Exam 12: Income Taxes and the Net Present Value Method

Exam 1: Master Budgeting173 Questions

Exam 2: Flexible Budgets and Performance Analysis307 Questions

Exam 3: Standard Costs and Variances187 Questions

Exam 4: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System111 Questions

Exam 5: Journal Entries to Record Variances56 Questions

Exam 6: Performance Measurement in Decentralized Organizations115 Questions

Exam 7: Transfer Pricing28 Questions

Exam 8: Service Department Charges51 Questions

Exam 9: Differential Analysis: the Key to Decision Making185 Questions

Exam 10: Capital Budgeting Decisions169 Questions

Exam 11: The Concept of Present Value13 Questions

Exam 12: Income Taxes and the Net Present Value Method147 Questions

Exam 13: Statement of Cash Flows132 Questions

Exam 14: The Direct Method of Determining the Net Cash Provided by Operating Activities56 Questions

Exam 15: Financial Statement Analysis289 Questions

Select questions type

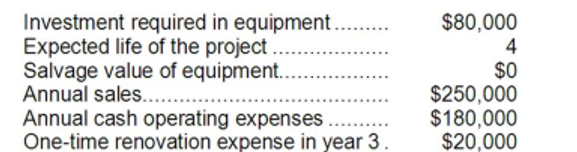

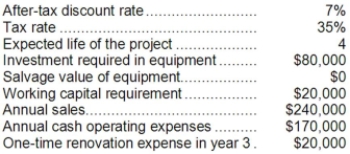

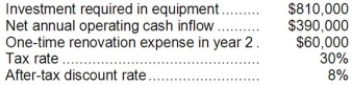

Credit Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 30% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

The company's income tax rate is 30% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

(Multiple Choice)

4.8/5  (35)

(35)

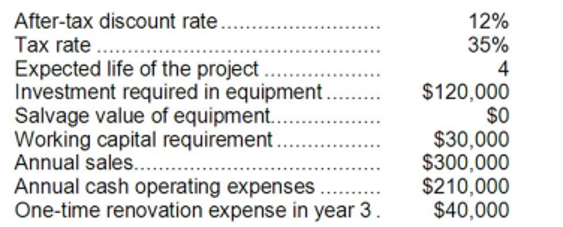

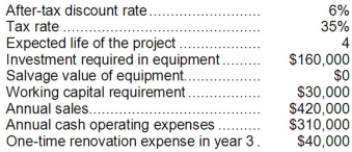

Amel Corporation has provided the following information concerning a capital budgeting project:

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 3 is:

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 3 is:

(Multiple Choice)

4.8/5  (38)

(38)

Battaglia Corporation is considering a capital budgeting project that would require investing $240,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $620,000 and annual incremental cash operating expenses would be $460,000. The project would also require a one-time renovation cost of $80,000 in year 3. The company's income tax rate is 30% and its after-tax discount rate is 7%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 2 is:

(Multiple Choice)

4.9/5  (41)

(41)

Stack Corporation is considering a capital budgeting project that would require investing $80,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $200,000 and annual incremental cash operating expenses would be $150,000. The project would also require a one-time renovation cost of $10,000 in year 3. The company's income tax rate is 35% and its after-tax discount rate is 7%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

(Multiple Choice)

4.8/5  (41)

(41)

Beecroft Corporation is considering a capital budgeting project that would require investing $120,000 in equipment with a 4 year useful life and zero salvage value. Annual incremental sales would be $390,000 and annual incremental cash operating expenses would be $300,000. A one-time expense of $40,000 for renovations would be required in year 3. An investment of $20,000 in working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The company's tax rate is 30% and the after-tax discount rate is 12%.

Required:

Determine the net present value of the project. Show your work!

(Essay)

4.9/5  (40)

(40)

Trammel Corporation is considering a capital budgeting project that would require investing $280,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $650,000 and annual incremental cash operating expenses would be $450,000. The project would also require a one-time renovation cost of $100,000 in year 3. The company's income tax rate is 30% and its after-tax discount rate is 7%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 3 is:

(Multiple Choice)

4.7/5  (39)

(39)

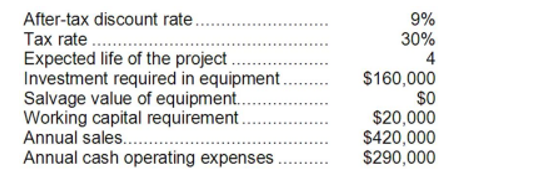

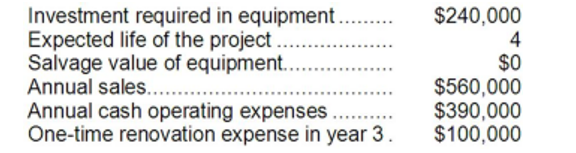

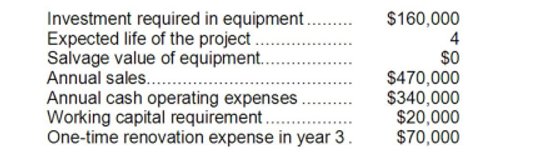

Boch Corporation has provided the following information concerning a capital budgeting project:

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

(Multiple Choice)

5.0/5  (36)

(36)

Mitton Corporation is considering a capital budgeting project that would require investing $160,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $440,000 and annual incremental cash operating expenses would be $320,000. The project would also require a one-time renovation cost of $0 in year 3. The company's income tax rate is 35% and its after-tax discount rate is 12%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 2 is:

(Multiple Choice)

4.8/5  (47)

(47)

Skolfield Corporation is considering a capital budgeting project that would require investing $280,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $590,000 and annual incremental cash operating expenses would be $470,000. The project would also require an immediate investment in working capital of $20,000 which would be released for use elsewhere at the end of the project. The project would also require a one-time renovation cost of $30,000 in year 3. The company's income tax rate is 30% and its after-tax discount rate is 15%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

(Multiple Choice)

5.0/5  (35)

(35)

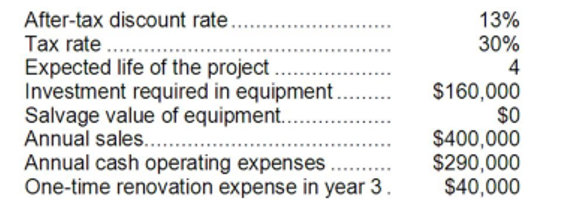

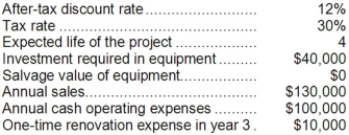

Prudencio Corporation has provided the following information concerning a capital budgeting project:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 3 is:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 3 is:

(Multiple Choice)

4.9/5  (42)

(42)

Pulkkinen Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. The total cash flow net of income taxes in year 2 is:

The company uses straight-line depreciation on all equipment. The total cash flow net of income taxes in year 2 is:

(Multiple Choice)

5.0/5  (38)

(38)

A company needs an increase in working capital of $20,000 in a project that will last 4 years. The company's tax rate is 30% and its after-tax discount rate is 10%. The present value of the release of the working capital at the end of the project is closest to:

(Multiple Choice)

4.9/5  (34)

(34)

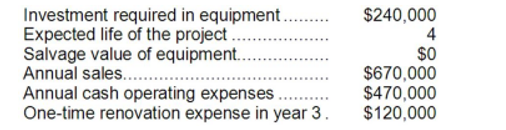

Brogden Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 30% and its after-tax discount rate is 10%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

The company's income tax rate is 30% and its after-tax discount rate is 10%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

(Multiple Choice)

4.7/5  (38)

(38)

Bourret Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

(Multiple Choice)

4.8/5  (43)

(43)

Foucault Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 35% and its after-tax discount rate is 12%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

The company's income tax rate is 35% and its after-tax discount rate is 12%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

(Multiple Choice)

4.8/5  (37)

(37)

Holzner Corporation has provided the following information concerning a capital budgeting project:  The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $270,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project. Show your work!

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $270,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project. Show your work!

(Essay)

4.8/5  (39)

(39)

Lucarell Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. The income tax expense in year 3 is:

The company uses straight-line depreciation on all equipment. The income tax expense in year 3 is:

(Multiple Choice)

4.7/5  (41)

(41)

Pont Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 30% and its after-tax discount rate is 10%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

The company's income tax rate is 30% and its after-tax discount rate is 10%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

(Multiple Choice)

4.8/5  (33)

(33)

Trammel Corporation is considering a capital budgeting project that would require investing $280,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $650,000 and annual incremental cash operating expenses would be $450,000. The project would also require a one-time renovation cost of $100,000 in year 3. The company's income tax rate is 30% and its after-tax discount rate is 7%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

(Multiple Choice)

4.9/5  (34)

(34)

Stack Corporation is considering a capital budgeting project that would require investing $80,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $200,000 and annual incremental cash operating expenses would be $150,000. The project would also require a one-time renovation cost of $10,000 in year 3. The company's income tax rate is 35% and its after-tax discount rate is 7%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 2 is:

(Multiple Choice)

5.0/5  (38)

(38)

Showing 101 - 120 of 147

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)