Exam 57: Exchange Rates and Financial Links Between Countries

Exam 1: Economics: The World Around You90 Questions

Exam 2: Choice, Opportunity Costs, and Specialization94 Questions

Exam 3: Markets, Demand and Supply, and the Price System97 Questions

Exam 5: The Market System and the Private and Public Sector97 Questions

Exam 4: Elasticity: Demand and Supply126 Questions

Exam 6: National Income Accounting104 Questions

Exam 7: an Introduction to the Foreign Exchange Market and the Balance of Payments90 Questions

Exam 8: Consumer Choice132 Questions

Exam 9: Supply: The Costs of Doing Business106 Questions

Exam 10: Unemployment and Inflation129 Questions

Exam 11: Macroeconomic Equilibrium: Aggregate Demand and Supply122 Questions

Exam 12: Profit Maximization122 Questions

Exam 13: Aggregate Expenditures115 Questions

Exam 14: Perfect Competition135 Questions

Exam 15: Income and Expenditures Equilibrium134 Questions

Exam 16: Monopoly118 Questions

Exam 17: Fiscal Policy93 Questions

Exam 18: Monopolistic Competition and Oligopoly111 Questions

Exam 19: Antitrust and Regulation100 Questions

Exam 10: Money and Banking125 Questions

Exam 21: Market Failures, Government Failures, and Rent Seeking121 Questions

Exam 22: Monetary Policy141 Questions

Exam 23: Macroeconomic Policy: Tradeoffs, Expectations, Credibility, and Sources of Business Cycles112 Questions

Exam 24: Resource Markets112 Questions

Exam 25: Macroeconomic Viewpoints: New Keynesian, Monetarist, and New Classical99 Questions

Exam 26: The Labor Market114 Questions

Exam 27: Capital Markets100 Questions

Exam 28: Economic Growth99 Questions

Exam 29: Development Economics104 Questions

Exam 30: the Land Market and Natural Resources55 Questions

Exam 31: Aging, Social Security and Health Care88 Questions

Exam 32: Globalization84 Questions

Exam 33: Elasticity: Demand and Supply126 Questions

Exam 34: Income Distribution, Poverty and Government Policy115 Questions

Exam 35: World Trade Equilibrium112 Questions

Exam 36: Consumer Choice132 Questions

Exam 37: International Trade Restrictions109 Questions

Exam 38: World Trade Equilibrium112 Questions

Exam 39: Exchange Rates and Financial Links Between Countries132 Questions

Exam 40: International Trade Restrictions109 Questions

Exam 41: Supply: the Costs of Doing Business106 Questions

Exam 42: Exchange Rates and Financial Links Between Countries132 Questions

Exam 43: Profit Maximization122 Questions

Exam 44: Perfect Competition135 Questions

Exam 45: Monopoly118 Questions

Exam 46: Monopolistic Competition and Oligopoly111 Questions

Exam 47: Antitrust and Regulation100 Questions

Exam 48: Market Failures, Government Failures, and Rent Seeking121 Questions

Exam 49: Resource Markets112 Questions

Exam 50: The Labor Market114 Questions

Exam 51: Capital Markets100 Questions

Exam 52: The Land Market and Natural Resources55 Questions

Exam 53: Aging, Social Security and Health Care87 Questions

Exam 54: Income Distribution, Poverty and Government Policy115 Questions

Exam 55: World Trade Equilibrium112 Questions

Exam 56: International Trade Restrictions109 Questions

Exam 57: Exchange Rates and Financial Links Between Countries132 Questions

Select questions type

Fixed exchange rates require the economic policies of countries linked by the exchange rate to be:

(Multiple Choice)

4.8/5  (27)

(27)

Under a floating exchange-rate system, a country needs to pay more attention to the economic policies of the rest of the world.

(True/False)

4.9/5  (36)

(36)

Assume that a country's government influences the exchange rate through active central bank intervention, with no pre-announced path.This policy is known as a(n):

(Multiple Choice)

4.9/5  (40)

(40)

An appreciation of the Norwegian kroner in relation to the U.S.dollar is most likely to cause:

(Multiple Choice)

4.8/5  (36)

(36)

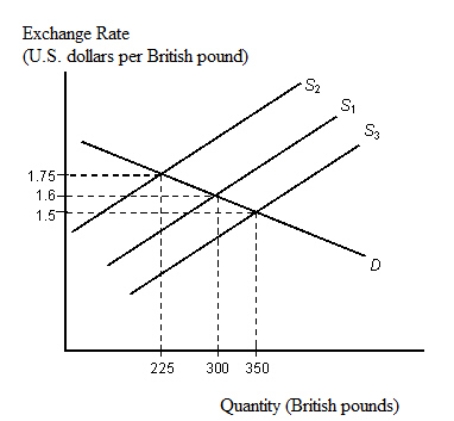

The figure given below depicts the foreign exchange market for British pounds traded for U.S.dollars. Figure 36.2  Refer to Figure 36.2.Suppose the British central bank is committed to maintaining an exchange rate of £1 = $1.50, but there is a permanent shift in supply from S1 to S3.According to the Bretton Woods agreement:

Refer to Figure 36.2.Suppose the British central bank is committed to maintaining an exchange rate of £1 = $1.50, but there is a permanent shift in supply from S1 to S3.According to the Bretton Woods agreement:

(Multiple Choice)

4.9/5  (38)

(38)

The euro floats against other currencies, but the member nations of the euro have no separate national money.For this reason, Spain, that uses the euro as its currency is listed under the managed float arrangement.

(True/False)

4.8/5  (36)

(36)

The gold standard ended in the 1970s because the gold supplies failed to keep pace with the increase in money supplies required for industrialization and rapid economic growth witnessed in this era.

(True/False)

4.8/5  (26)

(26)

Suppose a 10-mile taxi ride costs £6.50 in London and $10.00 in Los Angeles.If the exchange rate is £1 = $1.70 purchasing power parity holds.

(True/False)

4.9/5  (36)

(36)

Foreign exchange market intervention is most effective when:

(Multiple Choice)

4.8/5  (41)

(41)

Under both the gold standard and the gold exchange standard countries bought and sold U.S.dollars to maintain a fixed exchange rate with the dollar.

(True/False)

4.8/5  (38)

(38)

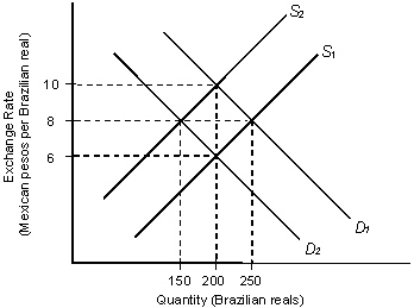

The figure given below depicts the demand and supply of Brazilian reals in the foreign exchange market.Assume that the market operates under a flexible exchange rate regime. Figure 36.1  In the figure:

D1 and D2: Demand for Brazilian reals

S1 and S2: Supply of Brazilian reals

Refer to Figure 36.1.If the initial equilibrium exchange rate is 6 pesos per real, then other things equal, a decrease in the number of Brazilian tourists to Mexico would:

In the figure:

D1 and D2: Demand for Brazilian reals

S1 and S2: Supply of Brazilian reals

Refer to Figure 36.1.If the initial equilibrium exchange rate is 6 pesos per real, then other things equal, a decrease in the number of Brazilian tourists to Mexico would:

(Multiple Choice)

4.8/5  (36)

(36)

Showing 121 - 132 of 132

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)