Exam 7: Inventories

Exam 1: Accounting Principles and the Financial Statements170 Questions

Exam 2: Analyzing and Recording Business Transactions136 Questions

Exam 3: Adjusting the Accounts164 Questions

Exam 4: Completing the Accounting Cycle170 Questions

Exam 5: Foundations of Financial Reporting and the Classified Balance Sheet133 Questions

Exam 6: Accounting for Merchandising Operations167 Questions

Exam 6: Supplement: Accounting for Merchandising Operations25 Questions

Exam 7: Inventories162 Questions

Exam 8: Cash and Internal Control137 Questions

Exam 9: Receivables103 Questions

Exam 10: Long -Term Assets220 Questions

Exam 11: Current Liabilities and Fair Value Accounting169 Questions

Exam 12: Accounting for Partnerships134 Questions

Exam 13: Accounting for Corporations179 Questions

Exam 14: Long Term Liabilities191 Questions

Exam 15: The Statement of Cash Flows140 Questions

Exam 15: Supplement: the Statement of Cash Flows32 Questions

Exam 16: Financial Statement Analysis168 Questions

Exam 19: Accounting for Investments97 Questions

Select questions type

The LIFO method is rarely used because most companies do not sell the last goods they purchase first.

Free

(True/False)

4.9/5  (32)

(32)

Correct Answer:

False

Which of the following accounts would not appear as an asset on a manufacturer's balance sheet?

Free

(Multiple Choice)

4.8/5  (41)

(41)

Correct Answer:

C

The determination of the balance sheet cost of merchandise inventory is not important to the determination of net income.

Free

(True/False)

4.7/5  (43)

(43)

Correct Answer:

False

Periodic and perpetual are examples of inventory costing systems.

(True/False)

4.9/5  (36)

(36)

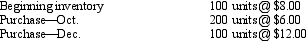

Use this information to answer the following question.  A periodic inventory system is used; ending inventory is 150 units.

What is ending inventory under the average-cost method?

A periodic inventory system is used; ending inventory is 150 units.

What is ending inventory under the average-cost method?

(Multiple Choice)

4.8/5  (23)

(23)

Assume that during the physical count of the inventory of a large corporation last year,$650,000 of merchandise was not counted.The error was not detected,and the financial statements for the current fiscal year were prepared.Identify the individual statements that would be affected and explain the effect the error would have on each of these statements.

(Essay)

4.8/5  (41)

(41)

When the cost of inventory is written down due to a market decline,a loss must be recorded.

(True/False)

4.7/5  (38)

(38)

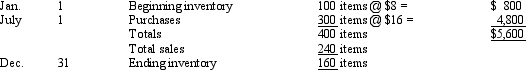

Given the following information about purchases and sales during the year,compute the cost to be assigned to ending inventory under each of three methods: (a)average-cost,(b)FIFO,and (c)LIFO.(Show your work.)

Assuming that a periodic inventory system is used

(Essay)

4.8/5  (45)

(45)

Which of the following is a reason for not using the specific identification method?

(Multiple Choice)

4.8/5  (42)

(42)

A major criticism of the FIFO method is that it magnifies the effects of the business cycle on business income.

(True/False)

4.9/5  (45)

(45)

The most important accounting problem in dealing with merchandise inventory is the application of which of the following conventions or rules?

(Multiple Choice)

4.9/5  (33)

(33)

The lower-of-cost-or-market rule implies that it is a violation of the conservatism concept to carry inventory at a cost that is in excess of its market value.

(True/False)

4.9/5  (39)

(39)

How does the perpetual inventory system differ from the periodic inventory system in the determination of cost of goods sold?

(Essay)

4.9/5  (39)

(39)

A cost-to-retail percentage must be calculated when applying the gross profit method.

(True/False)

4.8/5  (31)

(31)

A retail store had goods available for sale during the period of $250,000 at retail and $100,000 at cost.It has ending inventory of $28,500 at retail.What is the estimated cost of goods sold?

(Multiple Choice)

4.9/5  (33)

(33)

Specific identification is a very popular inventory method because it is very easy to apply.

(True/False)

4.8/5  (30)

(30)

The term cost flow refers to the association of costs with their assumed flow in the operation of a business.

(True/False)

5.0/5  (39)

(39)

Cost of goods sold equals $250,000,and average inventory equals $100,000.Days' inventory on hand equals

(Multiple Choice)

4.8/5  (35)

(35)

Inventory methods such as LIFO and FIFO deal more with cost flow than with goods flow.

(True/False)

4.9/5  (37)

(37)

An overstatement of beginning inventory in a period will result in an overstatement of gross margin in the next period.

(True/False)

4.8/5  (28)

(28)

Showing 1 - 20 of 162

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)