Exam 4: The Bookkeeping Process and Transaction Analysis

Exam 1: Accounting-Present and Past21 Questions

Exam 2: Financial Statements and Accounting Conceptsprinciples52 Questions

Exam 3: Fundamental Interpretations Made From Financial Statement Data24 Questions

Exam 4: The Bookkeeping Process and Transaction Analysis33 Questions

Exam 5: Accounting for and Presentation of Current Assets 54 Questions

Exam 6: Accounting for and Presentation of Property, Plant, and Equipment, and Other Noncurrent Assets39 Questions

Exam 7: Accounting for and Presentation of Liabilities51 Questions

Exam 8: Accounting for and Presentation of Stockholders Equity41 Questions

Exam 9: The Income Statement and the Statement of Cash Flows32 Questions

Exam 10: Corporate Governance, Notes to the Financial Statements, and Other Disclosures25 Questions

Exam 11: Financial Statement Analysis29 Questions

Exam 12: Managerial Accounting and Cost-Volume-Profit Relationships73 Questions

Exam 13: Cost Accounting and Reporting62 Questions

Exam 14: Cost Planning66 Questions

Exam 15: Cost Control59 Questions

Exam 16: Costs for Decision Making77 Questions

Select questions type

The Interest Receivable account for February showed transactions totaling $17,000 and an adjustment of $22,400.

(Multiple Choice)

4.8/5  (30)

(30)

To accrue $3,200 of employee salaries for the last week of February, the employer's journal entry is:

(Multiple Choice)

4.8/5  (34)

(34)

An engineering consultant provided $300 of services to a client; the client paid $50 when the bill was submitted and will pay the balance within a week. The consultant will record this transaction by:

(Multiple Choice)

4.7/5  (33)

(33)

A newspaper ad submitted and published this week, with the agreement to get paid for it next week would, in the newspaper's records:

(Multiple Choice)

4.9/5  (41)

(41)

The effect of an adjustment on the financial statements is usually to:

(Multiple Choice)

4.9/5  (38)

(38)

Martin & Associates borrowed $15,000 on April 1, 2016 at 8% interest with both principal and interest due on March 31, 2017.Which of the following journal entries should the firm use to record the payment of interest on March 31, 2017?

(Multiple Choice)

4.8/5  (33)

(33)

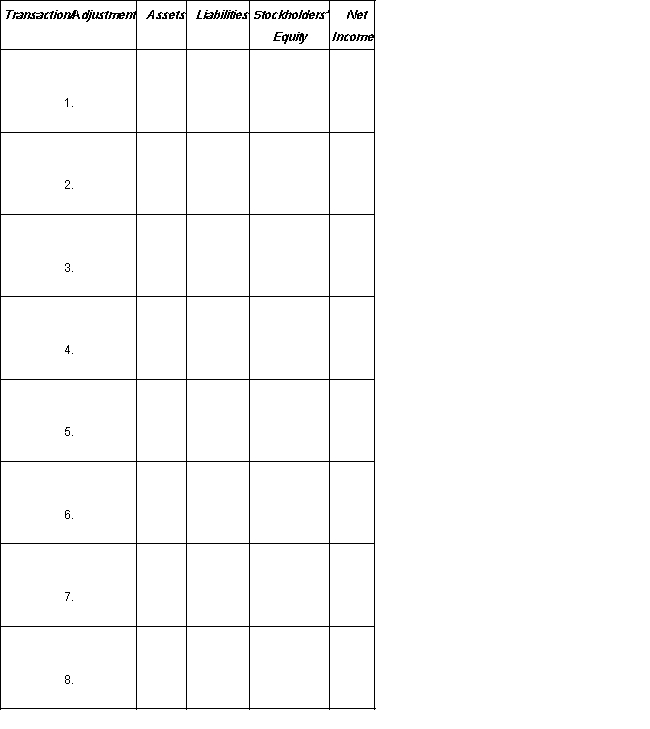

Using the column headings provided below, show the effect, if any, of the transaction entry or adjusting entry on the appropriate balance sheet category or on the income statement by entering the account name, amount, and indicating whether it is an addition (+) or subtraction (-). Column headings reflect the expanded balance sheet equation; items that affect net income should not be shown as affecting stockholders' equity.(1.) During the month, the board of directors declared a cash dividend of $2,400, payable next month.(2.) Employees were paid $3,800 in wages for their work during the first three weeks of the month.(3.) Employee wages of $1,200 for the last week of the month have not been recorded.(4.) Merchandise that cost $1,800 was sold for $2,700. Of this amount, $2,000 was received in cash and the balance is expected to be received within 30 days.(5.) A contract was signed with a local radio station for a $200 advertisement; the ad was aired during this month but will not be paid for until next month.(6.) Store equipment was purchased at a cash price of $600. The original list price of the equipment was $800, but a discount was received.(7.) Received $360 of interest income for the current month.(8.) Accrued $620 of interest expense at the end of the month.

(Essay)

4.8/5  (35)

(35)

Martin & Associates borrowed $15,000 on April 1, 2016 at 8% interest with both principal and interest due on March 31, 2017.How much should be in the firm's interest payable account at December 31, 2016?

(Multiple Choice)

4.9/5  (31)

(31)

Wisdom Co. has a note payable to its bank. An adjustment is likely to be required on Wisdom's books at the end of every month that the loan is outstanding to record the:

(Multiple Choice)

4.9/5  (42)

(42)

Showing 21 - 33 of 33

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)