Exam 22: Accounting in a Global Market

Exam 1: Financial Reporting79 Questions

Exam 2: A Review of the Accounting Cycle98 Questions

Exam 3: The Balance Sheet and Notes to the Financial Statements67 Questions

Exam 4: The Income Statement77 Questions

Exam 5: Statement of Cash Flows and Articulation80 Questions

Exam 6: Earnings Management32 Questions

Exam 7: The Revenuereceivablescash Cycle74 Questions

Exam 8: Revenue Recognition68 Questions

Exam 9: Inventory and Cost of Goods Sold121 Questions

Exam 10: Investments in Noncurrent Operating Assets-Acquisition79 Questions

Exam 11: Investments in Noncurrent Operating Assets-Utilization and Retirement79 Questions

Exam 12: Debt Financing99 Questions

Exam 13: Equity Financing96 Questions

Exam 14: Investments in Debt and Equity Securities81 Questions

Exam 15: Leases79 Questions

Exam 16: Income Taxes68 Questions

Exam 17: Employee Compensation-Payroll, pensions, Other Compissues74 Questions

Exam 19: Derivatives, contingencies, business Segments, and Interim Reports79 Questions

Exam 20: Accounting Changes and Error Corrections77 Questions

Exam 21: Statement of Cash Flows Revisited67 Questions

Exam 22: Accounting in a Global Market57 Questions

Exam 23: Analysis of Financial Statements50 Questions

Select questions type

Which of the following statements is true regarding equity reserves?

Free

(Multiple Choice)

4.8/5  (36)

(36)

Correct Answer:

D

Lunes Company,a U.S.company,owns a 100% interest in its subsidiary,Placido,S.A. ,located in Italy.Placido,S.A. ,began operations on January 1,2014.The subsidiary's operations consist of leasing space in an office building.The building,which cost one million euros,was financed primarily by Italian banks.All revenues and expenses are received and paid in euros.The subsidiary also maintains its accounting records in euros.In light of these facts,management of the U.S.parent has determined that the euro is the functional currency of the subsidiary.

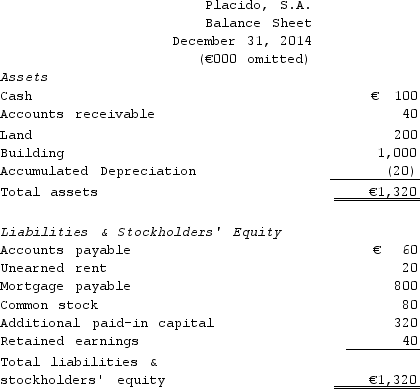

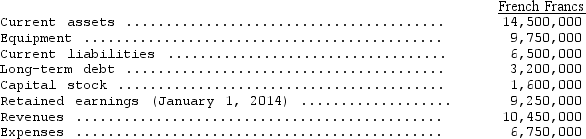

The subsidiary's balance sheet at December 31,2014,and income statement for the year then ended,are presented below,in euros:

The following are relevant exchange rates for the year 2014:

€1 = $1.50 at the beginning of 2014,at which time the common stock

was issued and the land and building were financed by the mortgage.

€1 = $1.55 weighted average for 2014.

€1 = $1.58 at the date the dividends were declared and paid and

the unearned rent was received.

€1 = $1.62 at the end of 2014.

Required:

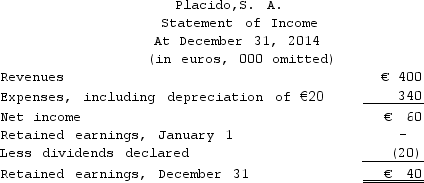

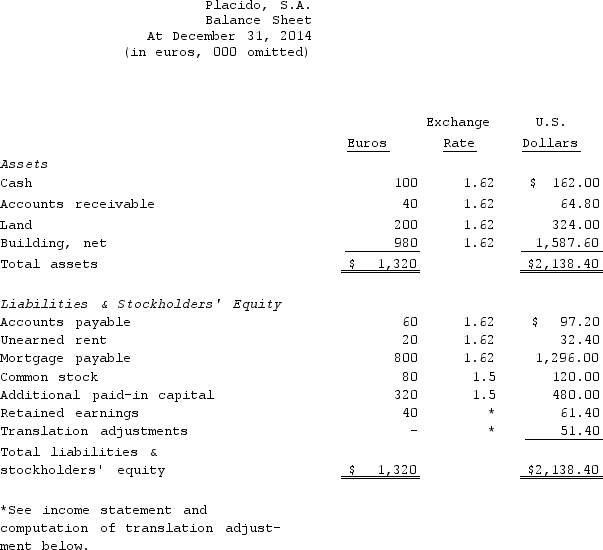

Prepare in U.S.dollars a balance sheet at December 31,2014,and an income statement for the year then ended.

The following are relevant exchange rates for the year 2014:

€1 = $1.50 at the beginning of 2014,at which time the common stock

was issued and the land and building were financed by the mortgage.

€1 = $1.55 weighted average for 2014.

€1 = $1.58 at the date the dividends were declared and paid and

the unearned rent was received.

€1 = $1.62 at the end of 2014.

Required:

Prepare in U.S.dollars a balance sheet at December 31,2014,and an income statement for the year then ended.

Free

(Essay)

4.8/5  (35)

(35)

Correct Answer:

Which of the following is the least likely means a company might choose to meet the needs of international investors?

Free

(Multiple Choice)

4.8/5  (30)

(30)

Correct Answer:

C

Under international accounting standards,if a sale-leaseback results in an operating lease then

(Multiple Choice)

4.8/5  (33)

(33)

A translation adjustment resulting from the translation process is disclosed on the financial statements as

(Multiple Choice)

4.8/5  (42)

(42)

Under international accounting standards,the standard for accounting for construction contracts

(Multiple Choice)

5.0/5  (40)

(40)

According to FASB ASC Topic 830 (Foreign Currency Matters - Translation of Financial Statements),the appropriate method of restatement from a foreign currency to the U.S.dollar for each of the following is Remeasurement Translation

(Multiple Choice)

4.8/5  (30)

(30)

The primary purpose of the Security and Exchange Commission's Form 20-F is to

(Multiple Choice)

4.7/5  (38)

(38)

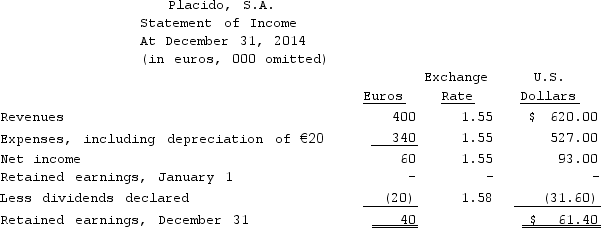

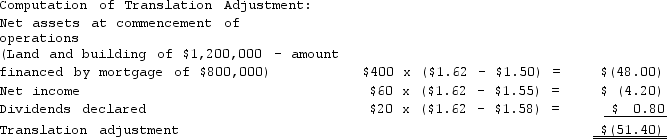

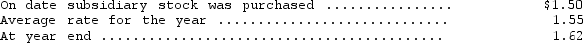

Florence Enterprises,a subsidiary of Verona Company based in New York,reported the following information at the end of its first year of operations (all in euros): assets--1,320,000;expenses--340,000;liabilities--880,000;capital stock--80,000,revenues--400,000.Relevant exchange rates are as follows:  As a result of the translation process,what amount is recorded on the financial statements as the translation adjustment?

As a result of the translation process,what amount is recorded on the financial statements as the translation adjustment?

(Multiple Choice)

4.8/5  (31)

(31)

Under international accounting standards,cash paid for interest (associated with interest expense)can be shown on the statement of cash flows as an

(Multiple Choice)

4.7/5  (32)

(32)

Monty Enterprises,a subsidiary of Kerry Company based in Delaware,reported the following information at the end of its first year of operations (all in British pounds): assets--483,000;expenses--360,000;liabilities--105,000;capital stock--90,000,revenues--648,000.Relevant exchange rates are as follows:  As a result of the translation process,what amount is recorded on the financial statements as the translation adjustment?

As a result of the translation process,what amount is recorded on the financial statements as the translation adjustment?

(Multiple Choice)

4.9/5  (32)

(32)

Under international accounting standards,the derecognition of receivables requires that

(Multiple Choice)

4.9/5  (32)

(32)

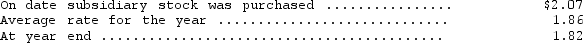

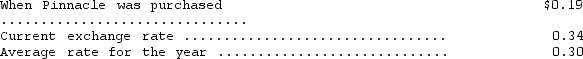

Financial information for Pinnacle Enterprises at the end of 2014 is as follows:

Relevant exchange rates are as follows:

Relevant exchange rates are as follows:

In addition,the computed retained earnings balance from the prior year's translated financial statements is $2,405,000 at the end of 2014.

Prepare a translated trial balance for Pinnacle Enterprises.

In addition,the computed retained earnings balance from the prior year's translated financial statements is $2,405,000 at the end of 2014.

Prepare a translated trial balance for Pinnacle Enterprises.

(Essay)

4.9/5  (39)

(39)

Under international accounting standards,cash paid for income taxes (associated with income tax expense)can be shown on the statement of cash flows as an

(Multiple Choice)

4.9/5  (39)

(39)

Under international accounting standards,the pension-related asset or liability is recognized on the balance sheet as the

(Multiple Choice)

4.9/5  (35)

(35)

Which of the following is not correct regarding the translation of a foreign entity's accounts?

(Multiple Choice)

4.8/5  (39)

(39)

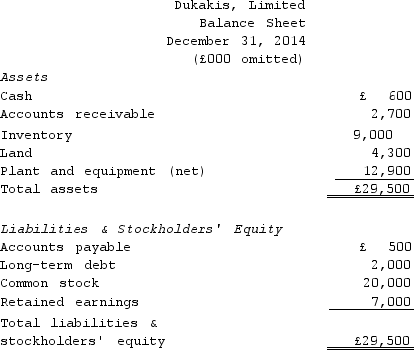

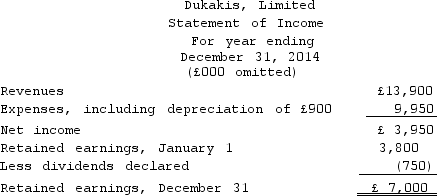

McGovern Corporation,a U.S.company,owns a 100% interest in its subsidiary,Dukakis Limited. ,located in the United Kingdom.Dukakis began operations on January 1,2013.All revenues and expenses are received and paid in British pounds.The subsidiary maintains its accounting records in British pounds.In light of these facts,management of the U.S.parent has determined that the British pound is the functional currency of the subsidiary.

The subsidiary's balance sheet at December 31,2014,and income statement for the year then ended,are presented below in British pounds:

The following are relevant exchange rates for the year 2014:

£1 = $1.51 at the beginning of 2013,at which time the common stock

was issued.

£1 = $1.55 weighted average for 2014.

£1 = $1.58 at the date the dividends were declared and paid.

£1 = $1.53 at the end of 2014.

£1 = $1.56 at the beginning of 2014.

The balance of the cumulative translation account at January 1,2014,was $1,157.

Required:

Prepare in U.S.dollars a balance sheet at December 31,2014,and an income statement for the year then ended for Dukakis,Limited.

The following are relevant exchange rates for the year 2014:

£1 = $1.51 at the beginning of 2013,at which time the common stock

was issued.

£1 = $1.55 weighted average for 2014.

£1 = $1.58 at the date the dividends were declared and paid.

£1 = $1.53 at the end of 2014.

£1 = $1.56 at the beginning of 2014.

The balance of the cumulative translation account at January 1,2014,was $1,157.

Required:

Prepare in U.S.dollars a balance sheet at December 31,2014,and an income statement for the year then ended for Dukakis,Limited.

(Essay)

4.8/5  (36)

(36)

Which of the following is the current group within the International Accounting Standard Board organization that interprets existing standards or provides guidance in areas for which no accounting formal standard exists?

(Multiple Choice)

4.8/5  (29)

(29)

Which of the following is correct regarding the treatment of short-term obligations expected to be refinanced?

(Multiple Choice)

4.8/5  (42)

(42)

Showing 1 - 20 of 57

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)