Exam 10: Reporting and Interpreting Bond Securities

Exam 1: Financial Statements and Business Decisions130 Questions

Exam 2: Investing and Financing Decisions and the Accounting System139 Questions

Exam 3: Operating Decisions and the Accounting System128 Questions

Exam 4: Adjustments, Financial Statements, and the Quality of Earnings138 Questions

Exam 5: Communicating and Interpreting Accounting Information119 Questions

Exam 6: Reporting and Interpreting Sales Revenue, Receivables, and Cash130 Questions

Exam 7: Reporting and Interpreting Cost of Goods Sold and Inventory137 Questions

Exam 8: Reporting and Interpreting Property, Plant, and Equipment; Intangibles; and Natural Resources131 Questions

Exam 9: Reporting and Interpreting Liabilities129 Questions

Exam 10: Reporting and Interpreting Bond Securities128 Questions

Exam 11: Reporting and Interpreting Stockholders Equity133 Questions

Exam 12: Statement of Cash Flows121 Questions

Exam 13: Analyzing Financial Statements125 Questions

Exam 14: PPA: Reporting and Interpreting Investments in Other Corporations115 Questions

Select questions type

On January 1, 2016, Tonika Company issued a four-year, $10,000, 7% bond. The interest is payable annually each December 31. The issue price was $9,668 based on an 8% effective interest rate. Tonika uses the effective-interest amortization method. Rounding calculations to the nearest whole dollar, which of the following journal entries correctly records the 2016 interest expense?

(Multiple Choice)

4.9/5  (36)

(36)

Interest expense decreases over time when a bond is initially issued at a premium and the effective-interest method is used.

(True/False)

4.9/5  (33)

(33)

The issuing company and the bond underwriter determine the selling price of a bond.

(True/False)

4.8/5  (27)

(27)

Assuming no adjusting journal entries have been made, the journal entry to record the cash interest payment on the due date for bonds issued at a discount results in which of the following?

(Multiple Choice)

4.9/5  (40)

(40)

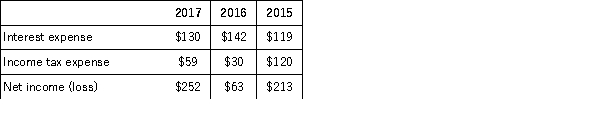

The following information was taken from the income statement of Tommy Toys for the years 2015 through 2017 (in millions):  Required:

A.Compute Tommy Toys times interest earned ratio for all three years.Round your answers to two decimal places.

B.Briefly interpret the times interest earned ratio for the three years.

Required:

A.Compute Tommy Toys times interest earned ratio for all three years.Round your answers to two decimal places.

B.Briefly interpret the times interest earned ratio for the three years.

(Essay)

4.8/5  (34)

(34)

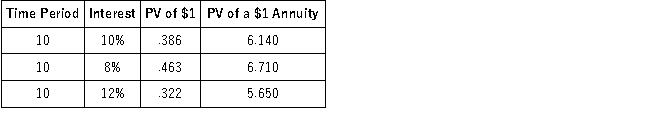

On January 1, 2016, Jason Company issued $5 million of 10-year bonds at a 10% coupon interest rate to be paid annually. The following present value factors have been provided:  Calculate the issuance price if the market rate of interest is 12%.

Calculate the issuance price if the market rate of interest is 12%.

(Multiple Choice)

4.9/5  (42)

(42)

On January 1, 2016, Tonika Company issued a four-year, $10,000, 7% bond. The interest is payable annually each December 31. The issue price was $9,668 based on an 8% effective interest rate. Tonika uses the effective-interest amortization method. The 2017 interest expense is closest to:

(Multiple Choice)

4.7/5  (33)

(33)

The journal entry to record the sale of bonds at their par value results in which of the following?

(Multiple Choice)

4.8/5  (37)

(37)

Grand Company authorized $150,000 of 5-year bonds dated January 1, 2017. The coupon rate of interest was 14%, payable annually each December 31. The bonds were issued on January 1, 2015, when the market interest rate was 12%. Assume effective-interest amortization. (The present value factor for $1 at 6% for 10 periods is 0.55839, for $1 at 7% for 10 periods is 0.50835, for $1 at 14% for 5 periods is 0.51937, and for $1 at 12% for 5 periods is 0.56743. The present value of an annuity of $1 for 10 periods at 6% is 7.36009, for 10 periods at 7% is 7.02358, for 5 periods at 6% is 4.21236, for 5 periods at 7% is 4.10020, and for 5 periods at 12% is 3.60478). Round your final answers to the nearest next whole dollar amount.

Required:

A.Calculate the issue price (total amount received) at January 1, 2017.

B.What would be the amount of premium amortization for December 31, 2017? No adjusting journal entries have been made during the year.

C.What would be the amount of the interest payment on December 31, 2017?

D.What is the book value of the bonds at December 31, 2017?

(Essay)

4.9/5  (43)

(43)

A bond will sell at a premium when the market rate of interest is greater than the coupon rate of interest.

(True/False)

4.8/5  (37)

(37)

On November 1, 2015, Davis Company issued $30,000, ten-year, 7% bonds for $29,100. The bonds were dated November 1, 2015, and interest is payable each November 1 and May 1. Davis uses the straight-line method of amortization.

How much is the semi-annual interest expense when the straight-line method of amortization is utilized?

(Multiple Choice)

4.8/5  (42)

(42)

The journal entry for the cash payment of interest on a bond issued at a discount will result in an increase in the book value of the bond liability.

(True/False)

4.9/5  (35)

(35)

On January 1, 2016, Maralie Company issued $500,000, 4%, ten-year bonds payable at 92. The market rate at the date of issue is 6%. Interest is payable annually at its year-end on each December 31. Laramie uses the effective interest method of amortization.

Required:

A.Prepare the journal entry to record the issuance of the bonds on January 1, 2016.

B.Prepare the journal entry to record the first interest payment and interest expense at December 31, 2016.No entries have yet been made for interest on these bonds.

C.Prepare the journal entry to record the second interest payment and interest expense at December 31, 2017.No entries have been made for these bonds since December 31, 2016.

D.What would the carrying value of the bonds be on December 31, 2017?

(Essay)

4.8/5  (37)

(37)

Rock Company issued a $1,000,000 bond on January 1, 2016. The bond was dated January 1, 2016, had an 8% coupon rate, pays interest annually on December 31, and sold for $924,184 at a time when the market rate of interest was 10%. Rock uses the effective-interest method to account for its bonds.

Required:

Prepare the necessary journal entry for each of the following dates (assuming that no adjusting journal entries have been made during the year):

(a) January 1, 2016

(b) December 31, 2016

(c) December 31, 2017

Round the entry items to the nearest whole dollar amounts.

(Essay)

4.8/5  (42)

(42)

When a company prepares a bond indenture, certain provisions of the bonds are included. Which of the following is not specified in the indenture?

(Multiple Choice)

4.9/5  (35)

(35)

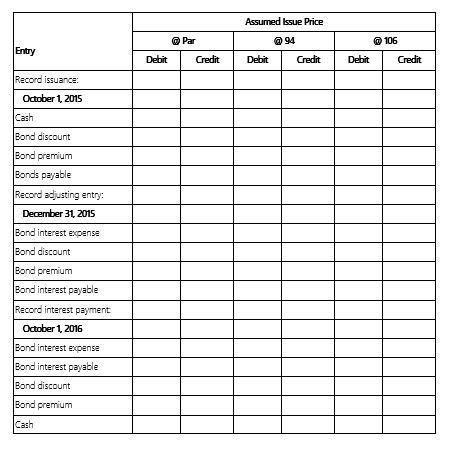

On October 1, 2015, Jack Company issued a $5,000, 6%, bond payable. The interest is payable annually each September 30 and the bond matures in five years. The annual accounting period for the company ends December 31.

(Essay)

4.8/5  (36)

(36)

A company retired $900,000 of bonds which have an unamortized discount of $30,000, by paying bondholders $920,000. What is the amount of the gain or loss on the retirement of the bonds?

(Multiple Choice)

4.8/5  (33)

(33)

Straight-line amortization of a premium related to a bond issuance would result in which of the following?

(Multiple Choice)

4.8/5  (34)

(34)

When the market rate of interest is greater than the coupon rate, the bond will sell at a discount.

(True/False)

4.8/5  (43)

(43)

Showing 81 - 100 of 128

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)