Exam 30: Pricing Products and Services

Exam 1: Managerial Accounting and Cost Concepts166 Questions

Exam 2: Job-Order Costing154 Questions

Exam 3: Process Costing109 Questions

Exam 4: Cost-Volume-Profit Relationships241 Questions

Exam 5: Variable Costing and Segment Reporting: Tools for Management200 Questions

Exam 6: Activity-Based Costing: a Tool to Aid Decision Making138 Questions

Exam 7: Profit Planning106 Questions

Exam 8: Flexible Budgets and Performance Analysis295 Questions

Exam 9: Standard Costs and Variances178 Questions

Exam 10: Performance Measurement in Decentralized Organizations93 Questions

Exam 11: Differential Analysis: The Key to Decision Making153 Questions

Exam 12: Capital Budgeting Decisions144 Questions

Exam 13: Statement of Cash Flows108 Questions

Exam 14: Financial Statement Analysis211 Questions

Exam 15: Least-Squares Regression Computations22 Questions

Exam 16: Appendix B: Cost of Quality42 Questions

Exam 17: The Predetermined Overhead Rate and Capacity27 Questions

Exam 18: Further Classification of Labor Costs20 Questions

Exam 19: Fifo Method79 Questions

Exam 20: Service Department Allocations46 Questions

Exam 21: Abc Action Analysis15 Questions

Exam 22: Using a Modified Form of Activity-Based Costing to Determine Product Costs for External Reports16 Questions

Exam 23: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System105 Questions

Exam 24: Journal Entries to Record Variances52 Questions

Exam 25: Transfer Pricing21 Questions

Exam 26: Service Department Charges41 Questions

Exam 27: The Concept of Present Value12 Questions

Exam 28: Income Taxes in Capital Budgeting Decisions36 Questions

Exam 29: The Direct Method of Determining the Net Cash Provided by Operating Activities48 Questions

Exam 30: Pricing Products and Services67 Questions

Exam 31: Profitability Analysis71 Questions

Select questions type

Salt is an example of a product whose demand is price inelastic.

(True/False)

4.7/5  (48)

(48)

Edelheit Company uses the absorption costing approach to cost-plus pricing as described in the text to set prices for its products. Based on budgeted sales of 26,000 units next year, the unit product cost of a particular product is $24.20. The company's selling and administrative expenses for this product are budgeted to be $629,000 in total for the year. The company has invested $340,000 in this product and expects a return on investment of 14%.

-The selling price based on the absorption costing approach for this product would be closest to:

(Multiple Choice)

4.8/5  (34)

(34)

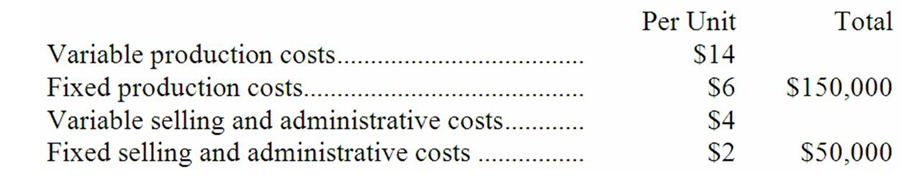

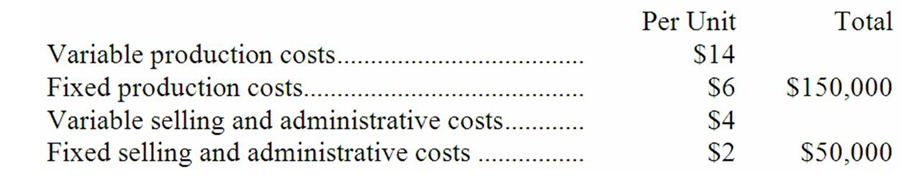

Werry Company is about to introduce a new product. It is expected that the following costs would be incurred when 25,000 units are produced and sold in a year:  Werry Company uses the absorption costing approach to cost-plus pricing as described in the text.

-After introducing the product at a markup of 90%,the company finds that it has excess capacity.A foreign dealer has offered to purchase 4,000 units of the product at a special price of $32 per unit.This sale would not disturb regular business.If the special price is accepted on the 4,000 units,the effect on total profits for the year will be a:

Werry Company uses the absorption costing approach to cost-plus pricing as described in the text.

-After introducing the product at a markup of 90%,the company finds that it has excess capacity.A foreign dealer has offered to purchase 4,000 units of the product at a special price of $32 per unit.This sale would not disturb regular business.If the special price is accepted on the 4,000 units,the effect on total profits for the year will be a:

(Multiple Choice)

5.0/5  (33)

(33)

Which of the following methods would probably be the most beneficial to a company that has little or no control over the price that it can charge for its product or service?

(Multiple Choice)

4.9/5  (32)

(32)

Nicklos Corporation's marketing manager believes that every 7% decrease in the selling price of one of the company's products would lead to a 10% increase in the product's total unit sales.The product's absorption costing unit product cost is $18.60.The variable production cost is $7.60 per unit and the variable selling and administrative cost is $4.90.

Required:

a.Compute the product's price elasticity of demand as defined in the text.

b.Compute the product's profit-maximizing price according to the formula in the text.

(Essay)

4.7/5  (34)

(34)

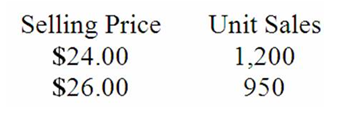

Coan Company recently changed the selling price of one of its products. Data concerning sales for comparable periods before and after the price change are presented below.  The product's variable cost is $21.40 per unit.

-The product's price elasticity of demand as defined in the text is closest to:

The product's variable cost is $21.40 per unit.

-The product's price elasticity of demand as defined in the text is closest to:

(Multiple Choice)

4.9/5  (31)

(31)

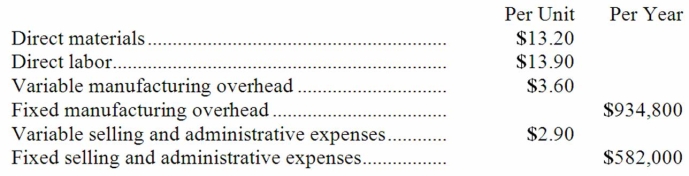

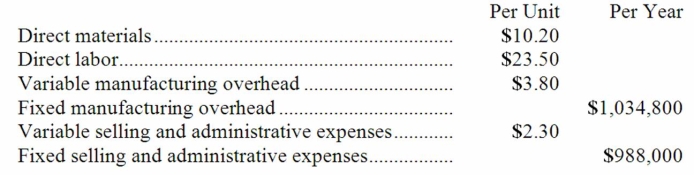

Rizer Corporation manufactures a product that has the following costs:  The company uses the absorption costing approach to cost-plus pricing as described in the text.The pricing calculations are based on budgeted production and sales of 40,000 units per year.

The company has invested $200,000 in this product and expects a return on investment of 15%.

Required:

a.Compute the markup on absorption cost.

b.Compute the selling price of the product using the absorption costing approach.

The company uses the absorption costing approach to cost-plus pricing as described in the text.The pricing calculations are based on budgeted production and sales of 40,000 units per year.

The company has invested $200,000 in this product and expects a return on investment of 15%.

Required:

a.Compute the markup on absorption cost.

b.Compute the selling price of the product using the absorption costing approach.

(Essay)

4.7/5  (38)

(38)

Holding all other things constant,if the price elasticity of demand increases (i.e. ,becomes more negative),then the markup under absorption costing will:

(Multiple Choice)

4.7/5  (31)

(31)

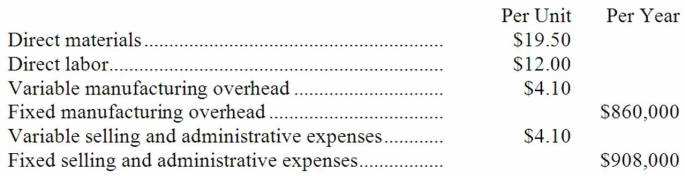

Kirsch,Inc. ,manufactures a product with the following costs:  The company uses the absorption costing approach to cost-plus pricing described in the text.The pricing calculations are based on budgeted production and sales of 41,000 units per year. The company has invested $540,000 in this product and expects a return on investment of 13%.

The selling price based on the absorption costing approach would be closest to:

The company uses the absorption costing approach to cost-plus pricing described in the text.The pricing calculations are based on budgeted production and sales of 41,000 units per year. The company has invested $540,000 in this product and expects a return on investment of 13%.

The selling price based on the absorption costing approach would be closest to:

(Multiple Choice)

4.9/5  (46)

(46)

The management of Nerby Corporation is considering introducing a new product--a compact lawn blower. At a selling price of $28 per unit, management projects sales of 40,000 units. The lawn blower would require an investment of $900,000. The desired return on investment is 20%.

-The target cost per lawn blower is closest to:

(Multiple Choice)

4.8/5  (36)

(36)

Blumstein Corporation would like to use target costing for a new product it is considering introducing. At a selling price of $22 per unit, management projects sales of 60,000 units. The new product would require an investment of $300,000. The desired return on investment is 11%.

-The target cost per unit is closest to:

(Multiple Choice)

4.7/5  (48)

(48)

Blumstein Corporation would like to use target costing for a new product it is considering introducing. At a selling price of $22 per unit, management projects sales of 60,000 units. The new product would require an investment of $300,000. The desired return on investment is 11%.

-The desired profit according to the target costing calculations is:

(Multiple Choice)

4.7/5  (33)

(33)

Edelheit Company uses the absorption costing approach to cost-plus pricing as described in the text to set prices for its products. Based on budgeted sales of 26,000 units next year, the unit product cost of a particular product is $24.20. The company's selling and administrative expenses for this product are budgeted to be $629,000 in total for the year. The company has invested $340,000 in this product and expects a return on investment of 14%.

-The markup on absorption cost for this product would be closest to:

(Multiple Choice)

4.7/5  (39)

(39)

The absorption costing approach to cost-plus pricing provides assurance that the company's required rate of return will be realized even if unit sales are less than forecasted.

(True/False)

4.9/5  (37)

(37)

Werry Company is about to introduce a new product. It is expected that the following costs would be incurred when 25,000 units are produced and sold in a year:  Werry Company uses the absorption costing approach to cost-plus pricing as described in the text.

-Assume that Werry Company has not yet determined a markup to use on the new product.The new product would require an investment of $800,000.The company requires a 20% rate of return on investment on all new products.The markup under the absorption costing approach would be closest to:

Werry Company uses the absorption costing approach to cost-plus pricing as described in the text.

-Assume that Werry Company has not yet determined a markup to use on the new product.The new product would require an investment of $800,000.The company requires a 20% rate of return on investment on all new products.The markup under the absorption costing approach would be closest to:

(Multiple Choice)

4.8/5  (47)

(47)

Epperson Company's management believes that every 3% decrease in the selling price of one of the company's products leads to an 8% increase in the product's total unit sales.The product's price elasticity of demand as defined in the text is closest to:

(Multiple Choice)

5.0/5  (37)

(37)

Finnie Company's management believes that every 5% increase in the selling price of one of the company's products results in a 13% decrease in the product's total unit sales.The variable production cost of this product is $23.10 per unit and the variable selling and administrative cost is $5.40 per unit. The product's profit-maximizing price according to the formula in the text is closest to:

(Multiple Choice)

4.8/5  (32)

(32)

Boden Company's management believes that every 2% increase in the selling price of one of the company's products would lead to a 5% decrease in the product's total unit sales. The product's variable cost is $19.30 per unit.

-The product's profit-maximizing price according to the formula in the text is closest to:

(Multiple Choice)

4.8/5  (39)

(39)

Holding all other things constant,an increase in the company's required ROI will affect:

(Multiple Choice)

4.7/5  (39)

(39)

Jaber Corporation makes a product with the following costs:  The company uses the absorption costing approach to cost-plus pricing described in the text.The pricing calculations are based on budgeted production and sales of 52,000 units per year. The company has invested $200,000 in this product and expects a return on investment of 9%.

The markup on absorption cost would be closest to:

The company uses the absorption costing approach to cost-plus pricing described in the text.The pricing calculations are based on budgeted production and sales of 52,000 units per year. The company has invested $200,000 in this product and expects a return on investment of 9%.

The markup on absorption cost would be closest to:

(Multiple Choice)

4.8/5  (33)

(33)

Showing 41 - 60 of 67

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)