Exam 17: Job Order Cost Systems and Overhead Allocations

Exam 1: Accounting: Information for Decision Making116 Questions

Exam 2: Basic Financial Statements115 Questions

Exam 3: The Accounting Cycle: Capturing Economic Events126 Questions

Exam 4: The Accounting Cycle: Accruals and Deferrals117 Questions

Exam 5: The Accounting Cycle: Reporting Financial Results111 Questions

Exam 6: Merchandising Activities122 Questions

Exam 7: Financial Assets182 Questions

Exam 8: Inventories and the Cost of Goods Sold120 Questions

Exam 9: Plant and Intangible Assets141 Questions

Exam 10: Liabilities143 Questions

Exam 11: Stockholders Equity: Paid-In Capital120 Questions

Exam 12: Income and Changes in Retained Earnings125 Questions

Exam 13: Statement of Cash Flows130 Questions

Exam 14: Financial Statement Analysis114 Questions

Exam 15: Global Business and Accounting78 Questions

Exam 16: Management Accounting: a Business Partner104 Questions

Exam 17: Job Order Cost Systems and Overhead Allocations94 Questions

Exam 18: Process Costing65 Questions

Exam 19: Costing and the Value Chain62 Questions

Exam 20: Cost-Volume-Profit Analysis88 Questions

Exam 21: Incremental Analysis70 Questions

Exam 22: Responsibility Accounting and Transfer Pricing72 Questions

Exam 23: Operational Budgeting79 Questions

Exam 24: Standard Cost Systems91 Questions

Exam 25: Rewarding Business Performance53 Questions

Exam 26: Capital Budgeting74 Questions

Exam 27: Forms of Business Organization52 Questions

Exam 28: The Time Value of Money: Future Amounts and Present Values50 Questions

Select questions type

An overhead application rate is computed by dividing the actual overhead costs by the expected amount of units in the activity base.

(True/False)

4.9/5  (34)

(34)

Accounting terminology

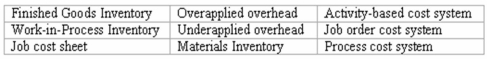

Listed below are nine technical accounting terms introduced or emphasized in this chapter:  Each of the following statements may (or may not)describe one of these technical terms.In the space provided below each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.

_____ (a)The balance remaining in the Manufacturing Overhead account when the overhead application rate used during the period is too low.

_____ (b)The account credited as component parts are transferred into production.

_____ (c)A schedule used to accumulate manufacturing costs and to determine the unit costs associated with a specific customer's order.

_____ (d)The inventory account credited when the cost of goods sold is recorded.

_____ (e)The type of cost accounting system most likely used by an oil refinery engaged in the continuous production of petroleum products.

_____ (f)The inventory account debited when manufacturing cost accounts (such as Direct Labor or Materials Inventory)are credited.

_____ (g)The type of cost accounting system likely to be used by a machine shop that manufactures items to the specifications provided by its customers.

Each of the following statements may (or may not)describe one of these technical terms.In the space provided below each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.

_____ (a)The balance remaining in the Manufacturing Overhead account when the overhead application rate used during the period is too low.

_____ (b)The account credited as component parts are transferred into production.

_____ (c)A schedule used to accumulate manufacturing costs and to determine the unit costs associated with a specific customer's order.

_____ (d)The inventory account credited when the cost of goods sold is recorded.

_____ (e)The type of cost accounting system most likely used by an oil refinery engaged in the continuous production of petroleum products.

_____ (f)The inventory account debited when manufacturing cost accounts (such as Direct Labor or Materials Inventory)are credited.

_____ (g)The type of cost accounting system likely to be used by a machine shop that manufactures items to the specifications provided by its customers.

(Essay)

4.8/5  (35)

(35)

What are the total manufacturing overhead costs allocated to the Strollers for the current month?

(Multiple Choice)

4.7/5  (35)

(35)

The document that provides information for the cost of goods manufactured is:

(Multiple Choice)

4.9/5  (29)

(29)

A debit balance in the Manufacturing Overhead account at the end of the period indicates that overhead has been under-applied to jobs.

(True/False)

4.7/5  (27)

(27)

Which of the following statements is true about activity-based costing?

(Multiple Choice)

4.8/5  (36)

(36)

Langdon Company manufactures custom designed toy sailboats.The company uses a job order costing system.Overhead is applied based on direct labor hours.Estimated overhead for 2015 is $11,840 and the company estimates it will use 7,400 direct labor hours.The following events occurred in March.

(a.)The company purchased materials for $800 on account.

(b.)The production supervisor requisitioned 15 sheets of fiberglass for constructing the boats.The fiberglass was in stock and originally cost $3 a sheet.

(c.)Direct labor on the boats cost $500.

(d.)More materials were purchased for $350 on account.

(e.)Indirect labor costs were $210.

(f.)A utility bill for the boat factory was $230 and was paid in cash.

(g.)A repair bill for the salesman's car was $75 and will be paid next month.

(h.)Additional materials were placed into production which cost $215.

(i.)Manufacturing overhead was applied (direct labor during March totaled 500 hours).

(j.)One sailboat was completed which cost $325.

(k.)The completed sailboat was sold for $750.Record the sale and the cost of sale.

Required:

(1.)Determine the overhead application rate.

(2.)Prepare journal entries for the above transactions.

(3.)What is the cost of the remaining Work in Process?

(Essay)

4.9/5  (34)

(34)

Management can compute the per-unit cost of finished goods accurately only when a job order cost system is in use.

(True/False)

4.8/5  (47)

(47)

The advantage of using a predetermined overhead application rate is that:

(Multiple Choice)

4.8/5  (41)

(41)

Metalworks employs 3 assembly workers that,on average,each work 40 hours per week and earn $9 per hour.During the current accounting period,Job #543 consumed 77 hours of direct labor totaling $693.

77 direct labor hours × $9 = $693.

(True/False)

4.8/5  (32)

(32)

Management uses a cost accounting system to evaluate and reward employee performance.

(True/False)

4.8/5  (36)

(36)

What are the setup costs allocated to Strollers during the current month?

(Multiple Choice)

4.7/5  (29)

(29)

Showing 81 - 94 of 94

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)