postretirement Benefits197 Questions

Exam 20: Accounting Changes and Error Corrections119 Questions

Exam 21: The Statement of Cash Flows Revisited155 Questions

Select questions type

What will Angel report as diluted earnings per share for 2013, rounded to the nearest cent?

(Multiple Choice)

4.9/5  (36)

(36)

Under its executive stock option plan, W Corporation granted options on January 1, 2013, that permit executives to purchase 15 million of the company's $1 par common shares within the next eight years, but not before December 31, 2015 (the vesting date). The exercise price is the market price of the shares on the date of grant, $18 per share. The fair value of the options, estimated by an appropriate option pricing model, is $4 per option. No forfeitures are anticipated. The options are exercised on April 2, 2016, when the market price is $21 per share. By what amount will W's shareholder's equity be increased when the options are exercised?

(Multiple Choice)

4.7/5  (47)

(47)

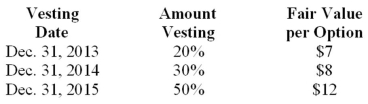

Red Company is a calendar-year U.S. firm with operations in several countries. At January 1, 2013, the company had issued 40,000 executive stock options permitting executives to buy 40,000 shares of stock for $25. The vesting schedule is 20% the first year, 30% the second year, and 50% the third year (graded-vesting). The fair value of the options is estimated as follows:  What is the compensation expense related to the options to be recorded in 2014?

What is the compensation expense related to the options to be recorded in 2014?

(Multiple Choice)

4.8/5  (37)

(37)

The Burford Corporation provides an executive stock option plan. Under the plan, the company granted options on January 1, 2013, that permit executives to acquire 12 million of the company's $1 par value common shares within the next five years, but not before December 31, 2016 (the vesting date). The exercise price is the market price of the shares on the date of the grant, $14 per share. The fair value of the options, estimated by an appropriate model, is $3 per option. No forfeitures are anticipated. Ignore taxes.

Required:

(1.) Determine the total compensation cost pertaining to the options. Show calculations.

(2.) Prepare the appropriate journal entry (if any) to record the award of options on January 1, 2013.

(3.) Prepare the appropriate journal entry (if any) to record compensation expense on December 31, 2013.

(Essay)

5.0/5  (38)

(38)

If the options have a vesting period of five years, what would be the balance in "Paid-in Capital-Stock Options" three years after the grant date?

(Multiple Choice)

4.8/5  (36)

(36)

The calculation of diluted earnings per share assumes that stock options were exercised and that the proceeds were used to buy treasury stock at:

(Multiple Choice)

4.8/5  (38)

(38)

Reacting to opposition to the FASB's "Share-Based Payment" Exposure Draft, Senator Carl Levin stated, "Stock options are the 800-pound gorilla that has yet to be caged by corporate reform." In reference to a bill that would thwart the FASB's position, Senator John McCain said, "This legislation blocking stock option expensing not only undermines FASB's independence, but undermines the effort to restore confidence in our financial markets as well." Discuss what these two senators meant by their statements.

(Essay)

4.7/5  (36)

(36)

On December 31, 2012, Belair Corporation had 100,000 shares of common stock outstanding and 30,000 shares of 7%, $50 par, cumulative preferred stock outstanding. On February 28, 2013, Belair purchased 24,000 shares of common stock on the open market as treasury stock paying $20 per share. On June 30, 2013, Belair declared and issued a 2-for-1 stock split on outstanding common stock. Belair sold 6,000 treasury shares on September 30, 2013, for $15 per share. Net income for 2013 was $180,905.

Required:

Compute Belair's basic earnings per share for 2013.

(Essay)

4.9/5  (33)

(33)

The tax code differentiates between qualified and nonqualified incentive plans. What are the major differences in tax treatment between the two?

(Essay)

4.8/5  (38)

(38)

On January 1, 2013, G Corp. granted stock options to key employees for the purchase of 80,000 shares of the company's common stock at $25 per share. The options are intended to compensate employees for the next two years. The options are exercisable within a four-year period beginning January 1, 2015, by the grantees still in the employ of the company. No options were terminated during 2013, but the company does have an experience of 4% forfeitures over the life of the stock options. The market price of the common stock was $31 per share at the date of the grant. G Corp. used the Binomial pricing model and estimated the fair value of each of the options at $10. What amount should G charge to compensation expense for the year ended December 31, 2013?

(Multiple Choice)

4.9/5  (43)

(43)

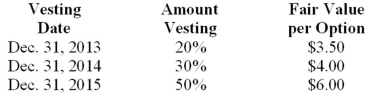

Pastner Brands is a calendar-year firm with operations in several countries. As part of its executive compensation plan, at January 1, 2013, the company had issued 20 million executive stock options permitting executives to buy 20 million shares of stock for $25. The vesting schedule is 20% the first year, 30% the second year, and 50% the third year (graded-vesting). The fair value of the options is estimated as follows:  Required:

Determine the compensation expense related to the options to be recorded each year for 2013-2015, assuming Pastner prepares its financial statements in accordance with International Financial Reporting Standards.

Required:

Determine the compensation expense related to the options to be recorded each year for 2013-2015, assuming Pastner prepares its financial statements in accordance with International Financial Reporting Standards.

(Essay)

4.8/5  (36)

(36)

When computing diluted earnings per share, which of the following will not be considered in the calculation?

(Multiple Choice)

4.8/5  (28)

(28)

How many types of potential common shares must a corporation have in order to be said to have a complex capital structure?

(Multiple Choice)

4.7/5  (30)

(30)

On March 1, 2017, when the market price of Wilson's stock was $14 per share, 3 million of the options were exercised. The journal entry to record this would include:

(Multiple Choice)

4.9/5  (42)

(42)

During the current year, East Corporation had 2 million shares of common stock outstanding. Two thousand $1,000, 8% convertible bonds were issued at face amount at the beginning of the year. East reported income before tax of $3 million and net income of $1.8 million for the year. Each bond is convertible into 10 shares of common stock. What is diluted EPS (rounded)?

(Multiple Choice)

4.8/5  (29)

(29)

The calculation of diluted earnings per share assumes that stock options were exercised and that the proceeds were used to:

(Multiple Choice)

4.9/5  (37)

(37)

Capital Consulting Company had 400,000 shares of common stock outstanding on December 31, 2013. On that date, there were also 5,000 shares of $100 par, 6% noncumulative preferred stock outstanding. On March 1, 2013, the company's common stock split 3-for-1. On December 15, 2013, a preferred dividend was declared and paid in the amount of $25,000. Net income for 2013 was $3,000,000.

Required:

Compute basic earnings per share (rounded to 2 decimal places) for the year ended December 31, 2013.

(Essay)

4.9/5  (36)

(36)

On December 31, 2012, Albacore Company had 300,000 shares of common stock issued and outstanding. Albacore issued a 10% stock dividend on June 30, 2013. On September 30, 2013, 12,000 shares of common stock were reacquired as treasury stock. What is the appropriate number of shares to be used in the basic earnings per share computation for 2013?

(Multiple Choice)

4.9/5  (35)

(35)

Showing 101 - 120 of 178

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)