Exam 1: Managerial Accounting and Cost Concepts

Exam 1: Managerial Accounting and Cost Concepts166 Questions

Exam 2: Job-Order Costing154 Questions

Exam 3: Process Costing109 Questions

Exam 4: Cost-Volume-Profit Relationships241 Questions

Exam 5: Variable Costing and Segment Reporting: Tools for Management200 Questions

Exam 6: Activity-Based Costing: a Tool to Aid Decision Making138 Questions

Exam 7: Profit Planning106 Questions

Exam 8: Flexible Budgets and Performance Analysis295 Questions

Exam 9: Standard Costs and Variances178 Questions

Exam 10: Performance Measurement in Decentralized Organizations93 Questions

Exam 11: Differential Analysis: The Key to Decision Making153 Questions

Exam 12: Capital Budgeting Decisions144 Questions

Exam 13: Statement of Cash Flows108 Questions

Exam 14: Financial Statement Analysis211 Questions

Exam 15: Least-Squares Regression Computations22 Questions

Exam 16: Appendix B: Cost of Quality42 Questions

Exam 17: The Predetermined Overhead Rate and Capacity27 Questions

Exam 18: Further Classification of Labor Costs20 Questions

Exam 19: Fifo Method79 Questions

Exam 20: Service Department Allocations46 Questions

Exam 21: Abc Action Analysis15 Questions

Exam 22: Using a Modified Form of Activity-Based Costing to Determine Product Costs for External Reports16 Questions

Exam 23: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System105 Questions

Exam 24: Journal Entries to Record Variances52 Questions

Exam 25: Transfer Pricing21 Questions

Exam 26: Service Department Charges41 Questions

Exam 27: The Concept of Present Value12 Questions

Exam 28: Income Taxes in Capital Budgeting Decisions36 Questions

Exam 29: The Direct Method of Determining the Net Cash Provided by Operating Activities48 Questions

Exam 30: Pricing Products and Services67 Questions

Exam 31: Profitability Analysis71 Questions

Select questions type

The term "relevant range" means the range of activity over which:

(Multiple Choice)

4.9/5  (33)

(33)

At a sales volume of 35,000 units, Thoma Corporation's sales commissions (a cost that is variable with respect to sales volume) total $448,000.

-To the nearest whole dollar,what should be the total sales commissions at a sales volume of 33,200 units? (Assume that this sales volume is within the relevant range. )

(Multiple Choice)

4.7/5  (36)

(36)

Management of Modugno Corporation is considering whether to purchase a new model 370 machine costing $441,000 or a new model 240 machine costing $387,000 to replace a machine that was purchased 7 years ago for $429,000. The old machine was used to make product M25A until it broke down last week. Unfortunately, the old machine cannot be repaired.

Management has decided to buy the new model 240 machine. It has less capacity than the new model 370 machine, but its capacity is sufficient to continue making product M25A.

Management also considered, but rejected, the alternative of simply dropping product M25A. If that were done, instead of investing $387,000 in the new machine, the money could be invested in a project that would return a total of $430,000.

-In making the decision to buy the model 240 machine rather than the model 370 machine,the sunk cost was:

(Multiple Choice)

4.8/5  (33)

(33)

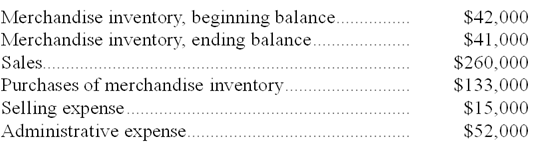

Salvadore Inc., a local retailer, has provided the following data for the month of September:

-The cost of goods sold for September was:

-The cost of goods sold for September was:

(Multiple Choice)

4.8/5  (44)

(44)

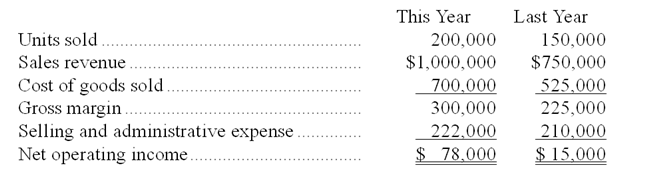

The following data have been provided by a retailer that sells a single product.  -What is the best estimate of the company's contribution margin for this year?

-What is the best estimate of the company's contribution margin for this year?

(Multiple Choice)

4.9/5  (38)

(38)

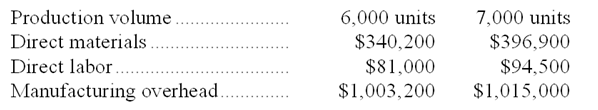

Babuca Corporation has provided the following production and total cost data for two levels of monthly production volume. The company produces a single product.  -The best estimate of the total cost to manufacture 6,300 units is closest to:

-The best estimate of the total cost to manufacture 6,300 units is closest to:

(Multiple Choice)

4.9/5  (40)

(40)

Getchman Marketing, Inc., a merchandising company, reported sales of $592,500 and cost of goods sold of $305,000 for April. The company's total variable selling expense was $37,500; its total fixed selling expense was $16,000; its total variable administrative expense was $35,000; and its total fixed administrative expense was $38,900. The cost of goods sold in this company is a variable cost.

-The contribution margin for April is:

(Multiple Choice)

4.8/5  (33)

(33)

A decrease in production will ordinarily result in an increase in fixed production costs per unit.

(True/False)

4.8/5  (45)

(45)

Management of Mcentire Corporation has asked your help as an intern in preparing some key reports for April. Direct materials cost was $64,000, direct labor cost was $47,000, and manufacturing overhead was $75,000. Selling expense was $15,000 and administrative expense was $44,000

-The prime cost for April was:

(Multiple Choice)

4.8/5  (35)

(35)

Temblador Corporation purchased a machine 7 years ago for $319,000 when it launched product E26T. Unfortunately, this machine has broken down and cannot be repaired. The machine could be replaced by a new model 330 machine costing $323,000 or by a new model 230 machine costing $285,000. Management has decided to buy the model 230 machine. It has less capacity than the model 330 machine, but its capacity is sufficient to continue making product E26T. Management also considered, but rejected, the alternative of dropping product E26T and not replacing the old machine. If that were done, the $285,000 invested in the new machine could instead have been invested in a project that would have returned a total of $386,000.

-In making the decision to invest in the model 230 machine,the opportunity cost was:

(Multiple Choice)

4.9/5  (38)

(38)

A variable cost is a cost whose cost per unit varies as the activity level rises and falls.

(True/False)

4.8/5  (37)

(37)

The wages of factory maintenance personnel would usually be considered to be: Indirect labor Manufacturing overhead A) No Yes B) Yes No C) Yes Yes D) No No

(Multiple Choice)

4.9/5  (33)

(33)

Erkkila Inc. reports that at an activity level of 7,900 machine-hours in a month, its total variable inspection cost is $210,061 and its total fixed inspection cost is $191,970.

-What would be the total variable inspection cost at an activity level of 8,100 machine-hours in a month? Assume that this level of activity is within the relevant range.

(Multiple Choice)

4.9/5  (36)

(36)

Chaffee Corporation staffs a helpline to answer questions from customers. The costs of operating the helpline are variable with respect to the number of calls in a month. At a volume of 33,000 calls in a month, the costs of operating the helpline total $742,500.

-To the nearest whole dollar,what should be the total cost of operating the helpline costs at a volume of 34,800 calls in a month? (Assume that this call volume is within the relevant range. )

(Multiple Choice)

4.8/5  (41)

(41)

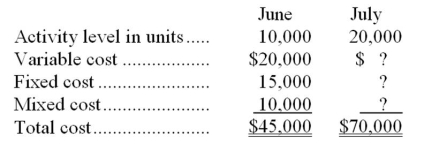

The following data pertains to activity and costs for two months:  Assuming that these activity levels are within the relevant range,the mixed cost for July was:

Assuming that these activity levels are within the relevant range,the mixed cost for July was:

(Multiple Choice)

4.8/5  (43)

(43)

Management of Modugno Corporation is considering whether to purchase a new model 370 machine costing $441,000 or a new model 240 machine costing $387,000 to replace a machine that was purchased 7 years ago for $429,000. The old machine was used to make product M25A until it broke down last week. Unfortunately, the old machine cannot be repaired.

Management has decided to buy the new model 240 machine. It has less capacity than the new model 370 machine, but its capacity is sufficient to continue making product M25A.

Management also considered, but rejected, the alternative of simply dropping product M25A. If that were done, instead of investing $387,000 in the new machine, the money could be invested in a project that would return a total of $430,000.

-In making the decision to buy the model 240 machine rather than the model 370 machine,the differential cost was:

(Multiple Choice)

4.9/5  (40)

(40)

At a sales volume of 27,000 units, Danielle Corporation's property taxes (a cost that is fixed with respect to sales volume) total $207,900.

-To the nearest whole cent,what should be the average property tax per unit at a sales volume of 27,600 units? (Assume that this sales volume is within the relevant range. )

(Multiple Choice)

4.9/5  (47)

(47)

Which of the following costs is an example of a period rather than a product cost?

(Multiple Choice)

4.8/5  (32)

(32)

Showing 61 - 80 of 166

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)