Exam 6: Internal Control and Accounting for Cash

Exam 1: An Introduction to Accounting148 Questions

Exam 2: Accounting for Accruals and Deferrals151 Questions

Exam 3: The Double-Entry Accounting System156 Questions

Exam 4: Accounting for Merchandising Businesses157 Questions

Exam 5: Accounting for Inventories142 Questions

Exam 6: Internal Control and Accounting for Cash140 Questions

Exam 7: Accounting for Receivables145 Questions

Exam 8: Accounting for Long-Term Operational Assets159 Questions

Exam 9: Accounting for Current Liabilities and Payroll130 Questions

Exam 10: Accounting for Long-Term Debt158 Questions

Exam 11: Proprietorships, Partnerships, and Corporations153 Questions

Exam 12: Statement of Cash Flows134 Questions

Exam 13: Financial Statement Analysis Available Online in the Connect Library139 Questions

Select questions type

If the financial statements cannot be relied upon because they contain one or more material departures from GAAP, the auditor will issue the following type of audit opinion:

(Multiple Choice)

4.9/5  (39)

(39)

During the process of preparing the bank reconciliation, an employee for Hearst Company discovered that the bank deducted a check from the Heath Company (a different company).

(Short Answer)

4.7/5  (31)

(31)

List three of the five interrelated components of the internal control framework established by The Committee of Sponsoring Organizations of the Treadway Commission (COS0) in 1992 that serve as the standards for Sarbanes-Oxley compliance.

(Essay)

4.8/5  (42)

(42)

A debit balance in Cash Short and Over represents a shortage of cash and would be treated as an expense.

(True/False)

4.9/5  (38)

(38)

List three measures that a business can use to achieve strong internal controls.

(Essay)

4.8/5  (34)

(34)

List three of the five primary roles of the independent auditor (CPA).

Any three of the following:

(Essay)

4.8/5  (46)

(46)

An error is considered material if it would influence the opinion of the average prudent investor.

(True/False)

5.0/5  (39)

(39)

The Securities and Exchange Commission regulates financial reporting of all U.S. companies.

(True/False)

4.8/5  (41)

(41)

On January 1, 2013, Whisnant Company established a petty cash fund for $200. On January 31, 2013, when the petty cash fund was replenished, it contained $24.40 in cash and petty cash receipts for: postage expense, $48.60; office supplies, $61; entertainment expense, $64.21

Required:

a) Prepare the journal entry to establish the petty cash fund.

b) Assuming that Warren treats all disbursements from petty cash as miscellaneous expenses, prepare the journal entry to replenish the fund on January 31.

(Essay)

4.8/5  (35)

(35)

Which internal control procedure addresses the idea that the likelihood of employee fraud or theft is reduced if collusion is required to accomplish it?

(Multiple Choice)

4.8/5  (39)

(39)

Oliver Company's unadjusted book balance at June 30, 2013 is $8,700. The company's bank statement reveals bank service charges of $45. Two credit memos are included in the bank statement: one for $900, which represents a collection that the bank made for Oliver, and one for $50, which represents the amount of interest that Oliver had earned on its interest-bearing account in June. Based on this information, Oliver's true cash balance is:

(Multiple Choice)

4.8/5  (34)

(34)

A savings account or certificate of deposit that imposes a substantial penalty for early withdrawals should be classified as Cash on the balance sheet.

(True/False)

4.8/5  (39)

(39)

For a petty cash fund to be most useful to a business, several of the business's employees should be designated as responsible for the fund.

(True/False)

4.7/5  (37)

(37)

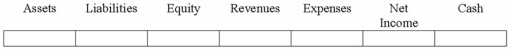

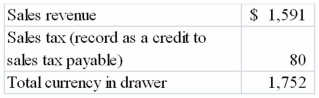

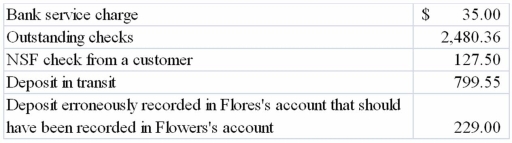

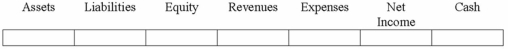

The Marvin Company's accountant is balancing the cash register drawer for the new cashier and discovers the following information for December 14, 2013:  The company started the day with a change fund of $100 and that figure is included in the above amount in the drawer.

Required:

Using the journal below, record the day's events including any shortage or overage. Do not include establishment of the change fund in your entry.

The company started the day with a change fund of $100 and that figure is included in the above amount in the drawer.

Required:

Using the journal below, record the day's events including any shortage or overage. Do not include establishment of the change fund in your entry.

(Essay)

4.8/5  (36)

(36)

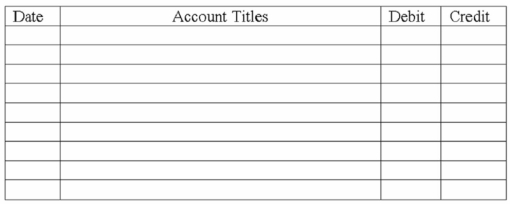

As of May 31, 2013, the bank statement of Flores Company showed an ending balance of $8,632.52. The following information was available:  Required:

Compute Flores's true cash balance at May 31, 2013.

Required:

Compute Flores's true cash balance at May 31, 2013.

(Essay)

4.8/5  (42)

(42)

Chavez Company established a petty cash fund by issuing a check in the amount of $200 to the petty cash custodian.

(Short Answer)

4.9/5  (35)

(35)

What are the three types of audit opinion, and what is the meaning of each? Which type of opinion is considered the best?

(Essay)

4.8/5  (32)

(32)

Showing 101 - 120 of 140

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)