Exam 10: Compound Interest - Further Topics

Exam 1: Review of Arithmetic144 Questions

Exam 2: Review of Basic Algebra274 Questions

Exam 3: Ratio, Proportion, and Percent210 Questions

Exam 4: Linear Systems94 Questions

Exam 5: Cost-Volume-Profit Analysis and Break-Even47 Questions

Exam 6: Trade Discounts, Cash Discounts, Markup, and Markdown170 Questions

Exam 7: Simple Interest132 Questions

Exam 8: Simple Interest Applications87 Questions

Exam 9: Compound Interest - Future Value and Present Value172 Questions

Exam 10: Compound Interest - Further Topics77 Questions

Exam 11: Ordinary Simple Annuities104 Questions

Exam 12: Ordinary General Annuities104 Questions

Exam 13: Annuities Due, Deferred Annuities, and Perpetuities182 Questions

Exam 14: Amortization of Loans, Residential Mortgages, and Sinking Funds132 Questions

Exam 15: Bond Valuation87 Questions

Exam 16: Investment Decision Applications78 Questions

Select questions type

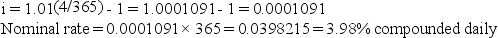

The treasurer of Lynn Lake Credit Union proposes changing the method of compounding interest on premium savings accounts to daily compounding. If the current rate is 4% compounded quarterly, what nominal rate should the treasurer suggest to the Board of Directors to maintain the same effective rate of interest?

Free

(Essay)

4.8/5  (40)

(40)

Correct Answer:

Invest $1 for one year:  =

=

What is the nominal rate of interest at which money will be 5 times itself in 20 years and six months if compounded semi-annually?

Free

(Multiple Choice)

4.8/5  (24)

(24)

Correct Answer:

D

Deon has $4000.00 invested at 4.5% compounded semi-annually at her bank. In order to make a comparison with another financial institution she needs to know the effective rate of interest at her bank. What is the effective annual rate of interest?

Free

(Multiple Choice)

4.8/5  (31)

(31)

Correct Answer:

D

If $1400.00 accumulates to $2350.00 in five years, six months compounded semi-annually, what is the effective rate of interest?

(Essay)

4.9/5  (37)

(37)

Calculate the nominal annual rate of interest compounded quarterly that is equivalent to 10% p.a. compounded semi-annually.

(Essay)

4.9/5  (34)

(34)

A financial obligation requires the payment of $1000.00 in nine months, and $500.00 in twelve months. When can the obligation be discharged by a single payment of $1700.00 if interest is 12% compounded quarterly?

(Essay)

4.9/5  (42)

(42)

According to the World Bank, the population in Georgia is decreasing by 0.83% per year. According to the 2011 consensus, the population of Georgia is 4.5 million. Assuming the population growth rate remains the same; calculate the year in which the population of Georgia will be half the population in 2011?

(Essay)

4.7/5  (33)

(33)

A loan of $9000.00 was repaid together with interest of $3728.00. If interest was 9.4% compounded quarterly, how long was the loan taken out? (Give answer in years and months to the nearest tenth.)

(Essay)

4.8/5  (31)

(31)

Moriaty owes two debt payments-a payment of $6.7 million due in twelve months and a payment of $8.75 million due in twenty-one months. If Moriaty makes a payment of $7 million now, when should he make a second payment of $7.9 million if money is worth 11.5% compounded semi-annually?

(Multiple Choice)

5.0/5  (34)

(34)

A financial obligation requires the payment of $250.00 in eighteen months, $350.00 in thirty months, and $300.00 in fifty-four months. When can the obligation be discharged by a single payment of $800.00 if interest is 5% compounded semi-annually?

(Essay)

4.9/5  (36)

(36)

The PC financial is considering changing the method of compounding interest on line of credit accounts to daily compounding. If the current rate is 5.75% compounded quarterly, what nominal rate should PC Financial propose to maintain the same effective rate of interest?

(Multiple Choice)

4.8/5  (24)

(24)

At what nominal rate of interest compounded semi-annually will $5900 earn $6400 interest in six years?

(Essay)

4.9/5  (34)

(34)

A five-year, $2000.00 note bearing interest at 10% compounded annually was discounted at 12% compounded semi-annually yielding proceeds of $1900.00. How many months before the due date was the discount date?

(Essay)

4.7/5  (40)

(40)

A financial obligation requires the payment of $25 000.00 in 12 months, $35 000.00 in 18 months, and $30 000.00 in 30 months. When can the obligation be discharged by a single payment of $83 000.00 if interest is 6.5% compounded semi-annually?

(Multiple Choice)

4.9/5  (39)

(39)

Musa's parents deposited $20,000 in a long-term savings account as a wedding expenditure for their grand daughter at her birth, expecting to triple by the time she gets married at the age of 22. Calculate the rate of return compounded monthly for the savings account.

(Multiple Choice)

4.9/5  (40)

(40)

For a given interest rate of 10% compounded quarterly, what is the equivalent nominal rate of interest with monthly compounding?

(Multiple Choice)

4.7/5  (33)

(33)

The Brick store credit card quotes a rate of 1.75% per month on the unpaid balance. When Leons took over Brick's management, they reduced the card's effective rate by 4%. What will be the new periodic rate per month?

(Essay)

4.7/5  (31)

(31)

A five-year, $4500.00 promissory note with interest at 7.5% compounded semi-annually was discounted at 8% compounded quarterly yielding proceeds of $6150.00. How many months before the due date was the discount date?

(Essay)

4.9/5  (37)

(37)

At what nominal rate of interest compounded quarterly will $8100 earn $1700.00 interest in six years?

(Essay)

4.7/5  (35)

(35)

Calculate the effective annual rate for 5% p.a. compounded semi-annually.

(Multiple Choice)

4.7/5  (43)

(43)

Showing 1 - 20 of 77

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)