Exam 10: Property Acquisition and Cost Recovery

Exam 1: An Introduction to Tax110 Questions

Exam 2: Tax Compliance, the Irs, and Tax Authorities111 Questions

Exam 3: Tax Planning Strategies and Related Limitations115 Questions

Exam 4: Individual Income Tax Overview, Exemptions, and Filing Status126 Questions

Exam 5: Gross Income and Exclusions131 Questions

Exam 6: Individual Deductions114 Questions

Exam 7: Investments76 Questions

Exam 8: Individual Income Tax Computation and Tax Credits157 Questions

Exam 9: Business Income, Deductions, and Accounting Methods99 Questions

Exam 10: Property Acquisition and Cost Recovery107 Questions

Exam 11: Property Dispositions110 Questions

Exam 12: Compensation102 Questions

Exam 13: Retirement Savings and Deferred Compensation115 Questions

Exam 14: Tax Consequences of Home Ownership112 Questions

Exam 15: Entities Overview70 Questions

Exam 16: Corporate Operations138 Questions

Exam 17: Accounting for Income Taxes100 Questions

Exam 18: Corporate Taxation: Nonliquidating Distributions100 Questions

Exam 19: Corporate Formation, Reorganization, and Liquidation100 Questions

Exam 20: Forming and Operating Partnerships100 Questions

Exam 21: Dispositions of Partnership Interests and Partnership Distributions100 Questions

Exam 22: S Corporations134 Questions

Exam 23: State and Local Taxes117 Questions

Exam 24: The Us Taxation of Multinational Transactions100 Questions

Exam 25: Transfer Taxes and Wealth Planning123 Questions

Select questions type

An example of an asset that is both personal-use and personal property is:

(Multiple Choice)

4.9/5  (40)

(40)

Santa Fe purchased the rights to extract turquoise on a tract of land over a five-year period. Santa Fe paid $300,000 for extraction rights. A geologist estimates that Santa Fe will recover 5,000 pounds of turquoise. During the current year, Santa Fe extracted 1,500 pounds of turquoise, which it sold for $200,000. What is Santa Fe's cost depletion expense for the current year?

(Multiple Choice)

4.7/5  (34)

(34)

Jasmine started a new business in the current year. She incurred $10,000 of start-up costs. How much of the start-up costs can be immediately expensed (excluding amounts amortized over 180 months) for the year?

(Multiple Choice)

4.8/5  (41)

(41)

Simmons LLC purchased an office building and land several years ago for $250,000. The purchase price was allocated as follows: $200,000 to the building and $50,000 to the land. The property was placed in service on October 2. If the property is disposed of on February 27 during the 10th year, calculate Simmons' maximum depreciation in the 10th year:

(Multiple Choice)

4.9/5  (35)

(35)

Real property is always depreciated using the straight-line method.

(True/False)

4.9/5  (34)

(34)

Alexandra purchased a $35,000 automobile during 2016. The business use was 70 percent. What is the allowable depreciation for the current year? (ignore any possible bonus depreciation)

(Short Answer)

5.0/5  (32)

(32)

Which depreciation convention is the general rule for tangible personal property?

(Multiple Choice)

4.8/5  (39)

(39)

Lenter LLC placed in service on April 29, 2016 machinery and equipment (7-year property) with a basis of $600,000. Assume that Lenter has sufficient income to avoid any limitations. Calculate the maximum depreciation expense including section 179 expensing (but ignoring bonus expensing). Assume that the 2015 §179 limits are identical to 2016:

(Multiple Choice)

4.9/5  (36)

(36)

Billie Bob purchased a used computer (5-year property) for use in his sole proprietorship in the prior year. The basis of the computer was $2,400. Billie Bob used the computer in his business 60 percent of the time during the first year. During the second year, Billie Bob used the computer 40 percent for business use. Calculate Billie Bob's depreciation expense during the second year assuming the sole proprietorship had a loss during the year (Billie Bob did not place the asset in service in the last quarter):

(Multiple Choice)

4.8/5  (43)

(43)

Businesses may immediately expense research and experimentation expenditures or they may elect to capitalize these costs and amortize them using the straight-line method over a period of not less than 60 months.

(True/False)

5.0/5  (39)

(39)

During August of the prior year, Julio purchased an apartment building that he used as a rental property. The basis was $1,400,000. Calculate the maximum depreciation expense during the current year.

(Short Answer)

4.8/5  (41)

(41)

Amit purchased two assets during the current year. Amit placed in service computer equipment (5-year property) on April 16th with a basis of $5,000 and furniture (7-year property) on September 9th with a basis of $20,000. Calculate the maximum depreciation expense (ignoring §179 and bonus depreciation).

(Short Answer)

4.8/5  (42)

(42)

Jaussi purchased a computer several years ago for $2,200 and used it for personal purposes. On November 10th of the current year, when the fair market value of the computer was $800, Jaussi converted it to business use. What is Jaussi's tax basis for the computer?

(Short Answer)

4.8/5  (45)

(45)

Assume that Yuri acquires a competitor's assets on May 1st. The purchase price was $500,000. Of the amount, $325,000 is allocated to tangible assets and $175,000 is allocated to goodwill (a §197 intangible asset). What is Yuri's amortization expense for the current year, rounded to the nearest whole number?

(Short Answer)

4.8/5  (36)

(36)

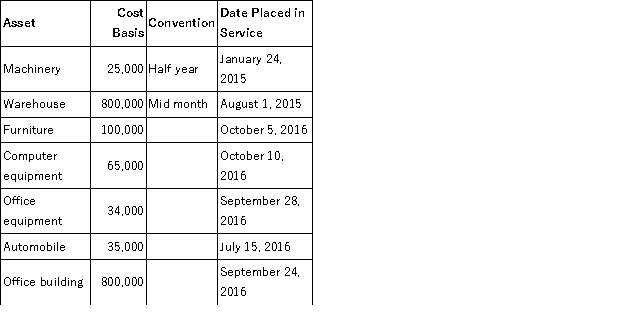

Boxer LLC has acquired various types of assets recently used 100% in its trade or business. Below is a list of assets acquired during 2015 and 2016:  Boxer did not elect §179 expense and elected out of bonus depreciation in 2015, but would like to elect §179 expense for 2016 (assume that taxable income is sufficient). Calculate Boxer's maximum depreciation expense for 2016, rounded to the nearest whole number (ignore bonus depreciation for 2016). If necessary, use the 2015 luxury automobile limitation amount for 2016 and assume that the 2015 §179 limits are identical to 2016.

Boxer did not elect §179 expense and elected out of bonus depreciation in 2015, but would like to elect §179 expense for 2016 (assume that taxable income is sufficient). Calculate Boxer's maximum depreciation expense for 2016, rounded to the nearest whole number (ignore bonus depreciation for 2016). If necessary, use the 2015 luxury automobile limitation amount for 2016 and assume that the 2015 §179 limits are identical to 2016.

(Short Answer)

4.9/5  (34)

(34)

Tax depreciation is currently calculated under what system?

(Multiple Choice)

4.9/5  (36)

(36)

Showing 21 - 40 of 107

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)