Exam 11: The Monetary System

Exam 1: Ten Principles of Economics347 Questions

Exam 2: Thinking Like an Economist528 Questions

Exam 3: Interdependence and the Gains From Trade413 Questions

Exam 4: The Market Forces of Supply and Demand568 Questions

Exam 5: Measuring a Nations Income428 Questions

Exam 6: Measuring the Cost of Living420 Questions

Exam 7: Production and Growth417 Questions

Exam 8: Saving, Investment, and the Financial System473 Questions

Exam 9: The Basic Tools of Finance419 Questions

Exam 10: Unemployment562 Questions

Exam 11: The Monetary System421 Questions

Exam 12: Money Growth and Inflation384 Questions

Exam 13: Open-Economy Macroeconomic Models447 Questions

Exam 14: A Macroeconomic Theory of the Open Economy375 Questions

Exam 15: Aggregate Demand and Aggregate Supply466 Questions

Exam 16: The Influence of Monetary and Fiscal Policy on Aggregate Demand416 Questions

Exam 17: The Short-Run Trade-Off Between Inflation and Unemployment367 Questions

Exam 18: Six Debates Over Macroeconomic Policy235 Questions

Select questions type

A bank has a 10 percent reserve requirement, $5,000 in deposits, and has loaned out all it can given the reserve requirement.

Free

(Multiple Choice)

4.9/5  (29)

(29)

Correct Answer:

B

If the reserve ratio is 9 percent, then a decrease in reserves of $6,000 can cause the money supply to fall by as much as

Free

(Multiple Choice)

4.8/5  (40)

(40)

Correct Answer:

B

Which list ranks assets from most to least liquid?

Free

(Multiple Choice)

4.8/5  (42)

(42)

Correct Answer:

A

The discount rate is the rate the Federal Reserve charges banks for loans. By lowering this rate, the Fed provides banks with a greater incentive to borrow from it.

(True/False)

5.0/5  (28)

(28)

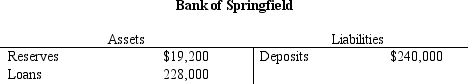

Table 11-6.

-Refer to Table 11-6. Assume the Fed's reserve requirement is 6 percent and that the Bank of Springfield makes new loans so as to make its new reserve ratio 6 percent. From then on, no bank holds any excess reserves. Assume also that people hold only deposits and no currency. Then by what amount does the economy's money supply increase?

-Refer to Table 11-6. Assume the Fed's reserve requirement is 6 percent and that the Bank of Springfield makes new loans so as to make its new reserve ratio 6 percent. From then on, no bank holds any excess reserves. Assume also that people hold only deposits and no currency. Then by what amount does the economy's money supply increase?

(Multiple Choice)

4.9/5  (38)

(38)

When prisoners use cigarettes or some other good as money, cigarettes become

(Multiple Choice)

4.9/5  (40)

(40)

The Fed purchases $200 worth of government bonds from the public. The reserve requirement is 8 percent, people hold no currency, and the banking system keeps no excess reserves. The U.S. money supply eventually increases by

(Multiple Choice)

4.8/5  (31)

(31)

What is meant by the term "lender of last resort?" In what circumstances might the Fed be a lender of last resort?

(Essay)

4.8/5  (32)

(32)

Explain why banks can influence the money supply if the required reserve ratio is less than 100 percent.

(Essay)

4.9/5  (44)

(44)

Scenario 11-1.

The monetary policy of Namdian is determined by the Namdian Central Bank. The local currency is the dia. Namdian banks collectively hold 100 million dias of required reserves, 25 million dias of excess reserves, 250 million dias of Namdian Treasury Bonds, and their customers hold 1,000 million dias of deposits. Namdians prefer to use only demand deposits and so the money supply consists of demand deposits.

-Refer to Scenario 11-1. Assume that banks desire to continue holding the same ratio of excess reserves to deposits. What is the reserve requirement and what is the reserve ratio?

(Multiple Choice)

4.9/5  (33)

(33)

In 1991, the Federal Reserve lowered the reserve requirement from 12 percent to 10 percent. Other things the same this should have

(Multiple Choice)

4.9/5  (30)

(30)

In the United States, currency holdings per person average about

(Multiple Choice)

4.9/5  (32)

(32)

If the federal funds rate were above the level the Federal Reserve had targeted, the Fed could move the rate back towards its target by

(Multiple Choice)

4.7/5  (35)

(35)

If the reserve ratio is 12.5 percent, then $5,600 of money can be generated by

(Multiple Choice)

4.8/5  (39)

(39)

Scenario 11-1.

The monetary policy of Namdian is determined by the Namdian Central Bank. The local currency is the dia. Namdian banks collectively hold 100 million dias of required reserves, 25 million dias of excess reserves, 250 million dias of Namdian Treasury Bonds, and their customers hold 1,000 million dias of deposits. Namdians prefer to use only demand deposits and so the money supply consists of demand deposits.

-Refer to Scenario 11-1 . Suppose the Central Bank of Namdia purchases 25 million dias of Namdian Treasury Bonds from banks. Suppose also that both the reserve requirement and the percentage of deposits held as excess reserves stay the same. By how much would the money supply of Namdia change?

(Multiple Choice)

4.8/5  (40)

(40)

A bank's reserve ratio is 10 percent and the bank has $2,000 in deposits. Its reserves amount to

(Multiple Choice)

4.7/5  (39)

(39)

Showing 1 - 20 of 421

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)