Exam 7: Inventories

Exam 1: Accounting Principles and the Financial Statements170 Questions

Exam 2: Analyzing and Recording Business Transactions136 Questions

Exam 3: Adjusting the Accounts164 Questions

Exam 4: Completing the Accounting Cycle170 Questions

Exam 5: Foundations of Financial Reporting and the Classified Balance Sheet133 Questions

Exam 6: Accounting for Merchandising Operations167 Questions

Exam 6: Supplement: Accounting for Merchandising Operations25 Questions

Exam 7: Inventories162 Questions

Exam 8: Cash and Internal Control137 Questions

Exam 9: Receivables103 Questions

Exam 10: Long -Term Assets220 Questions

Exam 11: Current Liabilities and Fair Value Accounting169 Questions

Exam 12: Accounting for Partnerships134 Questions

Exam 13: Accounting for Corporations179 Questions

Exam 14: Long Term Liabilities191 Questions

Exam 15: The Statement of Cash Flows140 Questions

Exam 15: Supplement: the Statement of Cash Flows32 Questions

Exam 16: Financial Statement Analysis168 Questions

Exam 19: Accounting for Investments97 Questions

Select questions type

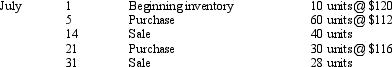

Use this inventory information for the month of July to answer the following question.  Assuming that a periodic inventory system is used,what is cost of goods sold on a FIFO basis?

Assuming that a periodic inventory system is used,what is cost of goods sold on a FIFO basis?

(Multiple Choice)

4.9/5  (31)

(31)

A company has cost of goods available for sale of $250,000,sales of $305,000,and a gross profit percentage of 30 percent.Using the gross profit method,what is the ending inventory?

(Multiple Choice)

4.8/5  (44)

(44)

Why are the amounts determined for ending inventory and cost of goods sold the same under both the periodic and perpetual inventory systems when FIFO is used but not when LIFO is used?

(Essay)

4.8/5  (37)

(37)

The portion of cost of goods available for sale that is not assigned to ending inventory is assigned to work in process.

(True/False)

4.8/5  (38)

(38)

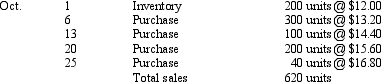

Use this information to answer the following question.  A periodic inventory system is used.

Using LIFO,cost of goods sold is

A periodic inventory system is used.

Using LIFO,cost of goods sold is

(Multiple Choice)

4.9/5  (36)

(36)

The higher the value assigned to ending inventory,the lower the gross margin.

(True/False)

4.7/5  (33)

(33)

The specific identification method and the FIFO method produce the same results under both the perpetual and periodic inventory systems.

(True/False)

4.8/5  (35)

(35)

In a period of rising prices,which inventory method is best to use for tax purposes?

(Multiple Choice)

4.8/5  (31)

(31)

If prices were to never change,there would be no need for alternative inventory methods.

(True/False)

4.9/5  (35)

(35)

When applying the retail method,which of the following would not be a component of the cost-to-retail percentage?

(Multiple Choice)

4.8/5  (34)

(34)

Which costing method can only be used when it is possible to identify units as coming from specific purchases?

(Multiple Choice)

4.9/5  (40)

(40)

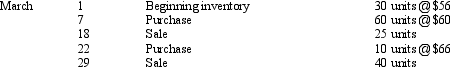

Use this inventory information for the month of March to answer the following question.  Assuming that a periodic inventory system is used,what is ending inventory (rounded)under the average-cost method?

Assuming that a periodic inventory system is used,what is ending inventory (rounded)under the average-cost method?

(Multiple Choice)

4.8/5  (38)

(38)

When the average-cost method is applied to a perpetual inventory system,the sale of goods will not change the unit cost of the goods that remain in inventory.

(True/False)

4.9/5  (35)

(35)

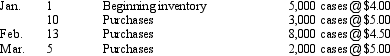

Atwood Company uses a periodic inventory system.During the first quarter of 2014,it sold 12,000 cases of Product A for $120,000.Facts related to its beginning inventory and purchases are as follows:

For the quarter ended March 31,2014,compute the ending inventory,cost of goods sold,and gross margin under three methods: (a)average-cost,(b)FIFO,and (c)LIFO.(Show your work.)

For the quarter ended March 31,2014,compute the ending inventory,cost of goods sold,and gross margin under three methods: (a)average-cost,(b)FIFO,and (c)LIFO.(Show your work.)

(Essay)

4.9/5  (39)

(39)

In periods of rising prices,the LIFO method will result in a larger gross margin than the FIFO method.

(True/False)

4.9/5  (30)

(30)

Which costing method is used based on the reasoning that the fairest determination of income occurs if the current costs are matched against current sales prices?

(Multiple Choice)

4.9/5  (43)

(43)

Why is the LIFO cost flow assumption an acceptable valuation method for merchandise inventory when it rarely matches the physical movement of the product?

(Essay)

4.9/5  (37)

(37)

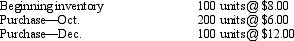

Use this information to answer the following question.  A periodic inventory system is used; ending inventory is 140 units.

What is cost of goods sold under FIFO?

A periodic inventory system is used; ending inventory is 140 units.

What is cost of goods sold under FIFO?

(Multiple Choice)

4.9/5  (41)

(41)

Inventory turnover is a measure expressed in terms of a percentage.

(True/False)

4.9/5  (34)

(34)

Showing 41 - 60 of 162

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)