Exam 3: Adjusting Accounts and Preparing Financial Statements

Exam 1: Accounting in Business240 Questions

Exam 2: Analyzing and Recording Transactions197 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements224 Questions

Exam 4: Completing the Accounting Cycle176 Questions

Exam 5: Accounting for Merchandising Operations198 Questions

Exam 6: Inventories and Cost of Sales198 Questions

Exam 7: Accounting Information Systems176 Questions

Exam 8: Cash and Internal Controls196 Questions

Exam 9: Accounting for Receivables191 Questions

Exam 10: Plant Assets, Natural Resources, and Intangibles223 Questions

Exam 11: Current Liabilities and Payroll Accounting193 Questions

Exam 12: Accounting for Partnerships139 Questions

Exam 13: Accounting for Corporations246 Questions

Exam 14: Long-Term Liabilities198 Questions

Exam 15: Investments and International Operations192 Questions

Exam 16: Reporting the Statement of Cash Flows187 Questions

Exam 17: Analysis of Financial Statements187 Questions

Exam 18: Managerial Accounting Concepts and Principles197 Questions

Exam 19: Job Order Cost Accounting164 Questions

Exam 20: Process Cost Accounting174 Questions

Exam 21: Cost Allocation and Performance Measurement170 Questions

Exam 22: Cost-Volume-Profit Analysis186 Questions

Exam 23: Master Budgets and Planning162 Questions

Exam 24: Flexible Budgets and Standard Costs174 Questions

Exam 25: Capital Budgeting and Managerial Decisions150 Questions

Exam 26: Time Value of Money60 Questions

Select questions type

A company performs 20 days work on a 30-day contract before the end of the year. The total contract is valued at $6,000 and payment is not due until the contract is fully completed. The adjusting entry includes a $4,000 credit to unearned revenue.

(True/False)

4.8/5  (35)

(35)

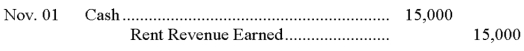

Manning, Co. collected 6-months' rent in advance from a tenant on November 1 of the current year. When it collected the cash, it recorded the following entry:  Prepare the required adjusting entry at December 31 of the current year.

Prepare the required adjusting entry at December 31 of the current year.

(Not Answered)

This question doesn't have any answer yet

If throughout an accounting period the fees for legal services paid in advance by clients are recorded in an account called Unearned Legal Fees, the end-of-period adjusting entry to record the portion of those fees that has been earned is:

(Multiple Choice)

4.8/5  (31)

(31)

Since the revenue recognition principle requires that revenues be recorded when earned, there are no unearned revenues in accrual accounting.

(True/False)

4.9/5  (36)

(36)

Adjusting entries made at the end of an accounting period accomplish all of the following except:

(Multiple Choice)

4.9/5  (29)

(29)

Which of the following does not require an adjusting entry at year-end?

(Multiple Choice)

4.8/5  (39)

(39)

Revenue and expense balances are transferred from the adjusted trial balance to the income statement.

(True/False)

4.8/5  (28)

(28)

A company made no adjusting entry for accrued and unpaid employee salaries of $9,000 on December 31. Which of the following statements is true?

(Multiple Choice)

4.9/5  (31)

(31)

Explain how the owner of Cheezburger Network uses the accrual basis of accounting.

(Essay)

4.7/5  (30)

(30)

Before an adjusting entry is made to recognize the cost of expired insurance for the period, Prepaid Insurance and Insurance Expense are both overstated.

(True/False)

4.8/5  (39)

(39)

The adjusted trial balance contains information pertaining to:

(Multiple Choice)

4.8/5  (43)

(43)

Prepare general journal entries on December 31 to record the following unrelated year-end adjustments.

a. Estimated depreciation on office equipment for the year, $4,000.

b. The Prepaid Insurance account has a $3,680 debit balance before adjustment. An examination of insurance policies shows $950 of insurance expired.

c. The Prepaid Insurance account has a $2,400 debit balance before adjustment. An examination of insurance policies shows $600 of unexpired insurance.

d. The company has three office employees who each earn $100 per day for a five-day workweek that ends on Friday. The employees were paid on Friday, December 26, and have worked full days on Monday, Tuesday, and Wednesday, December 29, 30, and 31.

e. On November 1, the company received 6 months' rent in advance from a tenant whose rent is $700 per month. The $4,200 was credited to the Unearned Rent account.

f. The company collects rent monthly from its tenants. One tenant whose rent is $750 per month has not paid his rent for December.

(Not Answered)

This question doesn't have any answer yet

The ________________________________ depreciation method allocates equal amounts of an asset's cost to depreciation during its useful life.

(Short Answer)

4.9/5  (43)

(43)

A company issued financial statements for the year ended December 31, but failed to include the following adjusting entries:

A. Accrued service fees earned of $2,200.

B. Depreciation expense of $8,000.

C. Portion of office supplies (an asset) used $3,100.

D. Accrued salaries of $5,200.

E. Revenues of $7,200, originally recorded as unearned, have been earned by the end of the year.

(Not Answered)

This question doesn't have any answer yet

Prepaid expenses, depreciation, accrued expenses, unearned revenues, and accrued revenues are all examples of:

(Multiple Choice)

4.9/5  (36)

(36)

A company purchased $6,000 worth of supplies in August and recorded the purchase in the Supplies account. On August 31, the fiscal year-end, the supplies count equaled $3,200. The adjusting entry would include a $2,800 debit to Supplies.

(True/False)

4.9/5  (39)

(39)

Discuss the importance of periodic reporting and the time period assumption.

(Essay)

4.9/5  (32)

(32)

Profit margin reflects the percent of profit in each dollar of revenue.

(True/False)

4.7/5  (41)

(41)

The cash basis of accounting commonly results in financial statements that are less comparable from period to period than the accrual basis of accounting.

(True/False)

5.0/5  (39)

(39)

Showing 41 - 60 of 224

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)