Exam 3: Standard Costs and Variances

Exam 1: Master Budgeting173 Questions

Exam 2: Flexible Budgets and Performance Analysis307 Questions

Exam 3: Standard Costs and Variances187 Questions

Exam 4: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System111 Questions

Exam 5: Journal Entries to Record Variances56 Questions

Exam 6: Performance Measurement in Decentralized Organizations115 Questions

Exam 7: Transfer Pricing28 Questions

Exam 8: Service Department Charges51 Questions

Exam 9: Differential Analysis: the Key to Decision Making185 Questions

Exam 10: Capital Budgeting Decisions169 Questions

Exam 11: The Concept of Present Value13 Questions

Exam 12: Income Taxes and the Net Present Value Method147 Questions

Exam 13: Statement of Cash Flows132 Questions

Exam 14: The Direct Method of Determining the Net Cash Provided by Operating Activities56 Questions

Exam 15: Financial Statement Analysis289 Questions

Select questions type

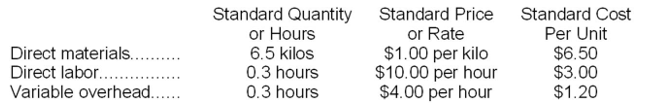

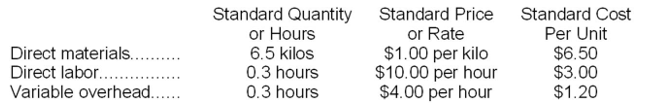

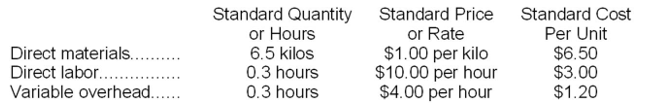

Eliezrie Corporation makes a product with the following standard costs:

In January the company's budgeted production was 7,400 units but the actual production was 7,500 units. The company used 45,580 kilos of the direct material and 2,030 direct labor-hours to produce this output. During the month, the company purchased 48,500 kilos of the direct material at a cost of $53,350. The actual direct labor cost was $18,473 and the actual variable overhead cost was $7,714.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

-The variable overhead rate variance for January is:

In January the company's budgeted production was 7,400 units but the actual production was 7,500 units. The company used 45,580 kilos of the direct material and 2,030 direct labor-hours to produce this output. During the month, the company purchased 48,500 kilos of the direct material at a cost of $53,350. The actual direct labor cost was $18,473 and the actual variable overhead cost was $7,714.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

-The variable overhead rate variance for January is:

(Multiple Choice)

4.9/5  (39)

(39)

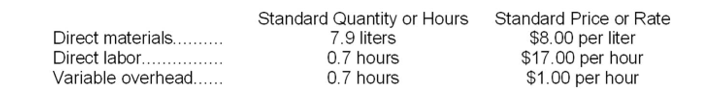

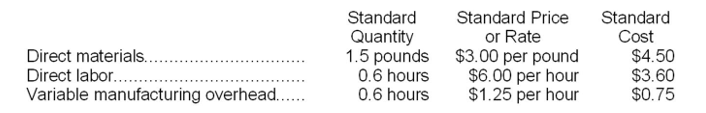

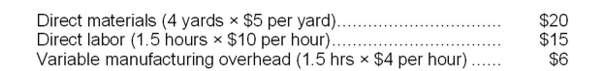

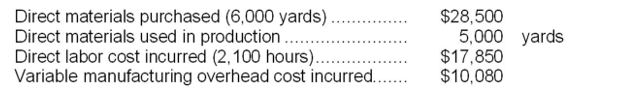

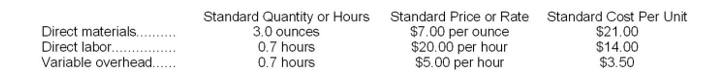

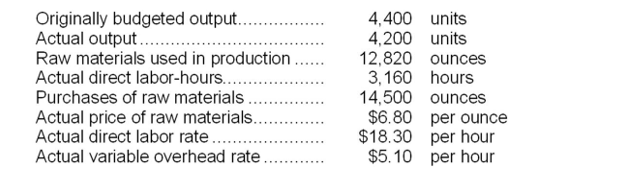

Ortman Corporation makes a product with the following standard costs:

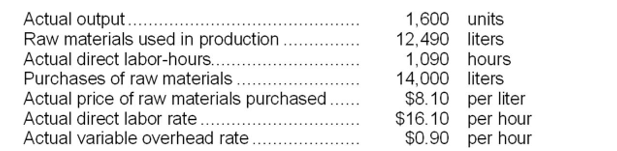

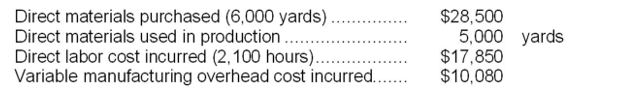

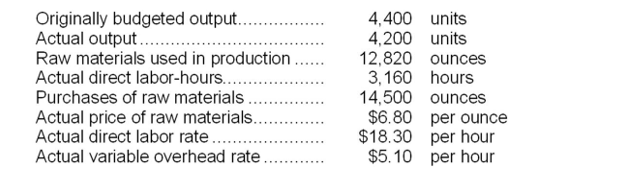

The company reported the following results concerning this product in May.

The company reported the following results concerning this product in May.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

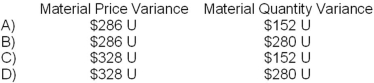

-The materials quantity variance for May is:

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

-The materials quantity variance for May is:

(Multiple Choice)

4.8/5  (33)

(33)

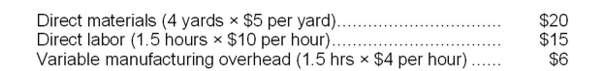

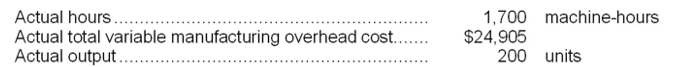

Beakins Corporation produces a single product. The standard cost card for the product follows:

During a recent period the company produced 1,200 units of product. Various costs associated with the production of these units are given below:

During a recent period the company produced 1,200 units of product. Various costs associated with the production of these units are given below:

The company records all variances at the earliest possible point in time. Variable manufacturing overhead costs are applied to products on the basis of standard direct labor-hours.

-The materials price variance for the period is:

The company records all variances at the earliest possible point in time. Variable manufacturing overhead costs are applied to products on the basis of standard direct labor-hours.

-The materials price variance for the period is:

(Multiple Choice)

4.8/5  (45)

(45)

The standard cost card for a product indicates that one unit of the product requires 8 kilograms of a raw material at $0.80 per kilogram. The production of the product in April was 870 units, but production had been budgeted for 850 units. During April, 8,200 kilograms of the raw material were purchased for $6,888 and 7,150 kilograms of the raw material were used in production. The material variances for April were:

(Multiple Choice)

4.8/5  (40)

(40)

Eliezrie Corporation makes a product with the following standard costs:

In January the company's budgeted production was 7,400 units but the actual production was 7,500 units. The company used 45,580 kilos of the direct material and 2,030 direct labor-hours to produce this output. During the month, the company purchased 48,500 kilos of the direct material at a cost of $53,350. The actual direct labor cost was $18,473 and the actual variable overhead cost was $7,714.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

-The variable overhead efficiency variance for January is:

In January the company's budgeted production was 7,400 units but the actual production was 7,500 units. The company used 45,580 kilos of the direct material and 2,030 direct labor-hours to produce this output. During the month, the company purchased 48,500 kilos of the direct material at a cost of $53,350. The actual direct labor cost was $18,473 and the actual variable overhead cost was $7,714.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

-The variable overhead efficiency variance for January is:

(Multiple Choice)

4.8/5  (33)

(33)

Blue Corporation's standards call for 2,500 direct labor-hours to produce 1,000 units of product. During May 900 units were produced and the company worked 2,400 direct labor-hours. The standard hours allowed for May production would be:

(Multiple Choice)

4.8/5  (31)

(31)

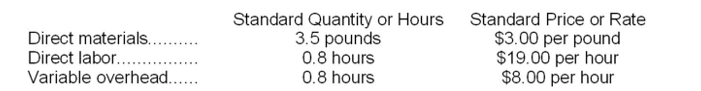

Pardoe, Inc., manufactures a single product in which variable manufacturing overhead is assigned on the basis of standard direct labor-hours. The company uses a standard cost system and has established the following standards for one unit of product:

During March, the following activity was recorded by the company:

• The company produced 3,000 units during the month.

• A total of 8,000 pounds of material were purchased at a cost of $23,000.

• There was no beginning inventory of materials on hand to start the month; at the end of the month, 2,000 pounds of material remained in the warehouse.

• During March, 1,600 direct labor-hours were worked at a rate of $6.50 per hour.

• Variable manufacturing overhead costs during March totaled $1,800.

The direct materials purchases variance is computed when the materials are purchased.

-The variable overhead rate variance for March is:

During March, the following activity was recorded by the company:

• The company produced 3,000 units during the month.

• A total of 8,000 pounds of material were purchased at a cost of $23,000.

• There was no beginning inventory of materials on hand to start the month; at the end of the month, 2,000 pounds of material remained in the warehouse.

• During March, 1,600 direct labor-hours were worked at a rate of $6.50 per hour.

• Variable manufacturing overhead costs during March totaled $1,800.

The direct materials purchases variance is computed when the materials are purchased.

-The variable overhead rate variance for March is:

(Multiple Choice)

4.8/5  (36)

(36)

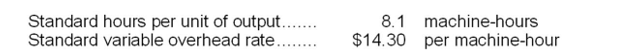

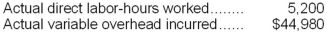

A manufacturing company that has only one product has established the following standards for its variable manufacturing overhead. Variable manufacturing overhead standards are based on machine-hours.

The following data pertain to operations for the last month:

The following data pertain to operations for the last month:

-What is the variable overhead efficiency variance for the month?

-What is the variable overhead efficiency variance for the month?

(Multiple Choice)

4.9/5  (35)

(35)

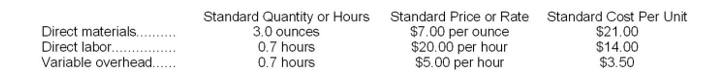

Beakins Corporation produces a single product. The standard cost card for the product follows:

During a recent period the company produced 1,200 units of product. Various costs associated with the production of these units are given below:

During a recent period the company produced 1,200 units of product. Various costs associated with the production of these units are given below:

The company records all variances at the earliest possible point in time. Variable manufacturing overhead costs are applied to products on the basis of standard direct labor-hours.

-The variable overhead rate variance for the period is:

The company records all variances at the earliest possible point in time. Variable manufacturing overhead costs are applied to products on the basis of standard direct labor-hours.

-The variable overhead rate variance for the period is:

(Multiple Choice)

4.9/5  (41)

(41)

The standard labor rate per hour defines the company's expected direct labor wage rate per hour, including employment taxes and fringe benefits.

(True/False)

4.8/5  (32)

(32)

The variable overhead efficiency variance measures how efficiently variable manufacturing overhead resources were used.

(True/False)

5.0/5  (45)

(45)

Eliezrie Corporation makes a product with the following standard costs:

In January the company's budgeted production was 7,400 units but the actual production was 7,500 units. The company used 45,580 kilos of the direct material and 2,030 direct labor-hours to produce this output. During the month, the company purchased 48,500 kilos of the direct material at a cost of $53,350. The actual direct labor cost was $18,473 and the actual variable overhead cost was $7,714.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

-The labor efficiency variance for January is:

In January the company's budgeted production was 7,400 units but the actual production was 7,500 units. The company used 45,580 kilos of the direct material and 2,030 direct labor-hours to produce this output. During the month, the company purchased 48,500 kilos of the direct material at a cost of $53,350. The actual direct labor cost was $18,473 and the actual variable overhead cost was $7,714.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

-The labor efficiency variance for January is:

(Multiple Choice)

4.8/5  (39)

(39)

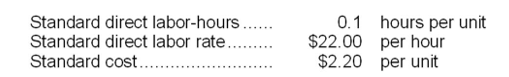

Tout Corporation makes a product that has the following direct labor standards:

The company budgeted for production of 6,400 units in October, but actual production was 6,500 units. The company used 610 direct labor-hours to produce this output. The actual direct labor rate was $21.80 per hour.

-The labor rate variance for October is:

The company budgeted for production of 6,400 units in October, but actual production was 6,500 units. The company used 610 direct labor-hours to produce this output. The actual direct labor rate was $21.80 per hour.

-The labor rate variance for October is:

(Multiple Choice)

4.8/5  (36)

(36)

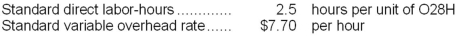

Deschamp Corporation's variable overhead is applied on the basis of direct labor-hours. The company has established the following variable overhead standards for product O28H:  The following data pertain to the most recent month's operations during which 2,160 units of product O28H were made:

The following data pertain to the most recent month's operations during which 2,160 units of product O28H were made:  Required:

a. What was the variable overhead rate variance for the month?

b. What was the variable overhead efficiency variance for the month?

Required:

a. What was the variable overhead rate variance for the month?

b. What was the variable overhead efficiency variance for the month?

(Essay)

4.7/5  (45)

(45)

Oddo Corporation makes a product with the following standard costs:

The company reported the following results concerning this product in December.

The company reported the following results concerning this product in December.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

-The variable overhead efficiency variance for December is:

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

-The variable overhead efficiency variance for December is:

(Multiple Choice)

4.9/5  (33)

(33)

Stench Foods Corporation uses a standard cost system to collect costs related to the production of its garlic flavored yogurt. The garlic (materials) standards for each container of yogurt produced are 0.8 ounces of crushed garlic at a standard cost of $2.30 per ounce.

During the month of June, Stench purchased 75,000 ounces of crushed garlic at a total cost of $171,000. Stench used 64,000 of these ounces to produce 71,500 containers of yogurt.

The direct materials purchases variance is computed when the materials are purchased.

-What is Stench's materials quantity variance for June?

(Multiple Choice)

4.9/5  (36)

(36)

Stench Foods Corporation uses a standard cost system to collect costs related to the production of its garlic flavored yogurt. The garlic (materials) standards for each container of yogurt produced are 0.8 ounces of crushed garlic at a standard cost of $2.30 per ounce.

During the month of June, Stench purchased 75,000 ounces of crushed garlic at a total cost of $171,000. Stench used 64,000 of these ounces to produce 71,500 containers of yogurt.

The direct materials purchases variance is computed when the materials are purchased.

-What is Stench's materials price variance for June?

(Multiple Choice)

4.8/5  (31)

(31)

Epley Corporation makes a product with the following standard costs:

In July the company produced 3,300 units using 12,240 pounds of the direct material and 2,760 direct labor-hours. During the month, the company purchased 13,000 pounds of the direct material at a cost of $35,100. The actual direct labor cost was $51,612 and the actual variable overhead cost was $20,148.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

-The variable overhead efficiency variance for July is:

In July the company produced 3,300 units using 12,240 pounds of the direct material and 2,760 direct labor-hours. During the month, the company purchased 13,000 pounds of the direct material at a cost of $35,100. The actual direct labor cost was $51,612 and the actual variable overhead cost was $20,148.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

-The variable overhead efficiency variance for July is:

(Multiple Choice)

4.8/5  (41)

(41)

Oddo Corporation makes a product with the following standard costs:

The company reported the following results concerning this product in December.

The company reported the following results concerning this product in December.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

-The labor rate variance for December is:

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

-The labor rate variance for December is:

(Multiple Choice)

4.9/5  (40)

(40)

Imrie Corporation makes a product that uses a material with the quantity standard of 9.5 grams per unit of output and the price standard of $5.00 per gram. In January the company produced 2,900 units using 26,940 grams of the direct material. During the month the company purchased 28,900 grams of the direct material at $4.90 per gram. The direct materials purchases variance is computed when the materials are purchased.

-The materials price variance for January is:

(Multiple Choice)

4.9/5  (39)

(39)

Showing 101 - 120 of 187

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)