Exam 13: Current Liabilities and Contingencies

Exam 1: Environment and Theoretical Structure of Financial Accounting135 Questions

Exam 2: Review of the Accounting Process126 Questions

Exam 3: The Balance Sheet and Financial Disclosures102 Questions

Exam 4: The Income Statement, Comprehensive Income, and the Statement of Cash Flows103 Questions

Exam 5: Income Measurement and Profitability Analysis210 Questions

Exam 6: Time Value of Money Concepts114 Questions

Exam 7: Cash and Receivables164 Questions

Exam 8: Inventories: Measurement126 Questions

Exam 9: Property, Plant, and Equipment and Intangible Assets: Acquisition and Disposition120 Questions

Exam 10: Property, Plant, and Equipment and Intangible Assets: Acquisition and Disposition128 Questions

Exam 11: Property, Plant, and Equipment and Intangible Assets: Utilization and Impairment146 Questions

Exam 12: Investments186 Questions

Exam 13: Current Liabilities and Contingencies153 Questions

Exam 14: Bonds and Long-Term Notes167 Questions

Exam 15: Leases160 Questions

Exam 16: Accounting for Income Taxes145 Questions

Exam 17: Pensions and Other Postretirement Benefits197 Questions

Exam 20: Accounting Changes and Error Corrections119 Questions

Exam 21: The Statement of Cash Flows Revisited155 Questions

Select questions type

When a deposit on returnable containers is forfeited, the firm holding the deposit will experience:

(Multiple Choice)

4.9/5  (36)

(36)

Bencorp issues a $90,000, 6-month, noninterest-bearing note that the bank discounted at a 10% discount rate.

Required:

1. Prepare the appropriate journal entry to record the issuance of the note.

2. Determine the effective interest rate.

(Essay)

4.9/5  (41)

(41)

Current liabilities are normally recorded at the amount expected to be paid rather than at their present value. This practice can be supported by GAAP according to the concept of:

(Multiple Choice)

4.8/5  (27)

(27)

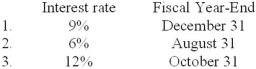

On June 30, 2013, Chu Industries issued 9-month notes in the amount of $700,000. Assume that interest is payable at maturity in the following three independent cases:  Required:

Determine the amount of interest expense that should be accrued in a year-end adjusting entry under each assumption:

Required:

Determine the amount of interest expense that should be accrued in a year-end adjusting entry under each assumption:

(Essay)

4.7/5  (23)

(23)

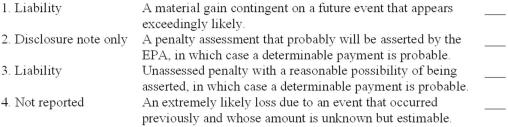

Indicate (by number) the way each of the items listed below should be reported in a balance sheet at December 31, 2013.

(Essay)

4.9/5  (37)

(37)

This is not a loss contingency. An extended warranty is priced and sold separately from the warranted product and therefore, essentially constitutes a separate sales transaction. Since the earning process for an extended warranty continues during the contract period, revenue should be recognized over the same period. Revenue from separately priced extended warranty contracts are deferred as a liability at the time of sale, and recognized over the contract period on a straight-line basis.

2. Sale of extended warranty:

(Essay)

4.9/5  (34)

(34)

A long-term liability should be reported as a current liability in a classified balance sheet if the long-term debt:

(Multiple Choice)

4.8/5  (42)

(42)

This is a loss contingency. Barone can use the information occurring after the end of the year in determining appropriate disclosure. Barone should accrue the $13 million loss because the ultimate outcome appears settled and the loss is probable.

(Essay)

4.9/5  (32)

(32)

At the beginning of 2013, Angel Corporation began offering a two-year warranty on its products. The warranty program was expected to cost Angel 4% of net sales. Net sales made under warranty in 2013 were $180 million. Fifteen percent of the units sold were returned in 2013 and repaired or replaced at a cost of $5.3 million. The amount of warranty expense on Angel's 2013 income statement is:

(Multiple Choice)

4.9/5  (38)

(38)

Clark's Chemical Company received customer deposits on returnable containers in the amount of $100,000 during 2013. Twelve percent of the containers were not returned. The deposits are based on the container cost marked up 20%. What is cost of goods sold relative to this forfeiture?

(Multiple Choice)

4.8/5  (29)

(29)

Under IFRS, the term "probable" indicates a threshold of probability that is substantially more than a 50 percent chance of occurrence.

(True/False)

4.9/5  (45)

(45)

Peterson Photoshop sold $1,000 in gift cards on a special promotion on October 15, 2013, and sold $1,500 in gift cards on another special promotion on November 15, 2013. Of the cards sold in October, $100 were redeemed in October, $250 in November, and $300 in December. Of the cards sold in November, $150 were redeemed in November and $350 were redeemed in December. Peterson views the probability of redemption of a gift card as remote if the card has not been redeemed within two months. At 12/31/2013, Peterson would show an unearned revenue account for the gift cards with a balance of:

(Multiple Choice)

4.9/5  (31)

(31)

A company should accrue a liability for a loss contingency if it is at least reasonably possible that assets have been impaired and the amount of potential loss can be reasonably estimated.

(True/False)

4.8/5  (38)

(38)

Hot Springs Marine borrowed $20 million cash on December 1, 2013, to provide working capital for year-end inventory. Hot Springs Marine issued a 4-month, 9% promissory note to Third Bank under a prearranged short-term line of credit. Interest on the note was payable at maturity. Each firm's fiscal period is the calendar year.

Required:

1. Prepare the journal entries to record (a) the issuance of the note by Hot Springs Marine and (b) Third Bank's receivable on December 1, 2013.

2. Prepare the journal entries by both firms to record all subsequent events related to the note through March 31, 2014.

3. Suppose the face amount of the note was adjusted to include interest (a noninterest-bearing note) and 9% is the bank's stated "discount rate." Prepare the journal entries to record the issuance of the noninterest-bearing note by Hot Springs Marine on December 1, 2013. What would be the effective interest rate?

(Essay)

4.7/5  (44)

(44)

Stern Corporation borrowed $10 million cash on September 1, 2013, to provide additional working capital for the year's production. Stern issued a 6-month, 10% promissory note to Second State Bank. Interest on the note is payable at maturity. Each firm uses the calendar year as the fiscal year.

Required:

1. Prepare all journal entries from issuance to maturity for Stern Corporation.

2. Prepare all journal entries from issuance to maturity for Second State Bank.

(Essay)

4.7/5  (40)

(40)

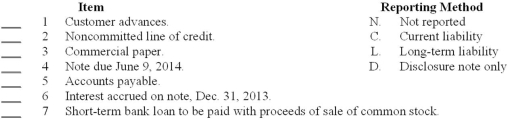

Indicate (by letter) the way each of the items listed below should be reported in a balance sheet at December 31, 2013.

(Essay)

4.8/5  (32)

(32)

On September 1, 2013, Hiker Shoes issued a $100,000, 8-month, noninterest-bearing note. The loan was made by Second Commercial Bank where the stated discount rate is 9%. Hiker's effective interest rate on this loan (rounded) is:

(Multiple Choice)

4.9/5  (44)

(44)

Showing 81 - 100 of 153

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)