Exam 1: An Introduction to Accounting

Exam 1: An Introduction to Accounting148 Questions

Exam 2: Accounting for Accruals and Deferrals151 Questions

Exam 3: The Double-Entry Accounting System156 Questions

Exam 4: Accounting for Merchandising Businesses157 Questions

Exam 5: Accounting for Inventories142 Questions

Exam 6: Internal Control and Accounting for Cash140 Questions

Exam 7: Accounting for Receivables145 Questions

Exam 8: Accounting for Long-Term Operational Assets159 Questions

Exam 9: Accounting for Current Liabilities and Payroll130 Questions

Exam 10: Accounting for Long-Term Debt158 Questions

Exam 11: Proprietorships, Partnerships, and Corporations153 Questions

Exam 12: Statement of Cash Flows134 Questions

Exam 13: Financial Statement Analysis Available Online in the Connect Library139 Questions

Select questions type

Mineola Company paid $30,000 cash to purchase land. As a result of this business event,

(Multiple Choice)

4.9/5  (33)

(33)

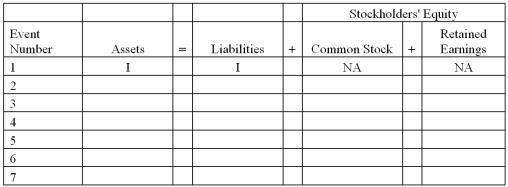

Jarvis Company experienced the following events during 2012 (all were cash events):

1. issued a note

2. purchased land

3. provided services to customers

4. repaid part of the note in event 1

5. paid operating expenses

6. paid a dividend to stockholders

7. issued common stock

Required:

Indicate how each of these events affects the accounting equation by writing the letter I for increase, the letter D for decrease, and NA for no effect under each of the components of the accounting equation. The first is done for you as an example.

(Essay)

4.8/5  (36)

(36)

The types of resources needed by a business are financial, physical, and capital resources.

(True/False)

4.9/5  (36)

(36)

Indicate whether each of the following statements about the types of transactions is true or false.

_______ a) An asset source transaction increases total assets and decreases claims to assets.

_______ b) The issuance of stock to owners for cash would be an example of an asset

exchange transaction.

_______ c) Purchasing equipment for cash is an example of an asset exchange transaction.

_______ d) Paying a dividend to stockholders is an example of an asset use transaction.

_______ e) Making a payment on a bank loan is an example of an asset exchange transaction.

(Short Answer)

4.8/5  (34)

(34)

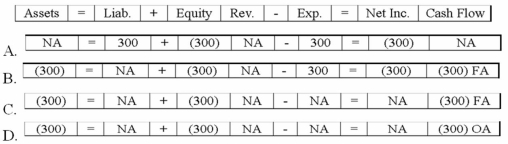

Jiminez Company paid a $300 cash dividend. Which of the following choices accurately reflects how this event affects the company's financial statements?

(Multiple Choice)

4.7/5  (40)

(40)

In a market, a company that manufactures cars would be referred to as a conversion agent.

(True/False)

4.9/5  (35)

(35)

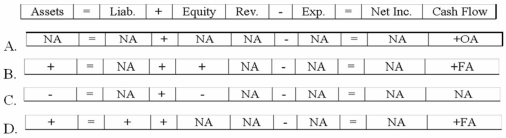

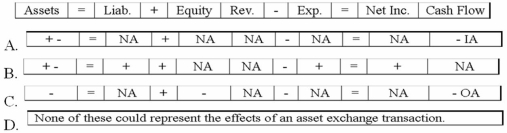

Which of the following could describe the effects of an asset exchange transaction on a company's financial statements?

(Multiple Choice)

4.9/5  (36)

(36)

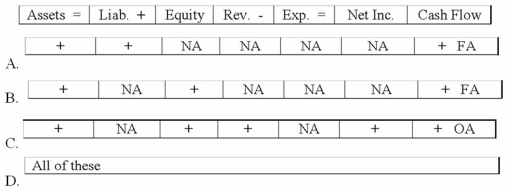

Which of the following could describe the effects of an asset source transaction on a company's financial statements?

(Multiple Choice)

4.7/5  (34)

(34)

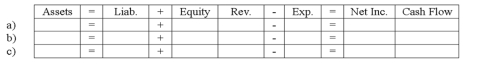

During 2013, Wynona Company issued common stock to stockholders for $12,000, purchased land for $3,200 cash, and paid cash dividends of $1,000 to the company's owners. Enter each of these three events into the horizontal financial statements model, below. Indicate dollar amounts of increases and decreases. For cash flows, show whether they are operating activities (OA), investing activities (IA), or financing activities (FA).

(Essay)

4.7/5  (37)

(37)

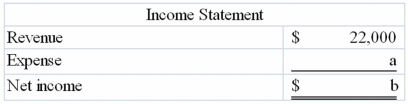

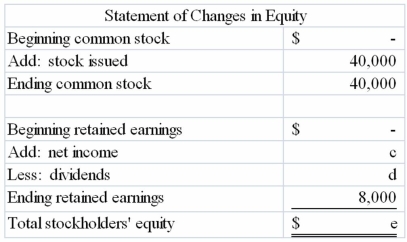

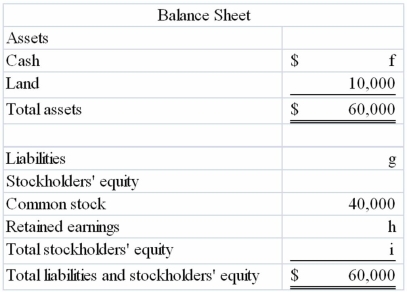

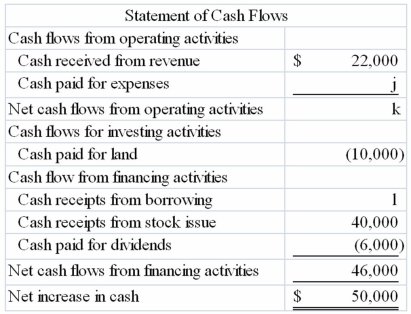

Fill in the blanks indicated by the alphabetic letters in the following financial statements. These financial statements were prepared for the company's first year in operation, and all transactions were for cash.

(Essay)

4.9/5  (30)

(30)

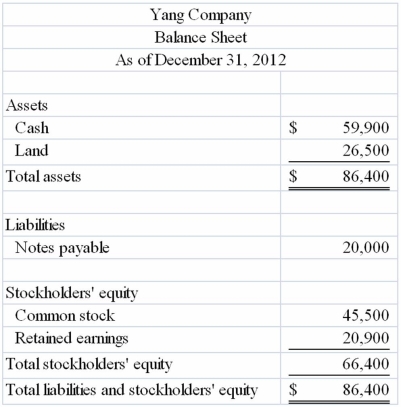

Yang Company reported the following balance sheet for the end of 2012:  During 2013, Yang reported the following transactions:

• Repaid $8,000 to a local bank on a note payable

• Provided services to clients for $26,400 cash

• Paid operating expenses of $19,200

• Paid $3,500 cash dividends to stockholders

Required:

Prepare Yang Company's balance sheet as of December 31, 2013

During 2013, Yang reported the following transactions:

• Repaid $8,000 to a local bank on a note payable

• Provided services to clients for $26,400 cash

• Paid operating expenses of $19,200

• Paid $3,500 cash dividends to stockholders

Required:

Prepare Yang Company's balance sheet as of December 31, 2013

(Essay)

5.0/5  (36)

(36)

Rosemont Company began operations on January 1, 2013, and on that date issued stock for $60,000 cash. In addition, Rosemont borrowed $50,000 cash from the local bank. The company provided services to its customers during 2013 and received $35,000. It purchased land for $70,000. During the year, it paid $10,000 cash for salaries and $9,000 cash for supplies that were used up in its operations. Stockholders were paid cash dividends of $8,000 during the year.

Required:

a) List the transactions from the information above (for example, issued common stock for $60,000) and indicate in which section of the statement of cash flows each transaction would be reported.

b) What would the amount be for net cash flows from operating activities?

c) What would be the amount of the total assets for the Rosemont Company at the end of 2013?

d) What would the end-of-year balance be for the retained earnings account?

e) What would the end-of-year balance be for the cash account?

(Essay)

4.8/5  (36)

(36)

Young Company provided services to a customer for $6,500 cash. As a result of this event,

(Multiple Choice)

4.9/5  (29)

(29)

Which of the following could represent the effects of an asset exchange transaction on a company's financial statements?

(Multiple Choice)

4.9/5  (41)

(41)

Financial accounting information is usually more detailed than managerial accounting information.

(True/False)

4.7/5  (35)

(35)

The amount of liabilities on La Paz's 2013 balance sheet was

(Multiple Choice)

4.9/5  (41)

(41)

An asset source transaction increases a business's assets and the claims to assets.

(True/False)

4.9/5  (35)

(35)

Showing 81 - 100 of 148

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)