Exam 30: Pricing Products and Services

Exam 1: Managerial Accounting and Cost Concepts166 Questions

Exam 2: Job-Order Costing154 Questions

Exam 3: Process Costing109 Questions

Exam 4: Cost-Volume-Profit Relationships241 Questions

Exam 5: Variable Costing and Segment Reporting: Tools for Management200 Questions

Exam 6: Activity-Based Costing: a Tool to Aid Decision Making138 Questions

Exam 7: Profit Planning106 Questions

Exam 8: Flexible Budgets and Performance Analysis295 Questions

Exam 9: Standard Costs and Variances178 Questions

Exam 10: Performance Measurement in Decentralized Organizations93 Questions

Exam 11: Differential Analysis: The Key to Decision Making153 Questions

Exam 12: Capital Budgeting Decisions144 Questions

Exam 13: Statement of Cash Flows108 Questions

Exam 14: Financial Statement Analysis211 Questions

Exam 15: Least-Squares Regression Computations22 Questions

Exam 16: Appendix B: Cost of Quality42 Questions

Exam 17: The Predetermined Overhead Rate and Capacity27 Questions

Exam 18: Further Classification of Labor Costs20 Questions

Exam 19: Fifo Method79 Questions

Exam 20: Service Department Allocations46 Questions

Exam 21: Abc Action Analysis15 Questions

Exam 22: Using a Modified Form of Activity-Based Costing to Determine Product Costs for External Reports16 Questions

Exam 23: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System105 Questions

Exam 24: Journal Entries to Record Variances52 Questions

Exam 25: Transfer Pricing21 Questions

Exam 26: Service Department Charges41 Questions

Exam 27: The Concept of Present Value12 Questions

Exam 28: Income Taxes in Capital Budgeting Decisions36 Questions

Exam 29: The Direct Method of Determining the Net Cash Provided by Operating Activities48 Questions

Exam 30: Pricing Products and Services67 Questions

Exam 31: Profitability Analysis71 Questions

Select questions type

Allen Corporation's vice president in charge of marketing believes that every 8% increase in the selling price of one of the company's products would lead to an 11% decrease in the product's total unit sales. The product's absorption costing unit product cost is $10.70. The variable production cost is $1.50 per unit and the variable selling and administrative cost is $4.40 per unit.

-The product's profit-maximizing price according to the formula in the text is closest to:

(Multiple Choice)

4.8/5  (42)

(42)

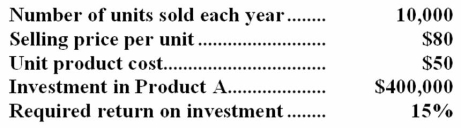

The following information is available on Bruder Inc.'s Product A:  The company uses the absorption costing approach to cost-plus pricing described in the text.Based on these data,the total selling and administrative expenses each year are:

The company uses the absorption costing approach to cost-plus pricing described in the text.Based on these data,the total selling and administrative expenses each year are:

(Multiple Choice)

4.8/5  (34)

(34)

Cost-plus pricing is so named because all costs--production,selling,and administrative--are included in the cost base from which a target selling price is derived.

(True/False)

4.8/5  (37)

(37)

Management of Fabiano Corporation is considering a new product,an outdoor speaker that would have a selling price of $43 per unit and projected sales of 20,000 units.Launching the new product would require an investment of $600,000.The desired return on investment is 14%.

Required:

Determine the target cost per unit for the outdoor speaker.

(Essay)

4.7/5  (51)

(51)

Guzzetta Corporation would like to use target costing for a new product that is under consideration.At a selling price of $70 per unit,management projects sales of 40,000 units.The new product would require an investment of $700,000.The desired return on investment is 17%.

Required:

Determine the target cost per unit for the new product.

(Essay)

4.9/5  (26)

(26)

The management of Mendoza,Inc. ,is considering a new product that would have a selling price of $98 per unit and projected sales of 40,000 units.The new product would require an investment of $600,000.The desired return on investment is 10%.

Required:

Determine the target cost per unit for the new product.

(Essay)

4.8/5  (39)

(39)

The management of Kozloff Corporation is considering introducing a new product--a compact barbecue.At a selling price of $74 per unit,management projects sales of 80,000 units.Launching the barbecue as a new product would require an investment of $800,000.The desired return on investment is 14%.The target cost per barbecue is closest to:

(Multiple Choice)

4.9/5  (48)

(48)

Assume that the price elasticity of demand is less than -1 (for example,-1.5).As the absolute value of the price elasticity of demand increases,the profit-maximizing price decreases.

(True/False)

4.8/5  (32)

(32)

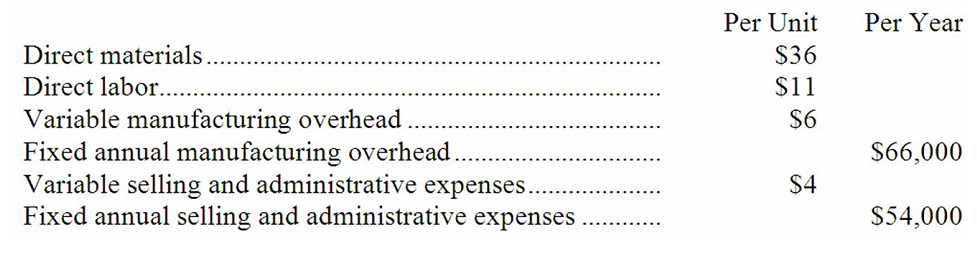

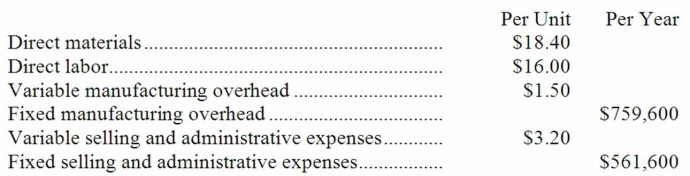

The management of Store Corporation would like to set the selling price on a new product using the absorption costing approach to cost-plus pricing. The company's accounting department has supplied the following estimates for the new product:  Management plans to produce and sell 6,000 units of the new product annually. The new product would require an investment of $1,140,000 and has a required return on investment of 10%.

-The absorption costing unit product cost is:

Management plans to produce and sell 6,000 units of the new product annually. The new product would require an investment of $1,140,000 and has a required return on investment of 10%.

-The absorption costing unit product cost is:

(Multiple Choice)

4.7/5  (36)

(36)

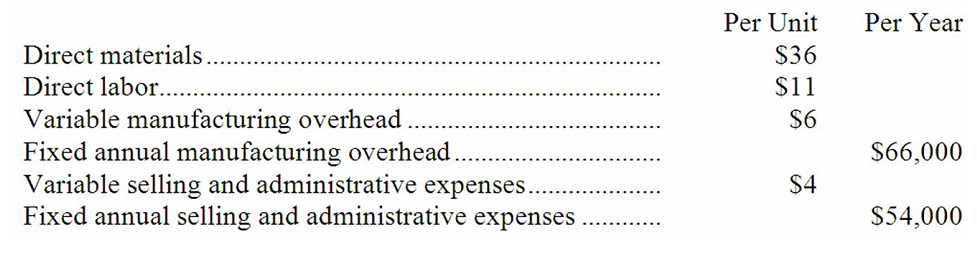

Madonia Corporation is introducing a new product whose direct materials cost is $37 per unit,direct labor cost is $19 per unit,variable manufacturing overhead is $6 per unit,and variable selling and administrative expense is $4 per unit.The annual fixed manufacturing overhead associated with the product is $91,000 and its annual fixed selling and administrative expense is $42,000.Management plans to produce and sell 7,000 units of the new product annually.The new product would require an investment of $595,000 and has a required return on investment of 20%.Management would like to set the selling price on a new product using the absorption costing approach to cost-plus pricing.

Required:

a.Determine the unit product cost for the new product.

b.Determine the markup percentage on absorption cost for the new product.

c.Determine the target selling price for the new product using the absorption costing approach.

(Essay)

4.7/5  (34)

(34)

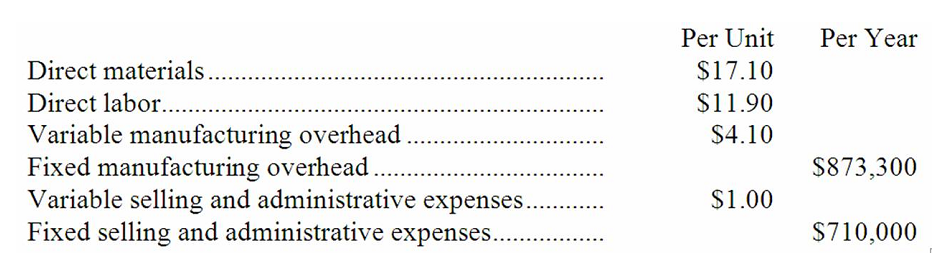

Dieckman Company makes a product with the following costs:  The company uses the absorption costing approach to cost-plus pricing described in the text. The pricing calculations are based on budgeted production and sales of 71,000 units per year.

The company has invested $360,000 in this product and expects a return on investment of 13%.

Direct labor is a variable cost in this company.

-The markup on absorption cost is closest to:

The company uses the absorption costing approach to cost-plus pricing described in the text. The pricing calculations are based on budgeted production and sales of 71,000 units per year.

The company has invested $360,000 in this product and expects a return on investment of 13%.

Direct labor is a variable cost in this company.

-The markup on absorption cost is closest to:

(Multiple Choice)

4.9/5  (29)

(29)

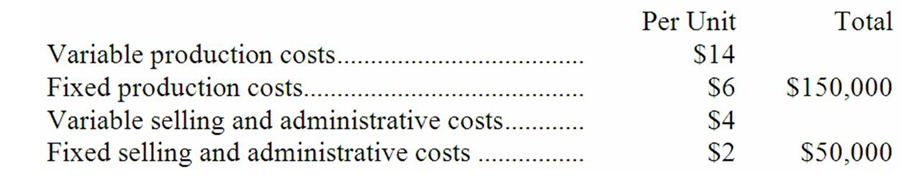

Werry Company is about to introduce a new product. It is expected that the following costs would be incurred when 25,000 units are produced and sold in a year:  Werry Company uses the absorption costing approach to cost-plus pricing as described in the text.

-Assume that the company uses a markup of 90% in order to determine selling prices.The selling price under the absorption costing approach would be:

Werry Company uses the absorption costing approach to cost-plus pricing as described in the text.

-Assume that the company uses a markup of 90% in order to determine selling prices.The selling price under the absorption costing approach would be:

(Multiple Choice)

4.8/5  (39)

(39)

The markup over cost under the absorption costing approach would increase if the unit product cost increases,holding everything else constant.

(True/False)

4.8/5  (29)

(29)

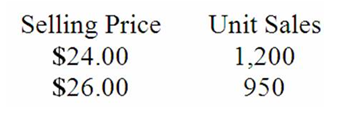

Coan Company recently changed the selling price of one of its products. Data concerning sales for comparable periods before and after the price change are presented below.  The product's variable cost is $21.40 per unit.

-The product's profit-maximizing price according to the formula in the text is closest to:

The product's variable cost is $21.40 per unit.

-The product's profit-maximizing price according to the formula in the text is closest to:

(Multiple Choice)

4.9/5  (38)

(38)

Mahboud,Inc. ,uses the absorption costing approach to cost-plus pricing described in the text to set prices for its products.Based on budgeted sales of 64,000 units next year,the unit product cost of a particular product is $84.20.The company's selling and administrative expenses for this product are budgeted to be $1,292,800 in total for the year.The company has invested $560,000 in this product and expects a return on investment of 13%. The selling price for this product based on the absorption costing approach would be closest to:

(Multiple Choice)

4.7/5  (35)

(35)

Qudsi Company makes a product that has the following costs:  The company uses the absorption costing approach to cost-plus pricing as described in the text.The pricing calculations are based on budgeted production and sales of 36,000 units per year.

The company has invested $580,000 in this product and expects a return on investment of 12%.

Required:

a.Compute the markup on absorption cost.

b.Compute the selling price of the product using the absorption costing approach.

c.Assume that every 10% increase in price leads to a 13% decrease in quantity sold.Assuming no change in cost structure and that direct labor is a variable cost,compute the profit-maximizing price.

The company uses the absorption costing approach to cost-plus pricing as described in the text.The pricing calculations are based on budgeted production and sales of 36,000 units per year.

The company has invested $580,000 in this product and expects a return on investment of 12%.

Required:

a.Compute the markup on absorption cost.

b.Compute the selling price of the product using the absorption costing approach.

c.Assume that every 10% increase in price leads to a 13% decrease in quantity sold.Assuming no change in cost structure and that direct labor is a variable cost,compute the profit-maximizing price.

(Essay)

4.8/5  (44)

(44)

Perin Corporation would like to use target costing for a new product it is considering introduce.At a selling price of $25 per unit,management projects sales of 30,000 units.The new product would require an investment of $500,000.The desired return on investment is 11%.The target cost per unit is closest to:

(Multiple Choice)

4.9/5  (31)

(31)

The management of Store Corporation would like to set the selling price on a new product using the absorption costing approach to cost-plus pricing. The company's accounting department has supplied the following estimates for the new product:  Management plans to produce and sell 6,000 units of the new product annually. The new product would require an investment of $1,140,000 and has a required return on investment of 10%.

-The unit target selling price using the absorption costing approach is closest to:

Management plans to produce and sell 6,000 units of the new product annually. The new product would require an investment of $1,140,000 and has a required return on investment of 10%.

-The unit target selling price using the absorption costing approach is closest to:

(Multiple Choice)

4.9/5  (37)

(37)

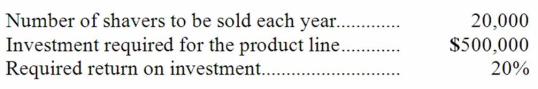

Penrod Company wants to manufacture and sell a new electric shaver.To compete effectively,the shaver would have to be priced at no more than $40 per unit.The following additional information is available:  The target cost per shaver would be:

The target cost per shaver would be:

(Multiple Choice)

4.9/5  (36)

(36)

Showing 21 - 40 of 67

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)