Exam 6: Reporting and Interpreting Sales Revenue, Receivables, and Cash

Exam 1: Financial Statements and Business Decisions130 Questions

Exam 2: Investing and Financing Decisions and the Accounting System139 Questions

Exam 3: Operating Decisions and the Accounting System128 Questions

Exam 4: Adjustments, Financial Statements, and the Quality of Earnings138 Questions

Exam 5: Communicating and Interpreting Accounting Information119 Questions

Exam 6: Reporting and Interpreting Sales Revenue, Receivables, and Cash130 Questions

Exam 7: Reporting and Interpreting Cost of Goods Sold and Inventory137 Questions

Exam 8: Reporting and Interpreting Property, Plant, and Equipment; Intangibles; and Natural Resources131 Questions

Exam 9: Reporting and Interpreting Liabilities129 Questions

Exam 10: Reporting and Interpreting Bond Securities128 Questions

Exam 11: Reporting and Interpreting Stockholders Equity133 Questions

Exam 12: Statement of Cash Flows121 Questions

Exam 13: Analyzing Financial Statements125 Questions

Exam 14: PPA: Reporting and Interpreting Investments in Other Corporations115 Questions

Select questions type

One of Hawk Company's customers returned products that cost Hawk $300, which was sold on account for $450. Which of the following does not correctly describe the effect of the return on the financial statements?

(Multiple Choice)

4.8/5  (37)

(37)

Woodland Company uses the allowance method to account for bad debts. During 2016, a customer declared bankruptcy and a receivable of $10,000 was deemed uncollectible. Which of the following journal entries records Woodland's uncollectible account write-off?

(Multiple Choice)

4.9/5  (39)

(39)

When a credit sale is made with terms of 2/10, n/30 on May 10 and the customer's check is received on May 19, which of the following is true about the May 19 journal entry?

(Multiple Choice)

4.8/5  (39)

(39)

Which of the following correctly describes the effect of a journal entry involving the recording of a sales return?

(Multiple Choice)

4.8/5  (26)

(26)

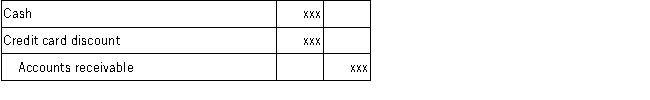

Which of the following does not correctly describe the following journal entry?

(Multiple Choice)

4.8/5  (36)

(36)

When preparing the statement of cash flows, the reason that net sales revenue is adjusted for the change in accounts receivables is to convert net sales to cash collected from customers, since accounts receivable represents sales revenue not collected from customers at the beginning and end of the accounting year.

(True/False)

4.8/5  (32)

(32)

Clark Company estimated the net realizable value of its accounts receivable as of December 31, 2016, to be $165,000, based on an aging schedule of accounts receivable. Clark has also provided the following information: • The accounts receivable balance on December 31, 2016 was $175,000.

• Uncollectible accounts receivable written off during 2016 totaled $12,000.

• The allowance for doubtful accounts balance on January 1, 2016 was $15,000.

How much is Clark's 2016 bad debt expense?

(Multiple Choice)

4.9/5  (40)

(40)

When goods are shipped FOB shipping point, title passes to the buyer on the shipment date.

(True/False)

4.9/5  (38)

(38)

One of Trent Company's customers returned products that had been sold on account for $800. Which of the following correctly describes the effect on the financial statements of the return?

(Multiple Choice)

4.7/5  (39)

(39)

A. What are "cash equivalents"?

B.Specifically where would cash equivalents appear on the financial statements?

(Essay)

4.9/5  (35)

(35)

Showing 121 - 130 of 130

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)