Exam 8: Simple Interest Applications

Exam 1: Review of Arithmetic144 Questions

Exam 2: Review of Basic Algebra274 Questions

Exam 3: Ratio, Proportion, and Percent210 Questions

Exam 4: Linear Systems94 Questions

Exam 5: Cost-Volume-Profit Analysis and Break-Even47 Questions

Exam 6: Trade Discounts, Cash Discounts, Markup, and Markdown170 Questions

Exam 7: Simple Interest132 Questions

Exam 8: Simple Interest Applications87 Questions

Exam 9: Compound Interest - Future Value and Present Value172 Questions

Exam 10: Compound Interest - Further Topics77 Questions

Exam 11: Ordinary Simple Annuities104 Questions

Exam 12: Ordinary General Annuities104 Questions

Exam 13: Annuities Due, Deferred Annuities, and Perpetuities182 Questions

Exam 14: Amortization of Loans, Residential Mortgages, and Sinking Funds132 Questions

Exam 15: Bond Valuation87 Questions

Exam 16: Investment Decision Applications78 Questions

Select questions type

The maturity value of a 155-day 7.5% note dated March 14 is $1721.74. Compute the face value of the note.

Free

(Essay)

4.8/5  (30)

(30)

Correct Answer:

Number of days = 158

S = 1721.74; r = 0.075; t =  P =

P =  =

=  = $1667.60

= $1667.60

Syed bought 168 day Government of Canada T-Bills on 30 April 2016, yielding 0.6%. The face value of the bills was $55 000. He immediately sold it to a client, Zeb, at a higher price that presented a yield to the client of 0.54%. Zeb sold the T-bills after 99 days, when the short term maturity had risen to 0.75%. What profit did Zeb make?

Free

(Multiple Choice)

4.9/5  (36)

(36)

Correct Answer:

B

You borrow $4000 on August 2nd this year. Your demand loan carries an interest rate of 8.41%. You make partial payments of $500 on September 15th and $1575 on October 17th. You want to make a final payment to pay off the remaining outstanding balance on November 21st. What is the size of your final payment? Use the declining balance method.

Free

(Multiple Choice)

4.8/5  (36)

(36)

Correct Answer:

D

Darren purchased $250 000 in 364-day T-bills 315 days before maturity to yield 2.86%. After holding it for 120 days, Darren sold the T-bill for a yield of 3.25%.

a) How much did Darren pay for the T-bills?

b) For how much did Darren sell the T-bills?

c) What rate of return (per annum) did Darren realize on the investment?

(Essay)

4.9/5  (28)

(28)

Meridian credit union approved a $500 000 line of credit on a demand basis to Hard Steel to finance the import of raw material. Interest at the rate of prime plus 1% is charged to Hard Steel's chequing account at the bank on the 1st of each month. The initial advance was $300 000 on 1st of June, 2016, when the prime rate stood at 3%. There were further advances of $40 000 on July 13 and $100 000 on July 28. Payments of $70 000 each were applied against the principal on August 15 and September 15. What was the total interest paid on the loan for the period June 1 to October 1?

(Multiple Choice)

4.8/5  (34)

(34)

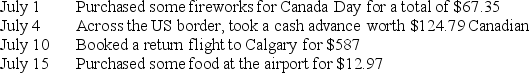

Bana received Scotiabank American Express (Amex) gold card, where the interest is charged at 18.9% per annum. The bill is issued on 16th of every month and is due on 4th of next month. She used her Amex card for the following transactions in the month of July:  The minimum payment due is greater of $10 or 2% of the outstanding balance. She intends to pay the balance in full on the 29th of July. How much must she pay?

The minimum payment due is greater of $10 or 2% of the outstanding balance. She intends to pay the balance in full on the 29th of July. How much must she pay?

(Multiple Choice)

4.8/5  (33)

(33)

You bought a $100 000 364-day T-bill. The T-bill was discounted at a rate of 5%. If you paid $99 900.00 for the T-bill, how many days before maturity did you buy it?

(Multiple Choice)

4.8/5  (37)

(37)

Saint Mary's Corporation issued a 150-day non-interest bearing note for $25 300 to Carlos Services on June 15. On August 21, the note was sold to Bearing Collections at a price reflecting a discount rate of 12.5%. What were the proceeds of the note?

(Essay)

4.7/5  (34)

(34)

You borrowed $4600 at 9.1% per annum calculated on the unpaid monthly balance and agree to repay the principal together with interest in monthly payments of $1050 each. Construct a complete repayment schedule.

(Essay)

4.9/5  (27)

(27)

Leonard buys a painting on his credit card for $14 990. He pays his credit card in full within the grace period of 11 days using his secured line of credit, which charges him prime (3%) plus 1%. He repays his loan in 168 days. If his credit card company charges him a rate of 28% after the grace period, what is the total amount of interest paid on the purchase of the painting?

(Multiple Choice)

5.0/5  (28)

(28)

Find the maturity value of a $1190, 7.275%, 120-day note dated February 5, 2013.

(Essay)

4.9/5  (21)

(21)

CIBC approved a $10 000 personal line of credit on a demand basis to Tara, who takes an advance of $2240 on 1st of every month to settle her monthly budget. She settles her loan when she receives her pay on 15th of every month. Interest at the rate of prime (3%) plus 2.75% is charged to the account at the bank on the 15th of each month. What is Tara's payment each month to settle the loan?

(Multiple Choice)

4.8/5  (38)

(38)

Joan buys a snow blower on her credit card for $1499. She pays her credit card in full a day after the grace period of 21 days using her secured line of credit, which charges her prime (3.25%) plus 1%. She repays her loan in 15 days. If her credit card company charges her a rate of 28% after the grace period, what is the total amount of interest paid on the purchase of the snow blower?

(Multiple Choice)

5.0/5  (32)

(32)

The owner of Easy Clips borrowed $8800.00 from Red Deer Community Credit Union on June 17. The loan was secured by a demand note with interest calculated on the daily balance and charged to the store's account on the 5th day of each month. The loan was repaid by payments of $2500.00 on July 25, $2300.00 on October 17, and $3500.00 on December 30. The rate of interest charged by the credit union was 6.5% on June 17. The rate was changed to 6.65% effective July 1 and to 6.95% effective November 1. Determine the total interest cost on the loan, up to and including Dec. 30.

(Essay)

4.8/5  (33)

(33)

Marty took a $5000 loan from a financial institute at a rate of 6%, which should be repaid in two equal installments of $2575.25 made every 4 months. How much more interest would have been paid, had Marty paid it in a single installment after 8 months?

(Multiple Choice)

5.0/5  (27)

(27)

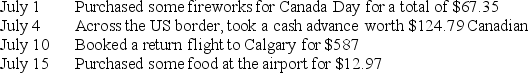

Bana received Scotiabank American Express (Amex) gold card, where the interest is charged at 18.9% per annum. The bill is issued on 16th of every month and is due on 4th of next month. She used her Amex card for the following transactions in the month of July:  The minimum payment due is greater of $20 or 2% of the outstanding balance on the billing day. She intends to pay the minimum amount on August 4 and pay the rest on August 11. How much must she pay on August 11?

The minimum payment due is greater of $20 or 2% of the outstanding balance on the billing day. She intends to pay the minimum amount on August 4 and pay the rest on August 11. How much must she pay on August 11?

(Multiple Choice)

5.0/5  (37)

(37)

The maturity value of a five-month promissory note issued May 31, 2013, is $2134.00. What is the present value of the note on the date of issue if money is worth 6.3%?

(Essay)

4.9/5  (29)

(29)

You bought a $100 000 91-day T-bill for $99 453.67 61 days before maturity. What discount rate was used?

(Multiple Choice)

4.8/5  (41)

(41)

Islamic banking is being introduced in Oman, such that no interest is given on the promissory notes. Compute the present value on the date of issue of a non-interest-bearing, worth $850 000, three-month promissory note dated September 1, 2013 (plus 3 days of grace), if money is worth 12.5% in Oman.

(Multiple Choice)

4.8/5  (31)

(31)

A promissory note has a face value of $5000 and it carries an interest rate of 5% for a period of 6 months (including the period of grace). It is sold 3 months before the legal due date. What is the present value of the note on the date of sale if money is worth 4%?

(Multiple Choice)

4.8/5  (39)

(39)

Showing 1 - 20 of 87

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)