Exam 11: Variance Analysis: Revenue and Cost

Exam 1: The Role of Accounting Information in Management Decision Making53 Questions

Exam 2: Cost Concepts, Behaviour and Estimation71 Questions

Exam 3: A Costing Framework and Cost Allocation68 Questions

Exam 4: Costvolumeprofit Cvp Analysis66 Questions

Exam 5: Planning Budgeting and Behaviour70 Questions

Exam 6: Operational Budgets69 Questions

Exam 7: Job Costing Systems72 Questions

Exam 8: Process Costing Systems67 Questions

Exam 9: Absorption and Variable Costing69 Questions

Exam 10: Flexible Budgets, Standard Costs and Variance Analysis69 Questions

Exam 11: Variance Analysis: Revenue and Cost68 Questions

Exam 12: Activity Analysis: Costing and Management63 Questions

Exam 13: Relevant Costs for Decision Making71 Questions

Exam 14: Strategy and Control72 Questions

Exam 15: Capital Budgeting and Strategic Investment Decisions58 Questions

Exam 16: The Strategic Management of Costs and Revenues55 Questions

Exam 17: Strategic Management Control: a Lean Perspective54 Questions

Exam 18: Responsibility Accounting, Performance Evaluation and Transfer Pricing50 Questions

Exam 19: The Balanced Scorecard and Strategy Maps54 Questions

Select questions type

The Jung Corporation's production budget calls for the following number of units to be produced each quarter for next year: Budgete dproduction Quarter 1. 45,000 units Quarter 2 38,000 units Quarter 3. 34,000 units Quarter 4 48,000 units

Each unit of product requires three pounds of direct material. The company's policy is to begin each quarter with an inventory of direct materials equal to 30% of that quarter's direct material requirements. Budgeted direct materials purchases for the third quarter would be

(Multiple Choice)

4.8/5  (41)

(41)

The International Company makes and sells only one product. There are 2 divisions, one in France and one in Newcastle.

The company is in the process of preparing its Selling and Administrative Expense Budget for the last half of the year. The following budget data are available:

French Division Cost Structure

Newcastle Division Cost Structure

Newcastle Division Cost Structure

- All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the French Division has budgeted to sell 24,000 units in September, then the total budgeted fixed selling and administrative expenses for September would be

- All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the French Division has budgeted to sell 24,000 units in September, then the total budgeted fixed selling and administrative expenses for September would be

(Multiple Choice)

4.9/5  (42)

(42)

The Adams Company, a merchandising firm, has budgeted its activity for November according to the following information:* Sales at , all for cash

* Merchandise inventory on October 31 was .

* The cash balance November 1 was .

* Selling and administrative expenses are budgeted at for November and are paid for in cash.

* Budgeted depreciation for Nowember is .

* The planned merchandise inventory on November 31 is .

* The cost of goods sold is of the selling price.

* All purchases are paid for in cash.

-

The budgeted net income for November is

(Multiple Choice)

5.0/5  (42)

(42)

"I can't see the point of budgeting. All we do is estimate and so we can never be right." Discuss

(Essay)

4.9/5  (30)

(30)

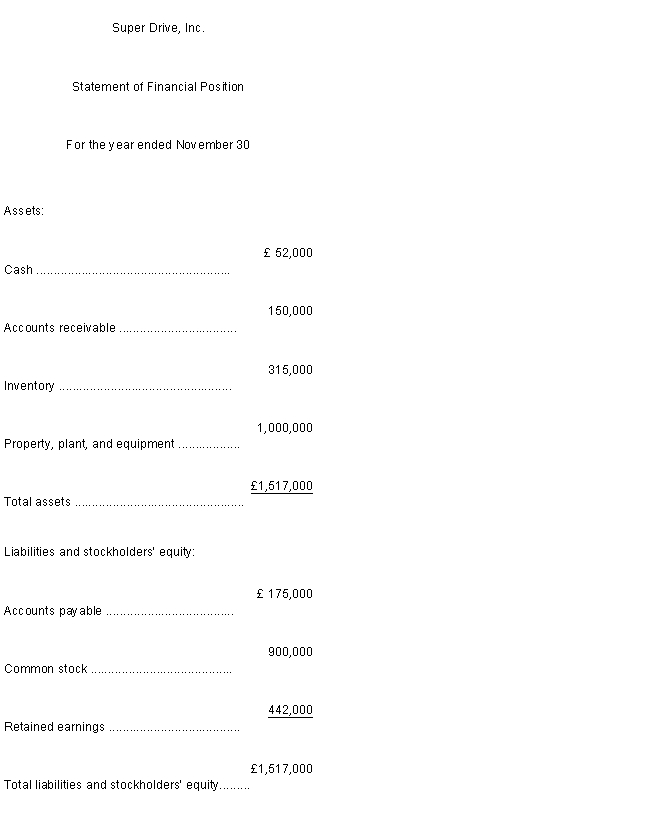

Super Drive is a computer hard drive manufacturer. The company's balance sheet for the fiscal year ended on November 30 appears below: Additional information regarding Super Drive's operations appear below:*Sales are budgeted at for December and for the upcoming year.

*Collections are expected to be in the month of sale and in the month following sale. There are no bad debts.

*80\% of the disk drive components are purchased in the month prior to the month of the sale, and are purchased in the month of the sale. Purchased components comprise of the cost of goods sold.

*Payment for components purchased is made in the month following the purchase.

*Assume that the cost of goods sold is of sales.

- The budgeted gross margin for the month ending December 31 would be

Additional information regarding Super Drive's operations appear below:*Sales are budgeted at for December and for the upcoming year.

*Collections are expected to be in the month of sale and in the month following sale. There are no bad debts.

*80\% of the disk drive components are purchased in the month prior to the month of the sale, and are purchased in the month of the sale. Purchased components comprise of the cost of goods sold.

*Payment for components purchased is made in the month following the purchase.

*Assume that the cost of goods sold is of sales.

- The budgeted gross margin for the month ending December 31 would be

(Multiple Choice)

4.8/5  (36)

(36)

The effect of responsibility accounting is to personalise the accounting system

(True/False)

4.7/5  (39)

(39)

"I can't see the point of budgeting. All we do is estimate and so we can never be right." Discuss

(Essay)

4.7/5  (41)

(41)

The budgeted amount of raw materials to be purchased is determined by

(Multiple Choice)

4.9/5  (31)

(31)

Trumbull Company budgeted sales on account of £120,000 for July, £211,000 for August, and £198,000 for September. Collection experience indicates that none of the budgeted sales will be collected in the month of the sale, 60% will be collected the month after the sale, 36% in the second month, and 4% will be uncollectible. The cash receipts from accounts receivable that should be budgeted for September would be

(Multiple Choice)

4.9/5  (47)

(47)

The International Company makes and sells only one product. There are 2 divisions, one in France and one in Newcastle.

The company is in the process of preparing its Selling and Administrative Expense Budget for the last half of the year. The following budget data are available:

French Division Cost Structure

Newcastle Division Cost Structure

Newcastle Division Cost Structure

- All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the Newcastle Division budgeted to sell 25,000 units in July, then the total budgeted selling and administrative expenses per unit sold for July is

- All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the Newcastle Division budgeted to sell 25,000 units in July, then the total budgeted selling and administrative expenses per unit sold for July is

(Multiple Choice)

5.0/5  (37)

(37)

When preparing a materials purchase budget, desired ending inventory is deducted from the total needs of the period to arrive at materials to be purchased

(True/False)

4.8/5  (43)

(43)

The International Company makes and sells only one product. There are 2 divisions, one in France and one in Newcastle.

The company is in the process of preparing its Selling and Administrative Expense Budget for the last half of the year. The following budget data are available:

French Division Cost Structure

Newcastle Division Cost Structure

Newcastle Division Cost Structure

- All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the French Division has budgeted to sell 20,000 units in October, then the total budgeted variable selling and administrative expenses for October will be

- All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the French Division has budgeted to sell 20,000 units in October, then the total budgeted variable selling and administrative expenses for October will be

(Multiple Choice)

4.8/5  (37)

(37)

The Carlquist Company makes and sells a product called Product K. Each unit of Product K sells for £24 and has a unit variable cost of £18. The company has budgeted the following data for November:

If necessary, the company will borrow cash from a bank. The borrowing will be in multiples of £1,000 and will bear interest at 2% per month. All borrowing will take place at the beginning of the month. The November interest will be paid in cash during November.* Sales of , all in cash.

*A cash balance on November 1 of .

* Cash dis bursements (other than interest) during November of .

*A minimum cash balance on November 30 of .

The amount of cash that must be borrowed on November 1 to cover all cash disbursements and to obtain the desired November 30 cash balance is

(Multiple Choice)

4.8/5  (31)

(31)

The International Company makes and sells only one product. There are 2 divisions, one in France and one in Newcastle.

The company is in the process of preparing its Selling and Administrative Expense Budget for the last half of the year. The following budget data are available:

French Division Cost Structure

Newcastle Division Cost Structure

Newcastle Division Cost Structure

- All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the budgeted disbursements (including depreciation) for selling and administrative expenses for November total £154,180, how many units does the French Division plan to sell in November (rounded to the nearest whole unit)

- All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the budgeted disbursements (including depreciation) for selling and administrative expenses for November total £154,180, how many units does the French Division plan to sell in November (rounded to the nearest whole unit)

(Multiple Choice)

4.8/5  (25)

(25)

One benefit of budgeting is that it coordinates the activities of the entire organisation

(True/False)

4.9/5  (37)

(37)

In the selling and administrative budget, the non-cash charges (such as depreciation) are added to the total budgeted selling and administrative expenses to determine the expected cash disbursements for selling and administrative expenses

(True/False)

4.8/5  (42)

(42)

Showing 21 - 40 of 68

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)