Exam 8: Inventories: Measurement

Exam 1: Environment and Theoretical Structure of Financial Accounting135 Questions

Exam 2: Review of the Accounting Process126 Questions

Exam 3: The Balance Sheet and Financial Disclosures102 Questions

Exam 4: The Income Statement, Comprehensive Income, and the Statement of Cash Flows103 Questions

Exam 5: Income Measurement and Profitability Analysis210 Questions

Exam 6: Time Value of Money Concepts114 Questions

Exam 7: Cash and Receivables164 Questions

Exam 8: Inventories: Measurement126 Questions

Exam 9: Property, Plant, and Equipment and Intangible Assets: Acquisition and Disposition120 Questions

Exam 10: Property, Plant, and Equipment and Intangible Assets: Acquisition and Disposition128 Questions

Exam 11: Property, Plant, and Equipment and Intangible Assets: Utilization and Impairment146 Questions

Exam 12: Investments186 Questions

Exam 13: Current Liabilities and Contingencies153 Questions

Exam 14: Bonds and Long-Term Notes167 Questions

Exam 15: Leases160 Questions

Exam 16: Accounting for Income Taxes145 Questions

Exam 17: Pensions and Other Postretirement Benefits197 Questions

Exam 20: Accounting Changes and Error Corrections119 Questions

Exam 21: The Statement of Cash Flows Revisited155 Questions

Select questions type

When reported in financial statements, a LIFO allowance account usually:

(Multiple Choice)

4.8/5  (36)

(36)

The inventory method that will always produce the same amount for cost of goods sold in a periodic inventory system as in a perpetual inventory system would be:

(Multiple Choice)

4.8/5  (36)

(36)

It is the end of the accounting period, and your boss asks you to help determine the inventory balance to place in the company's balance sheet. Explain which physical quantities of inventory that you will include and which you will exclude.

(Essay)

4.7/5  (31)

(31)

What inventory balance should Badger report on its 12/31/13 balance sheet?

(Multiple Choice)

4.9/5  (39)

(39)

Assuming Northwest uses the gross method to record purchases, what is the cost of goods available for sale?

(Multiple Choice)

5.0/5  (42)

(42)

Required:

Compute the January 31 ending inventory and cost of goods sold for January, assuming Denver uses average cost and a periodic inventory system.

(Essay)

4.8/5  (20)

(20)

Ending inventory using the average cost method (rounded) is:

(Multiple Choice)

4.9/5  (36)

(36)

Linguini Inc. adopted dollar-value LIFO (DVL) as of January 1, 2013, when it had an inventory of $800,000. Its inventory as of December 31, 2013, was $811,200 at year-end costs and the cost index was 1.04. What was DVL inventory on December 31, 2013?

(Multiple Choice)

4.8/5  (44)

(44)

Required:

Compute the January 31 ending inventory and cost of goods sold for January, assuming Random Creations uses LIFO and perpetual inventory system.

(Essay)

4.8/5  (32)

(32)

Ending inventory assuming LIFO in a perpetual inventory system would be:

(Multiple Choice)

4.8/5  (48)

(48)

In a period when costs are falling and inventory quantities are stable, the lowest taxable income would be reported by using the inventory method of:

(Multiple Choice)

4.7/5  (42)

(42)

Chavez Inc adopted dollar-value LIFO on January 1, 2013, when the inventory value was $850,000. The December 31, 2013, ending inventory at year-end cost was $950,000 and the cost index for the year is 1.08.

Required:

Compute the dollar-value LIFO inventory valuation (rounded) for the December 31, 2013, inventory.

(Essay)

4.9/5  (36)

(36)

On January 1, 2012, ECT Co. adopted the dollar-value LIFO method for its one inventory pool. The pool's value on this date was $600 million. The 2012 and 2013 ending inventory valued at year-end costs were $702 million and $840 million, respectively. The appropriate cost indexes are 1.08 for 2012 and 1.20 for 2013.

Required:

Calculate the inventory balance that ECT Co. would report on its year-end balance sheets for 2012 and 2013, using the dollar-value LIFO method.

(Essay)

4.9/5  (34)

(34)

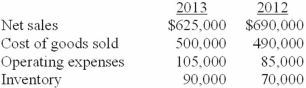

Selected financial statement data from Western Colorado Stores is shown below.  Required:

1. Compute the gross profit ratio for 2013.

2. Compute the inventory turnover ratio for 2013.

Required:

1. Compute the gross profit ratio for 2013.

2. Compute the inventory turnover ratio for 2013.

(Essay)

4.7/5  (31)

(31)

The gross profit ratio is calculated by dividing gross profit by average inventory.

(True/False)

4.9/5  (31)

(31)

During periods when costs are rising and inventory quantities are stable, ending inventory will be:

(Multiple Choice)

4.7/5  (47)

(47)

Showing 21 - 40 of 126

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)