Exam 20: Accounting Changes and Error Corrections

Exam 1: Financial Reporting79 Questions

Exam 2: A Review of the Accounting Cycle98 Questions

Exam 3: The Balance Sheet and Notes to the Financial Statements67 Questions

Exam 4: The Income Statement77 Questions

Exam 5: Statement of Cash Flows and Articulation80 Questions

Exam 6: Earnings Management32 Questions

Exam 7: The Revenuereceivablescash Cycle74 Questions

Exam 8: Revenue Recognition68 Questions

Exam 9: Inventory and Cost of Goods Sold121 Questions

Exam 10: Investments in Noncurrent Operating Assets-Acquisition79 Questions

Exam 11: Investments in Noncurrent Operating Assets-Utilization and Retirement79 Questions

Exam 12: Debt Financing99 Questions

Exam 13: Equity Financing96 Questions

Exam 14: Investments in Debt and Equity Securities81 Questions

Exam 15: Leases79 Questions

Exam 16: Income Taxes68 Questions

Exam 17: Employee Compensation-Payroll, pensions, Other Compissues74 Questions

Exam 19: Derivatives, contingencies, business Segments, and Interim Reports79 Questions

Exam 20: Accounting Changes and Error Corrections77 Questions

Exam 21: Statement of Cash Flows Revisited67 Questions

Exam 22: Accounting in a Global Market57 Questions

Exam 23: Analysis of Financial Statements50 Questions

Select questions type

Which of the following is NOT correct regarding a change in reporting entity?

Free

(Multiple Choice)

4.8/5  (30)

(30)

Correct Answer:

D

Which of the following is the proper time period in which to record a change in accounting estimate?

Free

(Multiple Choice)

4.8/5  (37)

(37)

Correct Answer:

A

Mako's Distributing purchased equipment on January 1,2011.The equipment cost $214,000 with a salvage value of $14,000 and an estimated life of 8 years.Initially,Mako depreciated the equipment using the sum-of-the-years'-digits method.On January 1,2014,the company elected to change to the straight-line method of depreciation.

Required:

Determine the depreciation expense for 2014 and prepare the appropriate journal entry.

Free

(Essay)

4.8/5  (47)

(47)

Correct Answer:

Accumulated depreciation at 1/1/2014:

Annual depreciation expense for the last five years of the life of the asset:

Annual depreciation expense for the last five years of the life of the asset:

($214,000 - $14,000 - $116,666)/ 5 years = $16,667

Journal entry at December 31,2014:

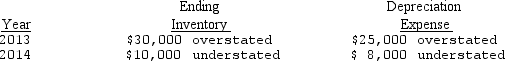

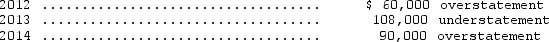

Rickles,Inc.is a calendar-year corporation whose financial statements for 2013 and 2014 included errors as follows:  Assume that purchases were recorded correctly and that no correcting entries were made at December 31,2013,or December 31,2014.Ignoring income taxes,by how much should Rickles's retained earnings be retroactively adjusted at January 1,2015?

Assume that purchases were recorded correctly and that no correcting entries were made at December 31,2013,or December 31,2014.Ignoring income taxes,by how much should Rickles's retained earnings be retroactively adjusted at January 1,2015?

(Multiple Choice)

4.8/5  (41)

(41)

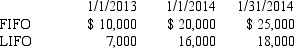

A retailing firm changed from LIFO to FIFO in 2014.Inventory valuations for the two methods appear below:

Purchases in 2013 and 2014 were $60,000 in each year.

-Using the information above,in the comparative 2013 and 2014 income statements,what amounts would be shown for cost of goods sold? 2013 2014

Purchases in 2013 and 2014 were $60,000 in each year.

-Using the information above,in the comparative 2013 and 2014 income statements,what amounts would be shown for cost of goods sold? 2013 2014

(Multiple Choice)

4.9/5  (44)

(44)

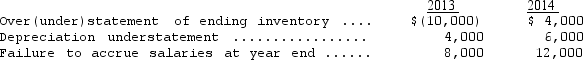

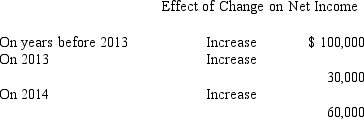

McCartney Corp.reports on a calendar-year basis.Its 2013 and 2014 financial statements contained the following errors:  As a result of the above errors,2014 income would be

As a result of the above errors,2014 income would be

(Multiple Choice)

4.9/5  (31)

(31)

If,at the end of a period,Michaels Company erroneously excluded some goods from its ending inventory and also erroneously did NOT record the purchase of these goods in its accounting records,these errors would cause

(Multiple Choice)

4.8/5  (42)

(42)

Which of the following does NOT represent a change in reporting entity?

(Multiple Choice)

4.9/5  (36)

(36)

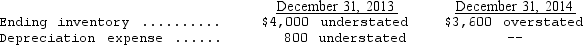

Strong Company's December 31 year-end financial statements contained the following errors:  An insurance premium of $3,600 was prepaid in 2013 covering the years 2013,2014,and 2015.The entire amount was charged to expense in 2013.In addition,on December 31,2014,fully depreciated machinery was sold for $6,400 cash,but the sale was not recorded until 2015.There were no other errors during 2013 or 2014,and no corrections have been made for any of the errors.Ignore income tax considerations.What is the total effect of the errors on 2014 net income?

An insurance premium of $3,600 was prepaid in 2013 covering the years 2013,2014,and 2015.The entire amount was charged to expense in 2013.In addition,on December 31,2014,fully depreciated machinery was sold for $6,400 cash,but the sale was not recorded until 2015.There were no other errors during 2013 or 2014,and no corrections have been made for any of the errors.Ignore income tax considerations.What is the total effect of the errors on 2014 net income?

(Multiple Choice)

4.8/5  (33)

(33)

A company mistakenly expensed a $100,000 machine purchased January 1,2011.The machine has no salvage value and is expected to provide benefits for five years.The error was discovered in 2014.The company shows two years of comparative statements in its December 31 annual reports.In the company's 2013 and 2014 reports shown comparatively,what amounts would be shown as adjustments to the respective retained earnings balances? 2013 2014

(Multiple Choice)

4.7/5  (33)

(33)

An example of an item that should be reported as a prior period adjustment is the

(Multiple Choice)

5.0/5  (36)

(36)

Badger Corporation purchased a machine for $132,000 on January 1,2011,and depreciated it by the straight-line method using an estimated useful life of eight years with no salvage value.On January 1,2014,Badger determined that the machine had a useful life of six years from the date of acquisition and will have a salvage value of $12,000.A change in estimate was made in 2014 to reflect these additional data.What amount should Badger record as the balance of the accumulated depreciation account for this machine at December 31,2014?

(Multiple Choice)

4.8/5  (38)

(38)

Cornwall Co.made the following errors in counting its year-end physical inventories:  The entry to correct the accounts at the end of 2014 is

The entry to correct the accounts at the end of 2014 is

(Multiple Choice)

4.8/5  (34)

(34)

Which of the following accounting treatments is proper for a change in reporting entity?

(Multiple Choice)

4.7/5  (37)

(37)

Which of the following types of errors will NOT self-correct in the next year?

(Multiple Choice)

4.7/5  (36)

(36)

Which of the following concepts or principles relates most directly to reporting accounting changes and errors?

(Multiple Choice)

4.8/5  (44)

(44)

Which of the following changes in accounting principle does not require the retrospective approach?

(Multiple Choice)

4.8/5  (46)

(46)

Effective January 2,2014,Moldaur Co.adopted the accounting principle of expensing advertising and promotion costs as they are incurred.Previously,advertising and promotion costs applicable to future periods were recorded in prepaid expenses.Moldaur can justify the change,which was made for both financial statement and income tax reporting purposes.Moldaur's prepaid advertising and promotion costs totaled $250,000 at December 31,2013.Assume that the income tax rate is 40 percent for 2013 and 2014.The adjustment for the effect of the change in accounting principle should result in a net charge against income in the income statement for 2014 of

(Multiple Choice)

5.0/5  (32)

(32)

Which of the following is NOT a change in accounting principle?

(Multiple Choice)

4.8/5  (34)

(34)

Diamond Company changed from the completed-contract method of accounting for long-term contracts to the percentage-of-completion method,during 2014.Reported earnings in 2013 were $50,000,and the beginning 2013 retained earnings balance was $150,000.Net income for 2014 under the competed-contract method would have been $140,000.No dividends were declared during 2013 and 2014.

Required:

Prepare the 2013 and 2014 comparative retained earnings statements.

Required:

Prepare the 2013 and 2014 comparative retained earnings statements.

(Essay)

4.9/5  (42)

(42)

Showing 1 - 20 of 77

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)