Exam 20: Forming and Operating Partnerships

Exam 1: An Introduction to Tax110 Questions

Exam 2: Tax Compliance, the Irs, and Tax Authorities111 Questions

Exam 3: Tax Planning Strategies and Related Limitations115 Questions

Exam 4: Individual Income Tax Overview, Exemptions, and Filing Status126 Questions

Exam 5: Gross Income and Exclusions131 Questions

Exam 6: Individual Deductions114 Questions

Exam 7: Investments76 Questions

Exam 8: Individual Income Tax Computation and Tax Credits157 Questions

Exam 9: Business Income, Deductions, and Accounting Methods99 Questions

Exam 10: Property Acquisition and Cost Recovery107 Questions

Exam 11: Property Dispositions110 Questions

Exam 12: Compensation102 Questions

Exam 13: Retirement Savings and Deferred Compensation115 Questions

Exam 14: Tax Consequences of Home Ownership112 Questions

Exam 15: Entities Overview70 Questions

Exam 16: Corporate Operations138 Questions

Exam 17: Accounting for Income Taxes100 Questions

Exam 18: Corporate Taxation: Nonliquidating Distributions100 Questions

Exam 19: Corporate Formation, Reorganization, and Liquidation100 Questions

Exam 20: Forming and Operating Partnerships100 Questions

Exam 21: Dispositions of Partnership Interests and Partnership Distributions100 Questions

Exam 22: S Corporations134 Questions

Exam 23: State and Local Taxes117 Questions

Exam 24: The Us Taxation of Multinational Transactions100 Questions

Exam 25: Transfer Taxes and Wealth Planning123 Questions

Select questions type

This year, Reggie's distributive share from Almonte Partnership includes $8,000 of interest income, $4,000 of dividend income, and $60,000 ordinary business income.

A.Assume that Reggie materially participates in the partnership.How much of his distributive share from Almonte Partnership is potentially subject to the Medicare contribution tax?

B.Assume that Reggie does not materially participate in the partnership.How much of his distributive share from Almonte Partnership is potentially subject to the Medicare contribution tax?

(Essay)

4.9/5  (43)

(43)

What is the correct order for applying the following three items to adjust a partner's tax basis in his partnership interest: (1) Increase for share of ordinary business income, (2) Decrease for share of separately stated loss items, and (3) Decrease for distributions?

(Multiple Choice)

4.7/5  (36)

(36)

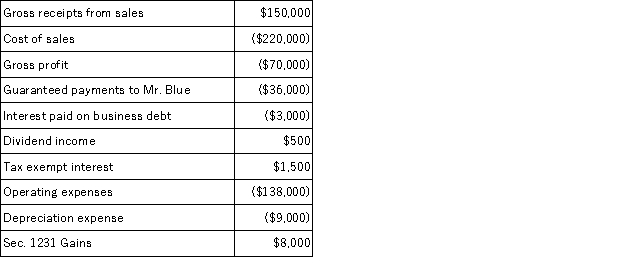

On January 1, 20X9, Mr. Blue and Mr. Grey each contributed $100,000 to form the B&G general partnership. Their partnership agreement states that they will each receive a 50% profits and loss interest. The partnership agreement also provides that Mr. Blue will receive an annual $36,000 guaranteed payment. B&G began business on January 1, 20X9. For its first taxable year, its accounting records contained the following information.  The $3,000 of interest was paid on a $60,000 loan made to B&G by Key Bank on June 30, 20X9. B&G repaid $10,000 of the loan on December 15, 20X9. Neither of the partners received a cash distribution from B&G in 20X9.

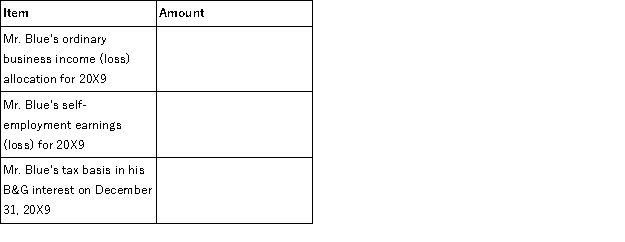

Complete the following table related to Mr. Blue's interest in B&G partnership:

The $3,000 of interest was paid on a $60,000 loan made to B&G by Key Bank on June 30, 20X9. B&G repaid $10,000 of the loan on December 15, 20X9. Neither of the partners received a cash distribution from B&G in 20X9.

Complete the following table related to Mr. Blue's interest in B&G partnership:

(Essay)

4.8/5  (40)

(40)

For partnership tax years ending after December 31, 2015, partnerships can request up to a six-month extension by filing IRS Form 7004 prior to the original due date of the partnership return.

(True/False)

4.8/5  (41)

(41)

Tom is talking to his friend Bob, who has an interest in Freedom, LLC, about purchasing his LLC interest. Bob's outside basis in Freedom, LLC is $10,000. This includes his $2,500 one-fourth share of the LLC's debt. Bob's 704(b) capital account is $17,000. If Tom bought Bob's LLC interest for $17,000, what would Tom's outside basis be in Freedom, LLC?

(Multiple Choice)

4.9/5  (41)

(41)

Which of the following would not be classified as a separately-stated item?

(Multiple Choice)

4.8/5  (46)

(46)

This year, HPLC, LLC was formed by H Inc., P Inc., L Inc., and C Inc. Each member had an equal share in the LLC's capital. H Inc., P Inc., and L Inc. each had a 30% profits interest in the LLC with C Inc. having a 10% profits interest. The members had the following tax year-ends: H Inc. [1/31], P Inc. [5/31], L Inc. [7/31], and C Inc. [10/31]. What tax year-end must the LLC use?

(Multiple Choice)

4.9/5  (33)

(33)

Which of the following statements regarding the rationale for adjusting a partner's basis is false?

(Multiple Choice)

5.0/5  (34)

(34)

Which of the following entities is not considered a flow-through entity?

(Multiple Choice)

4.9/5  (40)

(40)

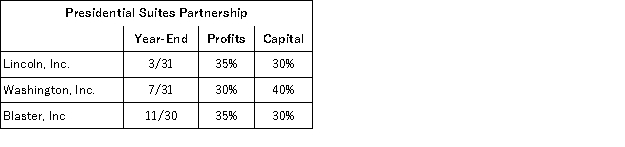

Lincoln, Inc., Washington, Inc., and Adams, Inc. form Presidential Suites Partnership on February 15, 20X9. Now, Presidential Suites must adopt its required tax year-end. The partners' year-ends, profits interests, and capital interests are reflected in the table below. Given this information, what tax year-end must Presidential Suites use and what rule requires this year-end?

(Essay)

5.0/5  (30)

(30)

Which of the following statements regarding a partner's basis adjustments is true?

(Multiple Choice)

4.9/5  (38)

(38)

Under proposed regulations issued by the Treasury Department, in which of the following situations should an LLC member be treated as a general partner for self-employment tax purposes?

(Multiple Choice)

4.8/5  (33)

(33)

On 12/31/X4, Zoom, LLC reported a $60,000 loss on its books. The items included in the loss computation were $30,000 in sales revenue, $15,000 in qualified dividends, $22,000 in cost of goods sold, $50,000 charitable contribution, $20,000 in employee wages, and $13,000 of rent expense. How much ordinary business income (loss) will Zoom report on its X4 return?

(Multiple Choice)

4.8/5  (43)

(43)

Tim, a real estate investor, Ken, a dealer in securities, and Hardware, Inc., a retail lumber store form a partnership called HKT, LP. HKT is in the home building business. Tim recently purchased his interest in HKT while the other partners purchased their interest several years ago. During X3, HKT reports a $12,000 gain from the sale of a stock in a wholesale lumber company it purchased in X1 for investment purposes. Which of the following statements best represents how their portion of the gain should be reported to the partner?

(Multiple Choice)

4.9/5  (42)

(42)

Alfred, a one-third profits and capital partner in Pizzeria Partnership needs help in adjusting his tax basis to reflect the information contained in his most recent Schedule K-1 from the partnership. Unfortunately, the Schedule K-1 he recently received was for year 3 of the partnership, but Alfred only knows that his tax basis at the beginning of year 2 of the partnership was $23,000. Thankfully, Alfred still has his Schedule K-1 from the partnership for years 1 and 2.

Using the following information from Alfred's year 1, year 2, and year 3 Schedule K-1, calculate his tax basis the end of year 2 and year 3.

(Essay)

5.0/5  (39)

(39)

On January 1, X9, Gerald received his 50% profits and capital interest in High Air, LLC in exchange for $2,000 in cash and real property with a $3,000 tax basis secured by a $2,000 nonrecourse mortgage. High Air reported a $15,000 loss for its X9 calendar year. How much loss can Gerald deduct, and how much loss must he suspend if he only applies the tax basis loss limitation?

(Multiple Choice)

4.8/5  (28)

(28)

Which of the following items will affect a partner's tax basis?

(Multiple Choice)

4.8/5  (43)

(43)

In X1, Adam and Jason formed ABC, LLC, a car dealership in Kansas City. In X2, Adam and Jason realized they needed an advertising expert to assist in their business. Thus, the two members offered Cory, a marketing expert, a 1/3 capital interest in their partnership for contributing his expert services. Cory agreed to this arrangement and received his capital interest in X2. If the value of the LLC's capital equals $180,000 when Cory receives his 1/3 capital interest, which of the following tax consequences does not occur in X2?

(Multiple Choice)

4.8/5  (39)

(39)

If a taxpayer sells a passive activity with suspended passive activity losses from prior years, what type of income can be offset by the suspended passive losses in the year of sale?

(Multiple Choice)

4.8/5  (39)

(39)

A partnership with a C corporation partner must always use the accrual method as its accounting method.

(True/False)

4.9/5  (34)

(34)

Showing 21 - 40 of 100

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)