Exam 6: Internal Control and Accounting for Cash

Exam 1: An Introduction to Accounting148 Questions

Exam 2: Accounting for Accruals and Deferrals151 Questions

Exam 3: The Double-Entry Accounting System156 Questions

Exam 4: Accounting for Merchandising Businesses157 Questions

Exam 5: Accounting for Inventories142 Questions

Exam 6: Internal Control and Accounting for Cash140 Questions

Exam 7: Accounting for Receivables145 Questions

Exam 8: Accounting for Long-Term Operational Assets159 Questions

Exam 9: Accounting for Current Liabilities and Payroll130 Questions

Exam 10: Accounting for Long-Term Debt158 Questions

Exam 11: Proprietorships, Partnerships, and Corporations153 Questions

Exam 12: Statement of Cash Flows134 Questions

Exam 13: Financial Statement Analysis Available Online in the Connect Library139 Questions

Select questions type

List five internal control procedures that should be followed to safeguard cash and reduce the likelihood of theft.

Any five of the following:

(Essay)

4.9/5  (39)

(39)

A business learns about customers' NSF checks through credit memos that are included with the bank statement.

(True/False)

4.9/5  (43)

(43)

Assuming that the unadjusted bank balance was $600, determine the unadjusted book balance.

(Multiple Choice)

4.8/5  (34)

(34)

Janet Higgins operates a small dress shop that sells various items of apparel and accessories. She employs two clerks who make sales to customers, accept returns when a customer is dissatisfied with merchandise, and put new merchandise on display. One of the clerks, Gretchen Grant, was hired recently. Janet had always done all the accounting for the store and had made bank deposits. However, Gretchen has offered to do the accounting for the store during slow periods when there are no customers in the store; she also has begun making bank deposits as she leaves for the day. Having Gretchen take these responsibilities allows Janet more time for acquiring merchandise for the store and for personal errands. What potential risks for the success of Janet's business are present in this situation?

(Essay)

4.8/5  (41)

(41)

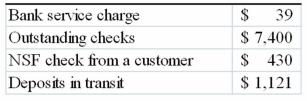

On November 30, 2013, Howard Company's bank statement showed an ending balance of $36,341. The following information is available about Howard's account:

1. Debit memo in bank statement for bank service charge, $39

2. Deposit in transit, $2,988

3. Outstanding checks, $3,156

4. Customer's NSF check for $723 was returned with the bank statement

Required:

a) Determine the true cash balance as of November 30, 2013

b) Determine the unadjusted balance of the company's Cash account as of November 30, 2013

(Essay)

4.8/5  (35)

(35)

Grimes Company established a $250 petty cash fund on January 1, 2013. On March 1, 2013 the fund contained $160 in receipts for miscellaneous expenses and $88 in cash. The entries necessary to replenish the petty cash fund will

(Multiple Choice)

4.8/5  (38)

(38)

The unadjusted cash account balance for Cali Company at December 31, 2013 is $12,342. The bank statement showed an ending balance of $18,350 at December 31, 2013. The following information is available from an examination of the bank statement and the company's accounting records:  Check #433 for the purchase of inventory was written correctly and paid by the bank correctly for $234, but was recorded on the books at $432. Cali uses the perpetual inventory system.

Required:

1) Prepare a bank reconciliation for December, 2013.

2) Prepare the necessary journal entries at December 31, 2013.

Check #433 for the purchase of inventory was written correctly and paid by the bank correctly for $234, but was recorded on the books at $432. Cali uses the perpetual inventory system.

Required:

1) Prepare a bank reconciliation for December, 2013.

2) Prepare the necessary journal entries at December 31, 2013.

(Essay)

4.9/5  (40)

(40)

The most favorable audit opinion that a company can receive is a(n):

(Multiple Choice)

4.9/5  (40)

(40)

In preparing the April bank reconciliation for Oscar Company, it was discovered that on April 10 a check was written to pay delivery expense of $45 but the check was erroneously recorded as $54 in the company's books. The journal entry required to correct the error is

(Multiple Choice)

4.8/5  (39)

(39)

Which of the item(s) would be added to the unadjusted bank balance to determine the true cash balance?

(Multiple Choice)

4.9/5  (31)

(31)

Before a business check is signed, the check signer should examine appropriate supporting documents.

(True/False)

4.9/5  (34)

(34)

After journal entries have been made related to a bank reconciliation, the book balance will be equal to the true cash balance.

(True/False)

4.9/5  (39)

(39)

At the time petty cash funds are disbursed, a journal entry should be made, debiting the appropriate asset or expense account.

(True/False)

4.8/5  (33)

(33)

At Chavez Company, the petty cash custodian used petty cash to pay for postage charges.

(Short Answer)

4.9/5  (36)

(36)

Which of the following statements concerning internal controls is true?

(Multiple Choice)

4.8/5  (41)

(41)

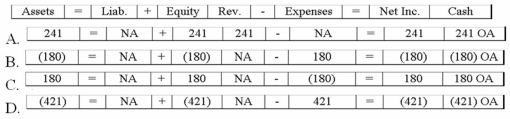

While performing its monthly bank reconciliation, the bookkeeper for the Maynard Company discovered that a check written for $241 for advertising expense was recorded in the firm's books as $421. Which of the following shows the effect of the correcting entry on the financial statements?

(Multiple Choice)

4.9/5  (39)

(39)

A well-designed system of internal controls will eliminate employee theft and fraud in a company.

(True/False)

4.7/5  (40)

(40)

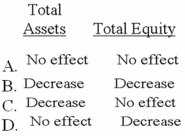

Harp Company accepted a check from Jasper Company as payment for services rendered. Harp's bank statement revealed that the Jasper check was an NSF check. What effect will the entry to record the NSF check have on the accounting equation of Harp Company?

(Multiple Choice)

4.9/5  (40)

(40)

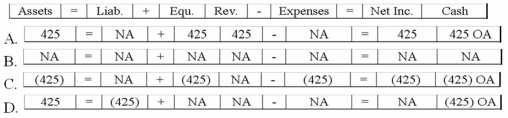

The owner of the King Company established a petty cash fund amounting to $425. What is the effect on the financial statements of the entry to record this transaction?

(Multiple Choice)

4.9/5  (41)

(41)

Showing 21 - 40 of 140

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)