Exam 9: The Basic Tools of Finance

Exam 1: Ten Principles of Economics347 Questions

Exam 2: Thinking Like an Economist528 Questions

Exam 3: Interdependence and the Gains From Trade413 Questions

Exam 4: The Market Forces of Supply and Demand568 Questions

Exam 5: Measuring a Nations Income428 Questions

Exam 6: Measuring the Cost of Living420 Questions

Exam 7: Production and Growth417 Questions

Exam 8: Saving, Investment, and the Financial System473 Questions

Exam 9: The Basic Tools of Finance419 Questions

Exam 10: Unemployment562 Questions

Exam 11: The Monetary System421 Questions

Exam 12: Money Growth and Inflation384 Questions

Exam 13: Open-Economy Macroeconomic Models447 Questions

Exam 14: A Macroeconomic Theory of the Open Economy375 Questions

Exam 15: Aggregate Demand and Aggregate Supply466 Questions

Exam 16: The Influence of Monetary and Fiscal Policy on Aggregate Demand416 Questions

Exam 17: The Short-Run Trade-Off Between Inflation and Unemployment367 Questions

Exam 18: Six Debates Over Macroeconomic Policy235 Questions

Select questions type

At which interest rate is the present value of $95.40 one year from today equal to $90 today?

Free

(Multiple Choice)

4.9/5  (30)

(30)

Correct Answer:

C

As the interest rate increases, what happens to the present value of a future payment? Explain why changes in the interest rate will lead to changes in the quantity of loanable funds demanded and investment spending.

Free

(Essay)

4.8/5  (37)

(37)

Correct Answer:

An increase in the interest rate reduces the present value of future payments. Investment spending is the purchasing of capital goods that are expected to raise future revenues. When interest rates rise, the present value of these future revenues decline so that fewer capital expenditures are likely to generate enough revenue to justify their price. Consequently firms will want to buy fewer capital goods and will demand a lower quantity of loanable funds.

According to the efficient markets hypothesis, worse-than-expected news about a corporation will

Free

(Multiple Choice)

4.8/5  (31)

(31)

Correct Answer:

C

Halvorson Construction has an investment project that would cost $150,000 today and yield a one-time payoff of $167,000 in three years. What is the highest interest rate at which Halvorson would find this project profitable?

(Multiple Choice)

4.9/5  (35)

(35)

Marcia has four savings accounts. Which account has the largest balance?

(Multiple Choice)

4.9/5  (35)

(35)

Of the following interest rates, which is the highest one at which you would prefer to have $170 ten years from today instead of $100 today?

(Multiple Choice)

4.8/5  (39)

(39)

Yoyo's Frozen Yogurt, Inc. is thinking of building a new warehouse. They believe that this will give them $50,000 of additional revenue at the end of one year, $60,000 additional revenue at the end of two years, and $70,000 in additional revenue at the end of three years. If the interest rate is 5 percent, Yoyo would be willing to pay

(Multiple Choice)

4.8/5  (31)

(31)

Phillip is a mortgage broker, who is paid by commission. When interest rates decline, he does a lot of business and earns a lot of money, as more people buy houses or refinance their mortgages. But when interest rates rise, business falls substantially. To diversify, Phillip should choose investments that

(Multiple Choice)

4.7/5  (40)

(40)

You could borrow $1,000 today from Bank A and repay the loan, with interest, by paying Bank A $1,060 one year from today. Or, you could borrow $1,500 today from Bank B and repay the loan, with interest, by paying Bank B $1,600 one year from today. Which of the following statements is correct?

(Multiple Choice)

4.7/5  (35)

(35)

Suppose that Thom experiences a greater loss in utility if he loses $50 than he would gain in utility if he wins $50. This implies that Thom's

(Multiple Choice)

4.9/5  (39)

(39)

Increasing the number of corporations whose stocks are in your portfolio reduces market risk.

(True/False)

4.9/5  (32)

(32)

Managed mutual funds usually outperform mutual funds that are supposed to follow some stock index.

(True/False)

4.8/5  (36)

(36)

The possibility of speculative bubbles in the stock market arises in part because

(Multiple Choice)

4.8/5  (31)

(31)

What is the present value of a payment of $100 one year from today if the interest rate is 5 percent?

(Multiple Choice)

4.7/5  (42)

(42)

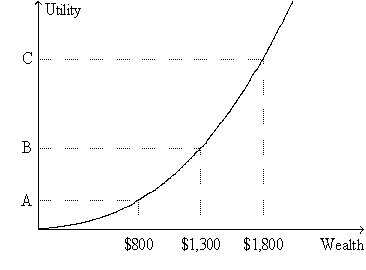

Figure 9-4. The figure shows a utility function for Dexter.

-Refer to Figure 9-4. In what way(s) does the graph differ from the usual case?

-Refer to Figure 9-4. In what way(s) does the graph differ from the usual case?

(Multiple Choice)

4.9/5  (26)

(26)

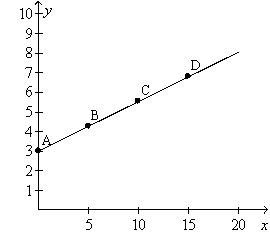

Figure 9-5. On the graph, x represents risk and y represents return.

-Refer to Figure 9-5. Point A represents a situation in which

-Refer to Figure 9-5. Point A represents a situation in which

(Multiple Choice)

4.9/5  (38)

(38)

Four years ago Ollie deposited some money into an account. He earned 5 percent interest on this account and now it has a balance of $303.88. About how much money did Ollie deposit into his account when he opened it?

(Multiple Choice)

4.7/5  (31)

(31)

If you are convinced that stock prices are impossible to predict from available information, then you probably also believe that

(Multiple Choice)

4.9/5  (26)

(26)

Showing 1 - 20 of 419

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)