Exam 11: Differential Analysis: The Key to Decision Making

Exam 1: Managerial Accounting and Cost Concepts166 Questions

Exam 2: Job-Order Costing154 Questions

Exam 3: Process Costing109 Questions

Exam 4: Cost-Volume-Profit Relationships241 Questions

Exam 5: Variable Costing and Segment Reporting: Tools for Management200 Questions

Exam 6: Activity-Based Costing: a Tool to Aid Decision Making138 Questions

Exam 7: Profit Planning106 Questions

Exam 8: Flexible Budgets and Performance Analysis295 Questions

Exam 9: Standard Costs and Variances178 Questions

Exam 10: Performance Measurement in Decentralized Organizations93 Questions

Exam 11: Differential Analysis: The Key to Decision Making153 Questions

Exam 12: Capital Budgeting Decisions144 Questions

Exam 13: Statement of Cash Flows108 Questions

Exam 14: Financial Statement Analysis211 Questions

Exam 15: Least-Squares Regression Computations22 Questions

Exam 16: Appendix B: Cost of Quality42 Questions

Exam 17: The Predetermined Overhead Rate and Capacity27 Questions

Exam 18: Further Classification of Labor Costs20 Questions

Exam 19: Fifo Method79 Questions

Exam 20: Service Department Allocations46 Questions

Exam 21: Abc Action Analysis15 Questions

Exam 22: Using a Modified Form of Activity-Based Costing to Determine Product Costs for External Reports16 Questions

Exam 23: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System105 Questions

Exam 24: Journal Entries to Record Variances52 Questions

Exam 25: Transfer Pricing21 Questions

Exam 26: Service Department Charges41 Questions

Exam 27: The Concept of Present Value12 Questions

Exam 28: Income Taxes in Capital Budgeting Decisions36 Questions

Exam 29: The Direct Method of Determining the Net Cash Provided by Operating Activities48 Questions

Exam 30: Pricing Products and Services67 Questions

Exam 31: Profitability Analysis71 Questions

Select questions type

Future costs that do not differ among the alternatives are not relevant in a decision.

(True/False)

4.8/5  (42)

(42)

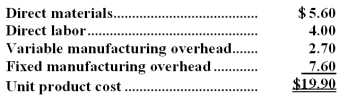

A customer has requested that Inga Corporation fill a special order for 2,000 units of product K81 for $25.00 a unit.While the product would be modified slightly for the special order,product K81's normal unit product cost is $19.90:  Direct labor is a variable cost.The special order would have no effect on the company's total fixed manufacturing overhead costs.The customer would like modifications made to product K81 that would increase the variable costs by $1.20 per unit and that would require an investment of $10,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales.The company has ample spare capacity for producing the special order.If the special order is accepted,the company's overall net operating income would increase (decrease)by:

Direct labor is a variable cost.The special order would have no effect on the company's total fixed manufacturing overhead costs.The customer would like modifications made to product K81 that would increase the variable costs by $1.20 per unit and that would require an investment of $10,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales.The company has ample spare capacity for producing the special order.If the special order is accepted,the company's overall net operating income would increase (decrease)by:

(Multiple Choice)

4.8/5  (38)

(38)

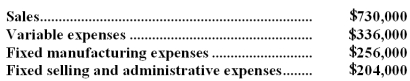

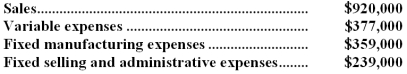

Nutall Corporation is considering dropping product N28X.Data from the company's accounting system appear below:  All fixed expenses of the company are fully allocated to products in the company's accounting system.Further investigation has revealed that $199,000 of the fixed manufacturing expenses and $114,000 of the fixed selling and administrative expenses are avoidable if product N28X is discontinued.

Required:

a.According to the company's accounting system,what is the net operating income earned by product N28X? Show your work!

b.What would be the effect on the company's overall net operating income of dropping product N28X? Should the product be dropped? Show your work!

All fixed expenses of the company are fully allocated to products in the company's accounting system.Further investigation has revealed that $199,000 of the fixed manufacturing expenses and $114,000 of the fixed selling and administrative expenses are avoidable if product N28X is discontinued.

Required:

a.According to the company's accounting system,what is the net operating income earned by product N28X? Show your work!

b.What would be the effect on the company's overall net operating income of dropping product N28X? Should the product be dropped? Show your work!

(Essay)

4.8/5  (34)

(34)

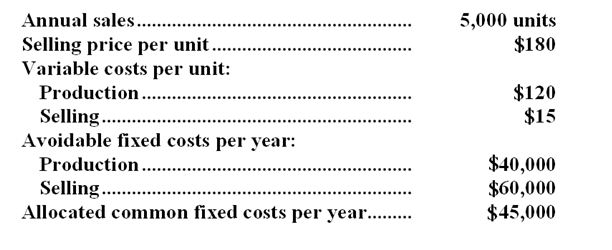

The Cabinet Shoppe is considering the addition of a new line of kitchen cabinets to its current product lines. Expected cost and revenue data for the new cabinets are as follows:  If the new cabinets are added, it is expected that the contribution margin of other product lines at the cabinet shop will drop by $20,000 per year.

-If the new cabinet product line is added next year,the increase in net operating income resulting from this decision would be:

If the new cabinets are added, it is expected that the contribution margin of other product lines at the cabinet shop will drop by $20,000 per year.

-If the new cabinet product line is added next year,the increase in net operating income resulting from this decision would be:

(Multiple Choice)

4.8/5  (36)

(36)

Dodrill Company makes two products from a common input. Joint processing costs up to the split-off point total $43,200 a year. The company allocates these costs to the joint products on the basis of their total sales values at the split-off point. Each product may be sold at the split-off point or processed further. Data concerning these products appear below:  -What is the net monetary advantage (disadvantage)of processing Product Y beyond the split-off point?

-What is the net monetary advantage (disadvantage)of processing Product Y beyond the split-off point?

(Multiple Choice)

4.9/5  (37)

(37)

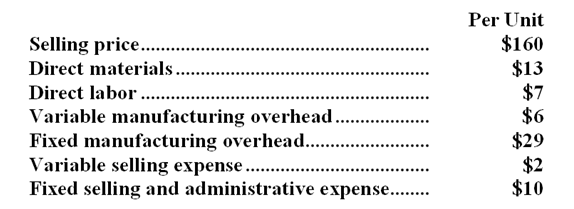

Mckerchie Inc. manufactures industrial components. One of its products, which is used in the construction of industrial air conditioners, is known as G62. Data concerning this product are given below:  The above per unit data are based on annual production of 9,000 units of the component. Direct labor can be considered to be a variable cost.

-Refer to the original data in the problem.What is the current contribution margin per unit for component G62 based on its selling price of $160 and its annual production of 9,000 units?

The above per unit data are based on annual production of 9,000 units of the component. Direct labor can be considered to be a variable cost.

-Refer to the original data in the problem.What is the current contribution margin per unit for component G62 based on its selling price of $160 and its annual production of 9,000 units?

(Multiple Choice)

4.9/5  (38)

(38)

Resendes Refiners, Inc., processes sugar cane that it purchases from farmers. Sugar cane is processed in batches. A batch of sugar cane costs $48 to buy from farmers and $16 to crush in the company's plant. Two intermediate products, cane fiber and cane juice, emerge from the crushing process. The cane fiber can be sold as is for $24 or processed further for $17 to make the end product industrial fiber that is sold for $38. The cane juice can be sold as is for $34 or processed further for $23 to make the end product molasses that is sold for $76.

-Which of the intermediate products should be processed further?

(Multiple Choice)

4.9/5  (36)

(36)

Meacham Company has traditionally made a subcomponent of its major product. Annual production of 20,000 subcomponents results in the following costs:  Meacham has received an offer from an outside supplier who is willing to provide 20,000 units of this subcomponent each year at a price of $28 per subcomponent. Meacham knows that the facilities now being used to make the subcomponent would be rented to another company for $75,000 per year if the subcomponent were purchased from the outside supplier. Otherwise, the fixed overhead would be unaffected.

-Suppose the price for the subcomponent has not been set.At what price per unit charged by the outside supplier would Meacham be economically indifferent between making the subcomponent or buying it from the outside?

Meacham has received an offer from an outside supplier who is willing to provide 20,000 units of this subcomponent each year at a price of $28 per subcomponent. Meacham knows that the facilities now being used to make the subcomponent would be rented to another company for $75,000 per year if the subcomponent were purchased from the outside supplier. Otherwise, the fixed overhead would be unaffected.

-Suppose the price for the subcomponent has not been set.At what price per unit charged by the outside supplier would Meacham be economically indifferent between making the subcomponent or buying it from the outside?

(Multiple Choice)

4.9/5  (35)

(35)

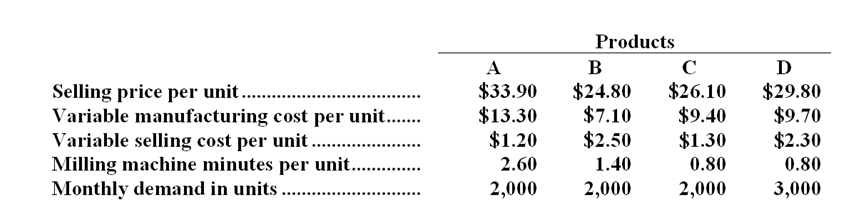

Cress Company makes four products in a single facility. Data concerning these products appear below:  The milling machines are potentially the constraint in the production facility. A total of 11,500 minutes are available per month on these machines.

-Which product makes the MOST profitable use of the milling machines?

The milling machines are potentially the constraint in the production facility. A total of 11,500 minutes are available per month on these machines.

-Which product makes the MOST profitable use of the milling machines?

(Multiple Choice)

4.8/5  (42)

(42)

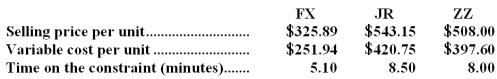

Block Corporation makes three products that use the current constraint,which is a particular type of machine.Data concerning those products appear below:  Required:

a.Rank the products in order of their current profitability from the most profitable to the least profitable.In other words,rank the products in the order in which they should be emphasized.Show your work!

b.Assume that sufficient constraint time is available to satisfy demand for all but the least profitable product.Up to how much should the company be willing to pay to acquire more of the constrained resource?

Required:

a.Rank the products in order of their current profitability from the most profitable to the least profitable.In other words,rank the products in the order in which they should be emphasized.Show your work!

b.Assume that sufficient constraint time is available to satisfy demand for all but the least profitable product.Up to how much should the company be willing to pay to acquire more of the constrained resource?

(Essay)

4.9/5  (37)

(37)

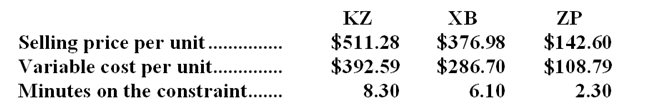

Marrin Corporation makes three products that use the current constraint-a particular type of machine. Data concerning those products appear below:  -Assume that sufficient constraint time is available to satisfy demand for all but the least profitable product.Up to how much should the company be willing to pay to acquire more of the constrained resource?

-Assume that sufficient constraint time is available to satisfy demand for all but the least profitable product.Up to how much should the company be willing to pay to acquire more of the constrained resource?

(Multiple Choice)

4.8/5  (41)

(41)

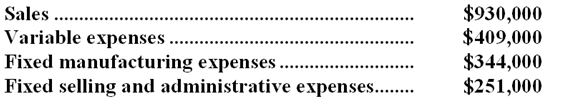

The management of Freshwater Corporation is considering dropping product C11B. Data from the company's accounting system appear below:  All fixed expenses of the company are fully allocated to products in the company's accounting system. Further investigation has revealed that $211,000 of the fixed manufacturing expenses and $122,000 of the fixed selling and administrative expenses are avoidable if product C11B is discontinued.

-What would be the effect on the company's overall net operating income if product C11B were dropped?

All fixed expenses of the company are fully allocated to products in the company's accounting system. Further investigation has revealed that $211,000 of the fixed manufacturing expenses and $122,000 of the fixed selling and administrative expenses are avoidable if product C11B is discontinued.

-What would be the effect on the company's overall net operating income if product C11B were dropped?

(Multiple Choice)

4.9/5  (41)

(41)

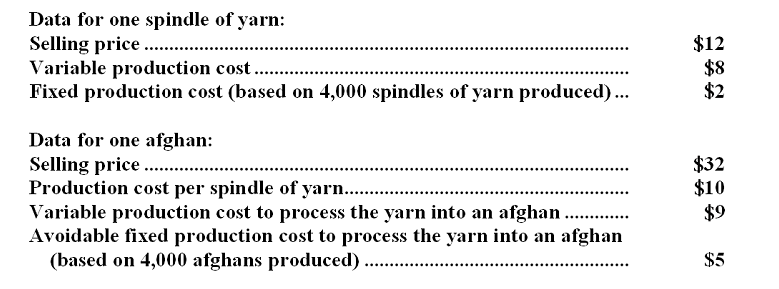

Austin Wool Products purchases raw wool and processes it into yarn. The spindles of yarn can then be sold directly to stores or they can be used by Austin Wool Products to make afghans. Each afghan requires one spindle of yarn. Current cost and revenue data for the spindles of yarn and for the afghans are as follows:  Each month 4,000 spindles of yarn are produced that can either be sold outright or processed into afghans.

-What is the lowest price Austin should be willing to accept for one afghan as long as it can sell spindles of yarn to the outside market for $12 each?

Each month 4,000 spindles of yarn are produced that can either be sold outright or processed into afghans.

-What is the lowest price Austin should be willing to accept for one afghan as long as it can sell spindles of yarn to the outside market for $12 each?

(Multiple Choice)

4.9/5  (41)

(41)

The management of Heider Corporation is considering dropping product J14V.Data from the company's accounting system appear below:  In the company's accounting system all fixed expenses of the company are fully allocated to products.Further investigation has revealed that $211,000 of the fixed manufacturing expenses and $172,000 of the fixed selling and administrative expenses are avoidable if product J14V is discontinued.What would be the effect on the company's overall net operating income if product J14V were dropped?

In the company's accounting system all fixed expenses of the company are fully allocated to products.Further investigation has revealed that $211,000 of the fixed manufacturing expenses and $172,000 of the fixed selling and administrative expenses are avoidable if product J14V is discontinued.What would be the effect on the company's overall net operating income if product J14V were dropped?

(Multiple Choice)

4.7/5  (43)

(43)

Depreciation expense on existing factory equipment is generally relevant to a decision of whether to accept or reject a special offer for a company's product.

(True/False)

4.9/5  (30)

(30)

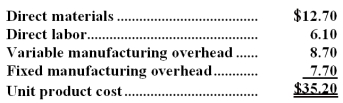

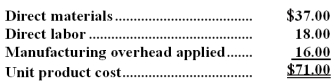

A customer has asked Twiner Corporation to supply 5,000 units of product D05,with some modifications,for $40.20 each.The normal selling price of this product is $52.80 each.The normal unit product cost of product D05 is computed as follows:  Direct labor is a variable cost.The special order would have no effect on the company's total fixed manufacturing overhead costs.The customer would like some modifications made to product D05 that would increase the variable costs by $3.50 per unit and that would require a one-time investment of $23,000 in special molds that would have no salvage value.This special order would have no effect on the company's other sales.The company has ample spare capacity for producing the special order.

Required:

Determine the effect on the company's total net operating income of accepting the special order.Show your work!

Direct labor is a variable cost.The special order would have no effect on the company's total fixed manufacturing overhead costs.The customer would like some modifications made to product D05 that would increase the variable costs by $3.50 per unit and that would require a one-time investment of $23,000 in special molds that would have no salvage value.This special order would have no effect on the company's other sales.The company has ample spare capacity for producing the special order.

Required:

Determine the effect on the company's total net operating income of accepting the special order.Show your work!

(Essay)

4.7/5  (37)

(37)

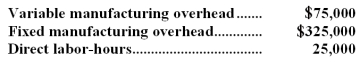

Humes Corporation makes a range of products.The company's predetermined overhead rate is $16 per direct labor-hour,which was calculated using the following budgeted data:  Management is considering a special order for 700 units of product J45K at $64 each.The normal selling price of product J45K is $75 and the unit product cost is determined as follows:

Management is considering a special order for 700 units of product J45K at $64 each.The normal selling price of product J45K is $75 and the unit product cost is determined as follows:  If the special order were accepted,normal sales of this and other products would not be affected.The company has ample excess capacity to produce the additional units.Assume that direct labor is a variable cost,variable manufacturing overhead is really driven by direct labor-hours,and total fixed manufacturing overhead would not be affected by the special order.

Required:

If the special order were accepted,what would be the impact on the company's overall profit?

If the special order were accepted,normal sales of this and other products would not be affected.The company has ample excess capacity to produce the additional units.Assume that direct labor is a variable cost,variable manufacturing overhead is really driven by direct labor-hours,and total fixed manufacturing overhead would not be affected by the special order.

Required:

If the special order were accepted,what would be the impact on the company's overall profit?

(Essay)

4.7/5  (37)

(37)

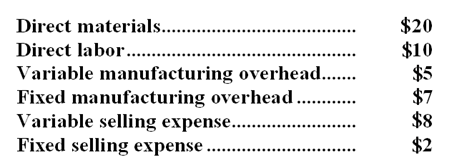

The Varone Company makes a single product called a Hom. The company has the capacity to produce 40,000 Homs per year. Per unit costs to produce and sell one Hom at that activity level are:  The regular selling price for one Hom is $60. A special order has been received at Varone from the Fairview Company to purchase 8,000 Homs next year at 15% off the regular selling price. If this special order were accepted, the variable selling expense would be reduced by 25%. However, Varone would have to purchase a specialized machine to engrave the Fairview name on each Hom in the special order. This machine would cost $12,000 and it would have no use after the special order was filled. The total fixed costs, both manufacturing and selling, are constant within the relevant range of 30,000 to 40,000 Homs per year. Assume direct labor is a variable cost.

-If Varone can expect to sell 32,000 Homs next year through regular channels and the special order is accepted at 15% off the regular selling price,the effect on net operating income next year due to accepting this order would be a:

The regular selling price for one Hom is $60. A special order has been received at Varone from the Fairview Company to purchase 8,000 Homs next year at 15% off the regular selling price. If this special order were accepted, the variable selling expense would be reduced by 25%. However, Varone would have to purchase a specialized machine to engrave the Fairview name on each Hom in the special order. This machine would cost $12,000 and it would have no use after the special order was filled. The total fixed costs, both manufacturing and selling, are constant within the relevant range of 30,000 to 40,000 Homs per year. Assume direct labor is a variable cost.

-If Varone can expect to sell 32,000 Homs next year through regular channels and the special order is accepted at 15% off the regular selling price,the effect on net operating income next year due to accepting this order would be a:

(Multiple Choice)

4.9/5  (32)

(32)

Lusk Company produces and sells 15,000 units of Product A each month.The selling price of Product A is $20 per unit,and variable expenses are $14 per unit.A study has been made concerning whether Product A should be discontinued.The study shows that $70,000 of the $100,000 in fixed expenses charged to Product A would continue even if the product was discontinued.These data indicate that if Product A is discontinued,the company's overall net operating income would:

(Multiple Choice)

4.7/5  (37)

(37)

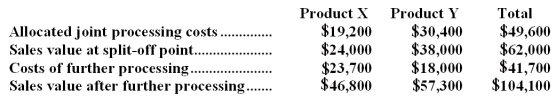

Iaukea Company makes two products from a common input.Joint processing costs up to the split-off point total $49,600 a year.The company allocates these costs to the joint products on the basis of their total sales values at the split-off point.Each product may be sold at the split-off point or processed further.Data concerning these products appear below:

Required:

a.What is the net monetary advantage (disadvantage)of processing Product X beyond the split-off point?

b.What is the net monetary advantage (disadvantage)of processing Product Y beyond the split-off point?

c.What is the minimum amount the company should accept for Product X if it is to be sold at the split-off point?

d.What is the minimum amount the company should accept for Product Y if it is to be sold at the split-off point?

Required:

a.What is the net monetary advantage (disadvantage)of processing Product X beyond the split-off point?

b.What is the net monetary advantage (disadvantage)of processing Product Y beyond the split-off point?

c.What is the minimum amount the company should accept for Product X if it is to be sold at the split-off point?

d.What is the minimum amount the company should accept for Product Y if it is to be sold at the split-off point?

(Essay)

4.8/5  (29)

(29)

Showing 21 - 40 of 153

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)