Exam 10: Investments in Noncurrent Operating Assets-Acquisition

Exam 1: Financial Reporting79 Questions

Exam 2: A Review of the Accounting Cycle98 Questions

Exam 3: The Balance Sheet and Notes to the Financial Statements67 Questions

Exam 4: The Income Statement77 Questions

Exam 5: Statement of Cash Flows and Articulation80 Questions

Exam 6: Earnings Management32 Questions

Exam 7: The Revenuereceivablescash Cycle74 Questions

Exam 8: Revenue Recognition68 Questions

Exam 9: Inventory and Cost of Goods Sold121 Questions

Exam 10: Investments in Noncurrent Operating Assets-Acquisition79 Questions

Exam 11: Investments in Noncurrent Operating Assets-Utilization and Retirement79 Questions

Exam 12: Debt Financing99 Questions

Exam 13: Equity Financing96 Questions

Exam 14: Investments in Debt and Equity Securities81 Questions

Exam 15: Leases79 Questions

Exam 16: Income Taxes68 Questions

Exam 17: Employee Compensation-Payroll, pensions, Other Compissues74 Questions

Exam 19: Derivatives, contingencies, business Segments, and Interim Reports79 Questions

Exam 20: Accounting Changes and Error Corrections77 Questions

Exam 21: Statement of Cash Flows Revisited67 Questions

Exam 22: Accounting in a Global Market57 Questions

Exam 23: Analysis of Financial Statements50 Questions

Select questions type

Diamond,Inc.purchased a machine under a deferred payment contract on December 31,2013.Under the terms of the contract,Diamond is required to make eight annual payments of $140,000 each beginning December 31,2014.The appropriate interest rate is 8 percent.The purchase price of the machine is

Free

(Multiple Choice)

4.7/5  (37)

(37)

Correct Answer:

D

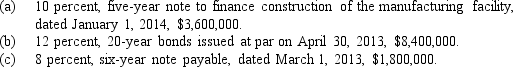

During 2014,Brent Industries,Inc.constructed a new manufacturing facility at a cost of $12,000,000.The weighted average accumulated expenditures for 2014 were calculated to be $5,400,000.The company had the following debt outstanding at December 31,2014:

Determine the amount of interest to be capitalized by Brent Industries for 2014.

Determine the amount of interest to be capitalized by Brent Industries for 2014.

Free

(Essay)

4.8/5  (42)

(42)

Correct Answer:

The interest that should be capitalized for 2014 by Brent Industries,Inc.is $563,220 (the lesser of the avoidable interest of $563,220 and the actual interest cost incurred of $1,512,000).

The interest that should be capitalized for 2014 by Brent Industries,Inc.is $563,220 (the lesser of the avoidable interest of $563,220 and the actual interest cost incurred of $1,512,000).

Cirrus Inc.purchased certain plant assets under a deferred payment contract.The agreement was to pay $40,000 per year for ten years.The plant assets should be valued at

Free

(Multiple Choice)

4.9/5  (38)

(38)

Correct Answer:

C

The cost of a building to be used in the operations of a business should usually include all of the following except

(Multiple Choice)

4.9/5  (32)

(32)

Broadcast rights are an example of which general category of intangible asset that should be recognized separately according to current generally accepted accounting principles?

(Multiple Choice)

4.9/5  (30)

(30)

The third year of a construction project began with a $30,000 balance in Construction in Progress.Included in that figure is $6,000 of interest capitalized in the first two years.Construction expenditures during the third year were $80,000 which were incurred evenly throughout the entire year.The company has had over $300,000 in interest-bearing debt outstanding the third year,at a weighted average rate of 9 percent.How much interest for the third year is capitalized?

(Multiple Choice)

4.8/5  (36)

(36)

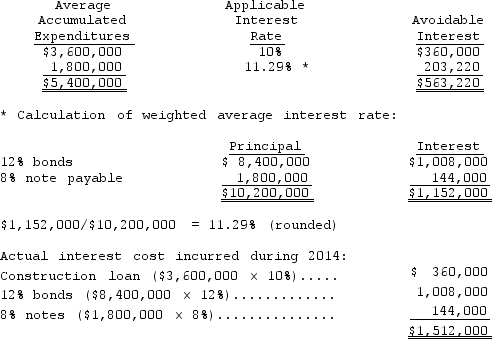

A company made the following cash expenditures on a self-constructed building begun January 1 of the current year:  The building is still under construction at year-end.What is the amount of the average accumulated expenditures for the purpose of capitalizing interest?

The building is still under construction at year-end.What is the amount of the average accumulated expenditures for the purpose of capitalizing interest?

(Multiple Choice)

4.8/5  (39)

(39)

In a "basket" or "lump-sum" purchase of assets,which of the following best describes the process by which the historical cost of the various assets acquired should be determined?

(Multiple Choice)

4.9/5  (38)

(38)

A copyright is an example of which general category of intangible asset that should be recognized separately according to current generally accepted accounting principles?

(Multiple Choice)

4.9/5  (38)

(38)

A trademark is an example of which general category of intangible asset that should be recognized separately according to current generally accepted accounting principles?

(Multiple Choice)

4.7/5  (30)

(30)

The Maker Company exchanged 25,000 shares of its own $50 par value common stock for a turret lathe from Turner Company.The market value of the Maker Company stock was $68 per share at the date of exchange.The equipment had a carrying value of $1,625,000.

Record the exchange on the books of Maker Company in general journal form.

(Essay)

4.8/5  (29)

(29)

Which of the following principles best describes the current method of accounting for research and development costs?

(Multiple Choice)

4.9/5  (36)

(36)

Shorecrest Company recently accepted a donation of land with a fair value of $250,000 from the city of Sutton in return for a promise to build a plant in Sutton. The entry that Shorecrest should use to record this land is:

(Multiple Choice)

4.7/5  (47)

(47)

Dan Company recently acquired two items of equipment.The transactions are described below: June 10:

Acquired a press at an invoice price of $6,500,subject to a 2% cash discount which was taken.Costs of freight and insurance during shipment were $205.Installation costs were $350.

November 12:

Acquired a welding machine at an invoice price of $4,000,subject to a 4% cash discount which was NOT taken.Additional welding supplies were acquired at a total cost of $300.

The increase in the equipment account as a result of the above transactions would be

(Multiple Choice)

4.7/5  (33)

(33)

When a company replaces an old asphalt roof on its plant with a new fiberglass insulated roof,which of the following types of expenditure has occurred?

(Multiple Choice)

4.8/5  (41)

(41)

Which of the following research and development related costs should be capitalized and amortized over current and future periods?

(Multiple Choice)

4.9/5  (36)

(36)

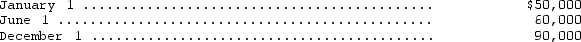

On March 1,2014,the Hauk Company paid $400,000 for all the issued and outstanding stock of Bodo Corporation in a transaction properly accounted for as a purchase.The market values of the assets and liabilities of Bodo Corporation on March 1,2014,are as follows:

Make the journal entry necessary for Hauk to record the purchase.

Make the journal entry necessary for Hauk to record the purchase.

(Essay)

4.8/5  (34)

(34)

According to the most current FASB standards,intangible assets acquired in a basket purchase that does not represent the acquisition of an entire business should be

(Multiple Choice)

4.8/5  (39)

(39)

Osborne Company acquired three machines for $200,000 in a package deal.The three assets together had a book value of $160,000 on the seller's books.An appraisal costing the purchaser $2,000 indicated that the three machines had the following market values (book values are given in parentheses): Machine 1: $60,000 ($40,000)

Machine 2: $80,000 ($50,000)

Machine 3: $100,000 ($70,000)

The three assets should be individually recorded at a cost of (rounded to the nearest dollar)

Machine 1 Machine 2 Machine 3

(Multiple Choice)

4.7/5  (36)

(36)

Showing 1 - 20 of 79

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)