Exam 11: Variable Costing and Segment Reporting: Tools for Management

Exam 1: Managerial Accounting and Cost Concepts190 Questions

Exam 2: Least-Squares Regression Computations21 Questions

Exam 3: Cost of Quality42 Questions

Exam 4: Job-Order Costing166 Questions

Exam 5: Activity-Based Absorption Costing17 Questions

Exam 6: The Predetermined Overhead Rate and Capacity28 Questions

Exam 7: Process Costing126 Questions

Exam 8: Fifo Method82 Questions

Exam 9: Service Department Allocations56 Questions

Exam 10: Cost-Volume-Profit Relationships187 Questions

Exam 11: Variable Costing and Segment Reporting: Tools for Management236 Questions

Exam 12: Super-Variable Costing49 Questions

Exam 13: Activity-Based Costing: a Tool to Aid Decision Making150 Questions

Exam 14: Abc Action Analysis16 Questions

Select questions type

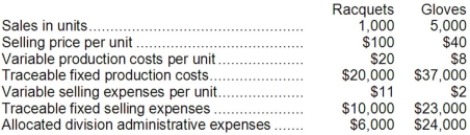

The Los Angeles Division of Awercamp Manufacturing produces and markets two product lines: Racquets and Gloves. The following data were gathered on activities last month:  Required:

Prepare a segmented income statement for last month.

Required:

Prepare a segmented income statement for last month.

(Essay)

4.8/5  (33)

(33)

Under variable costing, product costs consist of direct materials, direct labor, and variable manufacturing overhead.

(True/False)

4.9/5  (35)

(35)

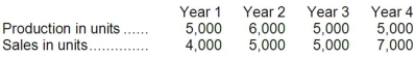

Routit Corporation had the following sales and production for the past four years:  Selling price per unit, variable cost per unit, and total fixed cost are the same each year. There were no beginning inventories in Year 1. Which of the following statements is correct?

Selling price per unit, variable cost per unit, and total fixed cost are the same each year. There were no beginning inventories in Year 1. Which of the following statements is correct?

(Multiple Choice)

4.8/5  (34)

(34)

When variable costing is used, and if selling prices exceed variable expenses and if the unit contribution margins, the sales mix, and fixed costs remain the same, profits move in the same direction as sales.

(True/False)

4.8/5  (32)

(32)

Under absorption costing, the ending inventory for the year would be valued at:

(Multiple Choice)

4.8/5  (35)

(35)

The Retail Division's break-even sales in dollars is closest to:

(Multiple Choice)

4.9/5  (39)

(39)

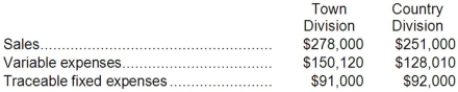

Roskos Corporation has two divisions: Town Division and Country Division. The following report is for the most recent operating period:  The company's common fixed expenses total $52,900.

Required:

a. What is the Town Division's break-even in sales dollars?

b. What is the Country Division's break-even in sales dollars?

c. What is the company's overall break-even in sales dollars?

The company's common fixed expenses total $52,900.

Required:

a. What is the Town Division's break-even in sales dollars?

b. What is the Country Division's break-even in sales dollars?

c. What is the company's overall break-even in sales dollars?

(Essay)

4.8/5  (31)

(31)

The total gross margin for the month under the absorption costing approach is:

(Multiple Choice)

4.8/5  (36)

(36)

George Corporation has no beginning inventory and manufactures a single product. If the number of units produced exceeds the number of units sold, then net operating income under the absorption method for the year will:

(Multiple Choice)

4.8/5  (35)

(35)

Under variable costing, fixed manufacturing overhead cost is not treated as a product cost.

(True/False)

4.8/5  (40)

(40)

What is the unit product cost for the month under absorption costing?

(Multiple Choice)

4.9/5  (34)

(34)

If Store B sales increase by $20,000 with no change in fixed expenses, the overall company net operating income should:

(Multiple Choice)

4.9/5  (35)

(35)

What is the net operating income for the month under absorption costing?

(Multiple Choice)

4.9/5  (32)

(32)

The total gross margin for the month under the absorption costing approach is:

(Multiple Choice)

4.9/5  (39)

(39)

If a company operates at the break even point for each of its segments, it will lose money overall if common fixed expenses exist.

(True/False)

4.7/5  (36)

(36)

A national retail company has segmented its income statement by sales territories. If each sales territory statement is further segmented by individual stores, which of the following will most likely occur?

(Multiple Choice)

4.8/5  (39)

(39)

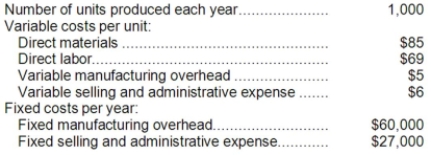

Ragins Corporation produces a single product and has the following cost structure:  The absorption costing unit product cost is:

The absorption costing unit product cost is:

(Multiple Choice)

4.8/5  (37)

(37)

What is the total period cost for the month under variable costing?

(Multiple Choice)

4.8/5  (36)

(36)

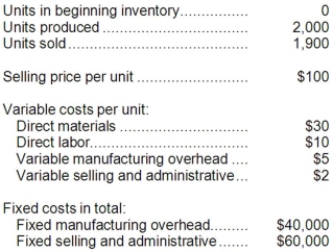

Italia Espresso Machina Inc. produces a single product. Data concerning the company's operations last year appear below:  Required:

a. Compute the unit product cost under both absorption and variable costing.

b. Prepare an income statement for the year using absorption costing.

c. Prepare a contribution format income statement for the year using variable costing.

d. Prepare a report reconciling the difference in net operating income between absorption and variable costing for the year.

Required:

a. Compute the unit product cost under both absorption and variable costing.

b. Prepare an income statement for the year using absorption costing.

c. Prepare a contribution format income statement for the year using variable costing.

d. Prepare a report reconciling the difference in net operating income between absorption and variable costing for the year.

(Essay)

4.7/5  (27)

(27)

Showing 41 - 60 of 236

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)