Exam 7: Inventories

Exam 1: Accounting Principles and the Financial Statements170 Questions

Exam 2: Analyzing and Recording Business Transactions136 Questions

Exam 3: Adjusting the Accounts164 Questions

Exam 4: Completing the Accounting Cycle170 Questions

Exam 5: Foundations of Financial Reporting and the Classified Balance Sheet133 Questions

Exam 6: Accounting for Merchandising Operations167 Questions

Exam 6: Supplement: Accounting for Merchandising Operations25 Questions

Exam 7: Inventories162 Questions

Exam 8: Cash and Internal Control137 Questions

Exam 9: Receivables103 Questions

Exam 10: Long -Term Assets220 Questions

Exam 11: Current Liabilities and Fair Value Accounting169 Questions

Exam 12: Accounting for Partnerships134 Questions

Exam 13: Accounting for Corporations179 Questions

Exam 14: Long Term Liabilities191 Questions

Exam 15: The Statement of Cash Flows140 Questions

Exam 15: Supplement: the Statement of Cash Flows32 Questions

Exam 16: Financial Statement Analysis168 Questions

Exam 19: Accounting for Investments97 Questions

Select questions type

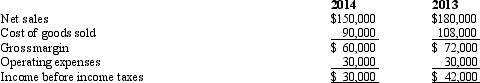

Condensed income statements for Marlin Company are shown below for two years.

Compute the corrected income before income taxes for 2013 and 2014,assuming that the inventory as of the end of 2013 was mistakenly understated by $26,000.

Compute the corrected income before income taxes for 2013 and 2014,assuming that the inventory as of the end of 2013 was mistakenly understated by $26,000.

(Essay)

4.8/5  (39)

(39)

Given equal circumstances,which inventory method probably would be the most time consuming?

(Multiple Choice)

4.8/5  (34)

(34)

Which of the following companies would be most likely to use the retail method?

(Multiple Choice)

4.9/5  (37)

(37)

Which of the following would normally be included in the inventory?

(Multiple Choice)

4.8/5  (34)

(34)

In periods of rising inventory prices,the LIFO method will result in a higher inventory valuation than will the average-cost method.

(True/False)

4.8/5  (29)

(29)

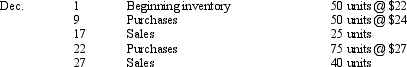

Assuming a perpetual inventory system is used,use the following information to calculate cost of goods sold on an average-cost basis.

(Essay)

4.9/5  (38)

(38)

Which of the following costs would not be included in the inventory cost?

(Multiple Choice)

4.9/5  (39)

(39)

An unrealistic picture of the inventory's current value on the balance sheet is an argument against using

(Multiple Choice)

4.8/5  (33)

(33)

Why are cost flow assumptions made when accounting for merchandise inventory?

(Essay)

4.8/5  (45)

(45)

Emily Holmes owns and operates a large antique shop.She uses the specific identification method to account for transactions that affect inventory.Holmes recently completed a physical inventory of the merchandise in her shop as part of her year-end work.Today,her accountant called to inform her that it would be necessary to adjust the inventory figure shown on the balance sheet,which will increase Holme's tax liability.Holmes argued that the inventory had to be correct,because she counted it twice and matched every item to an invoice.Cite reasons why the accountant would find it necessary to adjust the inventory even if Holme's count is accurate.

(Essay)

4.8/5  (35)

(35)

In verifying a claim for a loss of inventory,an insurance company might use the gross profit method.

(True/False)

4.8/5  (38)

(38)

Why will an understated beginning inventory produce an overstated income before income taxes for the same period? Will the understatement have a favorable or unfavorable effect on current year income taxes?

(Essay)

4.8/5  (36)

(36)

The lower the inventory turnover,the lower the days' inventory on hand.

(True/False)

5.0/5  (35)

(35)

Direct materials and direct labor are components of manufacturing overhead.

(True/False)

4.9/5  (39)

(39)

The average-cost method produces an ending inventory figure that is somewhere between the figures produced by FIFO and LIFO.

(True/False)

4.8/5  (38)

(38)

In a period of rising prices,which of the following inventory methods generally results in the highest gross margin figure?

(Multiple Choice)

4.7/5  (40)

(40)

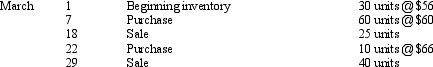

Use this inventory information for the month of March to answer the following question.  Assuming that a periodic inventory system is used,what is cost of goods sold on a FIFO basis?

Assuming that a periodic inventory system is used,what is cost of goods sold on a FIFO basis?

(Multiple Choice)

4.8/5  (42)

(42)

Goods held on consignment should be included in the consignee's ending inventory.

(True/False)

4.9/5  (41)

(41)

Under the perpetual inventory system,cost of goods sold is not recorded until the end of the accounting period.

(True/False)

4.8/5  (31)

(31)

Showing 21 - 40 of 162

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)